With the acquisition of EQM Indexes, VettaFi’s family of indexes now powers nearly $19 billion in ETFs and other investment vehicles. In May 2022, VettaFi was created by unifying complementary businesses who shared a common vision for client success, the value of relationships, and the importance of data. We believe an informed advisor is a better advisor. EQM Indexes is the second major indexing firm acquired by VettaFi this year, following the acquisition of the ROBO Global Index suite in April. The deals have expanded VettaFi’s presence and supported education about thematic ETFs.

See related: Dave Nadig and Todd Rosenbluth on Thematic ETFs in 2023

Which ETFs Track a VettaFi Family Index?

The Amplify Online Retail ETF (IBUY), the Amplify Lithium & Battery Technology ETF (BATT), the Adasina Social Justice All Cap Global ETF (JSTC), and the MUSQ Global Music Industry ETF (MUSQ) are examples of ETFs tracking EQM Indexes.

They join the Alerian MLP ETF (AMLP), the ALPS Sector Dividend Dogs (SDOG), the American Century US Quality Growth ETF (QGRO), the ROBO Global Artificial Intelligence ETF (THNQ), and the ROBO Global Robotics & Automation Index ETF (ROBO) as examples of ETFs tracking an index part of the VettaFi family.

“A great investment idea can often remain just that: an idea. But with a well-constructed index, great investment ideas can become great investments,” explained Brian Coco, Head of Index Products at VettaFi.

Advisors Eager to Learn About Artificial Intelligence ETFs

VettaFi has strong expertise about thematic industry trends that are impacting the broader ETF industry. For example, VettaFi hosted and moderated a well-attended AI symposium in August. Asset managers helped educate more than 650 live attendees about the drivers behind the Global X Robotics and Artificial Intelligence ETF (BOTZ) and iShares Robotics and Artificial Intelligence Multisector ETF (IRBO).

BOTZ and IRBO provide distinct exposure from each other and ROBO and many advisors are choosing among them to fit into their thematic slice of clients’ portfolios.

Thematic ETFs a Key Growth Component to Portfolio

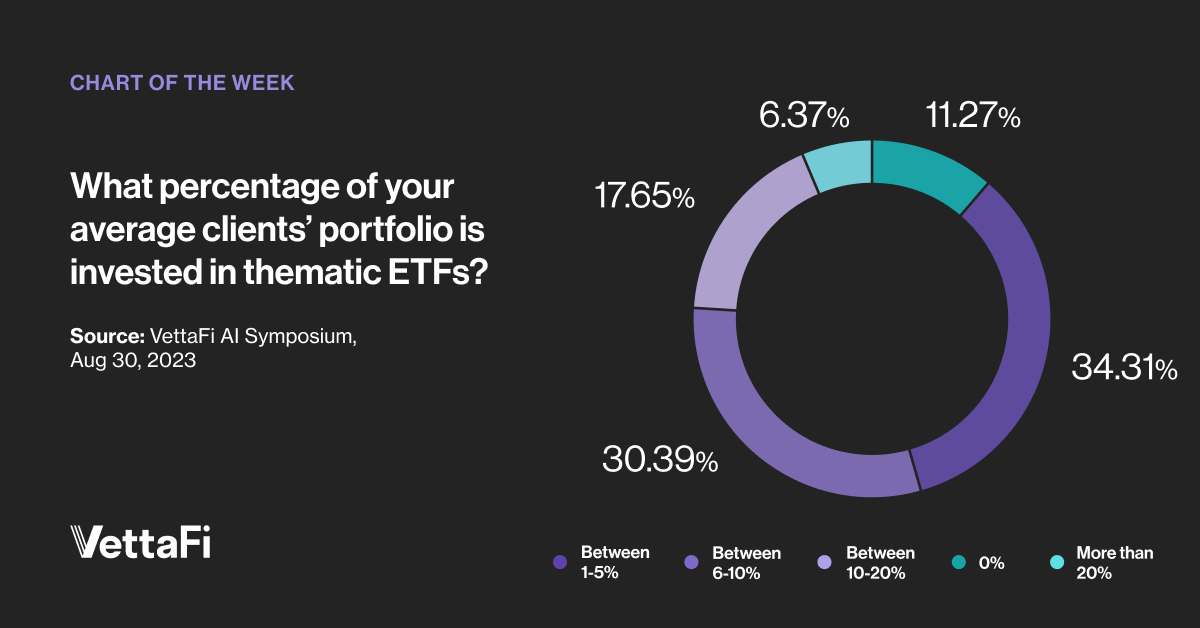

During the AI symposium, we asked attendees “What percentage of your average clients’ portfolio is invested in thematic ETFs?”. Nearly two thirds (65%) said between 1%-10%. However, some respondents were more heavily invested in thematics. These ETFs also tend to have staying power. Thematics focus on multi-year trends. Investors often show patience even if the stocks inside are temporarily out of favor.

We also find that advisors are interested in a range of investment trends. For example, they want to keep up with latest developments in e-commerce, electric vehicles, video games, and other trends. VettaFi aims to share with our community what’s driving the long-term trend. We also look to inform people of some of the various ways they can participate, regardless of the index provider. Or even if the ETF is actively managed. We just love educating about ETFs.

We have similarly written content about high dividend yielding ETFs that included SDOG as well as the Vanguard High Dividend Yield ETF (VYM), the Invesco High Yield Dividend Achievers ETF (PEY), and the VictoryShares US Large Cap High Dividend Volatility Weighted ETF (CDL). These ETFs are constructed differently than SDOG and unsurprisingly have unique performance records.

VettaFi’s Equity Symposium

VettaFi will be hosting an Equity Symposium on September 21 with the help of asset management experts. Speakers from firms like Amplify, Columbia Threadneedle, Dimensional Funds, Fidelity, Franklin Templeton, Gabelli, Goldman Sachs, Harbor Capital, and VanEck will be talking to VettaFi’s Tom Lydon and me in front of hundreds of advisors. Join us by registering today.

For more news, information, and analysis, visit Vettafi | ETF Trends.