Last week, the VettaFi AI Symposium was one of the more popular places to be in the days before Labor Day. We had more than 1,200 people registered with over 650 live attendees (many more of you will catch the replay). Those attending live stayed with us an average of 99 minutes for the just-over-two-hour event.

AI Perspective

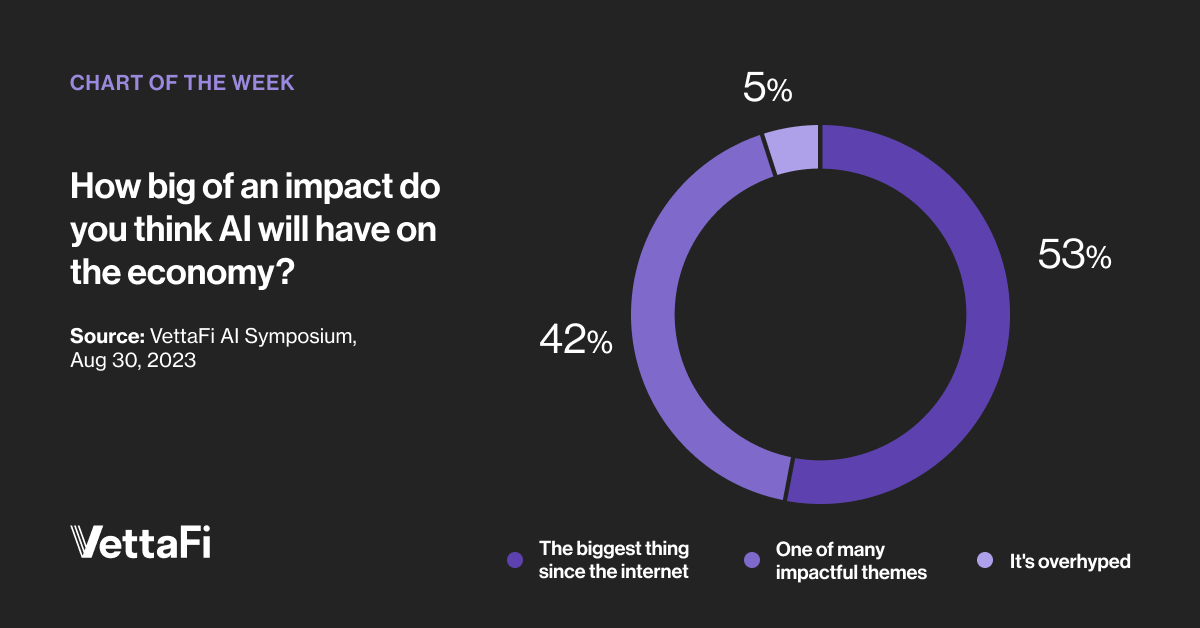

During the event, we asked attendees to help us put AI in perspective. “How big of an impact do you think AI will have on the economy?” we asked. The majority, 54% of the respondents, said “the biggest thing since the Internet”. This compared to 42% that believed AI was “one of many impactful themes”. Just under 5% thought AI was “overhyped.”

There’s some self-selecting in this poll question due to its occurrence during an AI educational event. Yet, with a sample size of 325, there’s clearly bullish sentiment toward AI from advisors not just asset managers.

“We believe that this is going to be one of the most transformational technologies really since the introduction of the internet,” explained Jay Jacobs, U.S. head of thematics and active equity ETFs at BlackRock. “If you look at AI as a whole, this is probably a $15 trillion economy within AI, with probably $25 trillion worth of economic impact.”

During the VettaFi AI Symposium, Jacobs talked about the iShares Robotics and Artificial Intel Multisector ETF (IRBO) as a long-term play on artificial intelligence that invests across the AI ecosystem. In addition, he noted the iShares Semiconductor ETF (SOXX) as a shorter-term play due to the AI-driven demand for semiconductors.

“It is in my view that by the end of the decade, we’re going to have two types of companies,” said Pedro Palandrani, director of research at Global X and a fellow panelist. “These include companies utilizing AI within their business model and across their products and offerings, and then those that cease to exist because they didn’t grow to incorporate AI in some manner.”

Palandrani explained last week that Global X Artificial Intelligence & Technology ETF (AIQ) focuses on the mega-cap companies employing AI in their business models. Meanwhile, the Global X Cloud Computing ETF (CLOU) invests in companies that currently have generative AI offerings and features.

Taking an Active Approach With AI

Global X ETFs and iShares take an index-based approach, but many active ETFs are also focused on AI.

Marissa Ansell, head of thematic client portfolio management for Goldman Sachs Asset Management, told the Symposium attendees that the newness of AI underscores the importance for active management. She expects the AI landscape to change dramatically in the next few years as the industry matures.

“We’re trying to invest in stocks before expectations are fully priced in,” Ansell said. Goldman Sachs Asset Management has three actively managed ETFs that all provide real exposure to AI: the Goldman Sachs Future Tech Leaders Equity ETF (GTEK), the Goldman Sachs Future Health Care Equity ETF (GDOC), and the Goldman Sachs Future Consumer Equity ETF (GBUY).

ETFs Powered By AI

Some asset managers are investing in companies that will likely benefit from AI as a disruptive technology. Others, like Qraft Technologies and Kaiju ETF Advisors, are utilizing AI to duplicate portfolio managers’ investment and decision-making processes.

“The additional benefit of AI, however, is the lack of emotional bias, explained Francis Oh, QRAFT Technologies APAC CEO. “AI is able to make methodical, calculated decisions without being influenced by emotion. AI uses a data-driven approach to enhance returns, limiting human behavioral mistakes. QRAFT offers four AI driven ETFs including the QRAFT AI-Enhanced US Large Cap Momentum ETF (AMOM).

However, QRAFT also recently filed to launch the LG QRAFT AI-Powered U.S. Large Cap Core ETF in partnership with a technology heavyweight LG. LG AI Research’s portfolio construction AI model predicts the risk level and return ranking of individual stocks four weeks in advance, utilizing various market data without requiring human intervention. Subsequently, it identifies the top 100 stocks based on the obtained scores.

VettaFi expects this pending AI ETF to launch in the fourth quarter of 2023. For advisors and end clients bullish on AI, there’s a lot of ETFs worthy to conduct due diligence on.

For more news, information, and analysis, visit VettaFi | ETF Trends.