The video gaming, entertainment, and overall communications services sector is shifting away from physical media. And headed toward digital downloads and subscription-based models. The video gaming industry is further behind the video and audio streaming industries. But it could see a shift toward cloud-based gaming. With the Microsoft-Activision deal in the news recently, commentary from regulators has continued to support the outlook for cloud-based gaming. This note provides a brief overview of cloud-based gaming, video game ETFs, and the broader push toward cloud computing/storage.

Cloud Gaming in the News

On Monday, European Union regulators approved Microsoft’s (MSFT) proposed acquisition of Activision Blizzard (ATVI). The proposed $69 billion acquisition would give Microsoft, known for its Xbox console, ownership of video game franchises like Call of Duty, World of Warcraft, and Diablo. United Kingdom regulators had previously blocked the deal due to competition concerns in cloud gaming. The concern was that Microsoft would restrict the release of Activision games to the Xbox. This would hurt rivals like Sony and their PlayStation console. While Microsoft emphasizes a greater vision for cloud gaming, they have made concessions to ensure that other companies would have access to Activision titles. According to EU regulators, cloud gaming is only 1%-3% of the gaming market but is viewed as a segment of the gaming industry that will be crucial soon. According to Fortune Business Insights, the cloud gaming market totaled $1.7 billion in 2021 and is expected to rise from $3.2 billion in 2022 to $40.8 billion in 2029.

Video and audio industries have seen a shift toward streaming — are video games next?

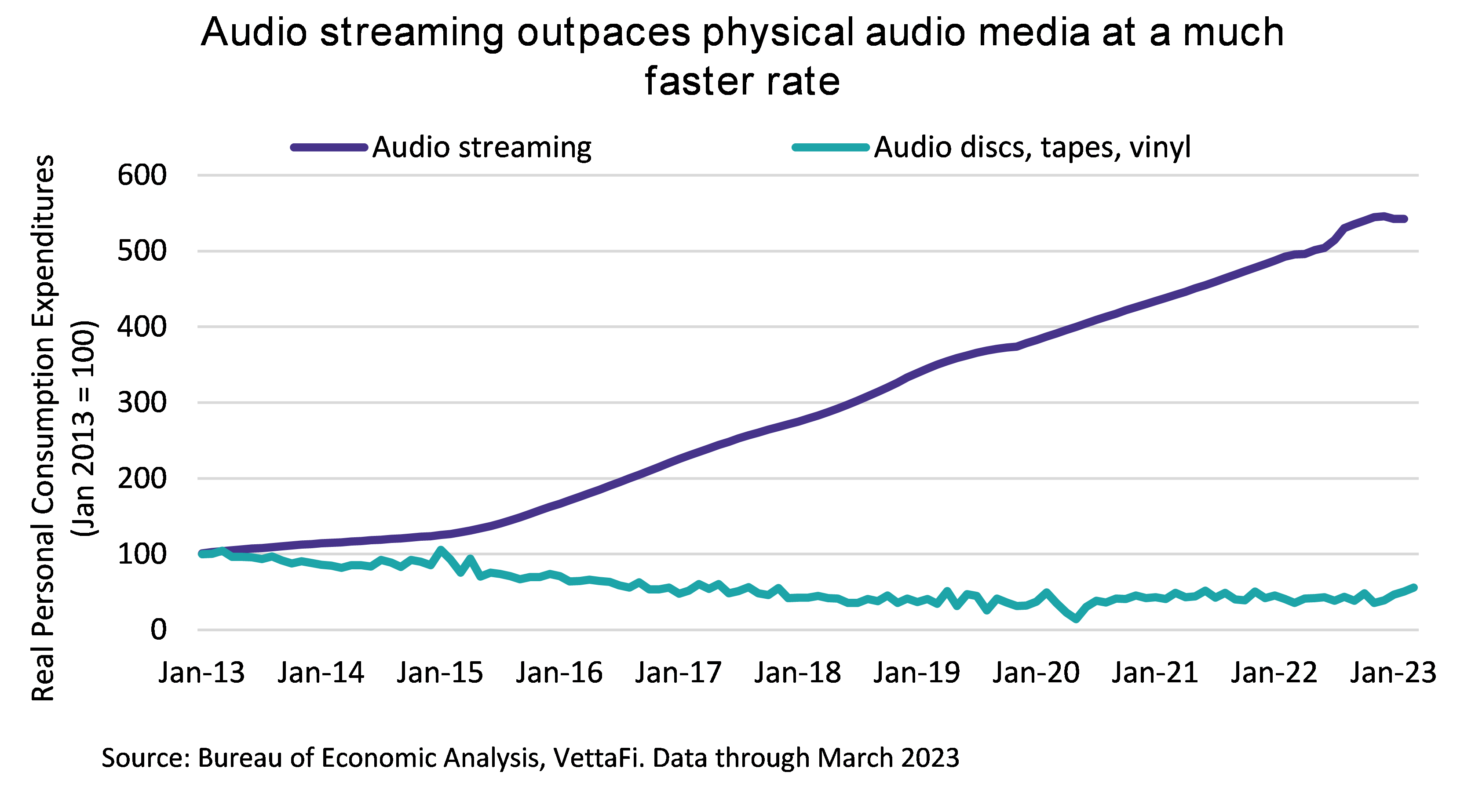

Cloud gaming is essentially online gaming. A provider’s hardware stores the game and streams it to users. This requires a reliable and high-speed internet connection. This is in contrast to users downloading and installing games on their own devices. This might require rigorous hardware requirements or require compact discs/cartridges. While physical media is still popular among collectors, consumers have been moving away from physical media to streaming due to convenience and ease. Cloud gaming also allows the user to access a broad catalog of games through a single source—like Netflix. On a broader scale, the video game sector has been behind other streaming sectors like video streaming and audio streaming. Large video streaming companies like Netflix have been around since 2007, while large audio streaming companies like Spotify have existed for even longer (Spotify has been around since 2006). Since then, streaming video and audio has become the normal relative to collecting physical discs and tapes. Because of the broader shifts in higher internet usage and a greater number of connected devices, the growth in the cloud gaming market could serve as a significant growth area and source of revenue for the video gaming industry as well.

Video streaming and rental vs. physical media

Audio streaming vs. physical audio

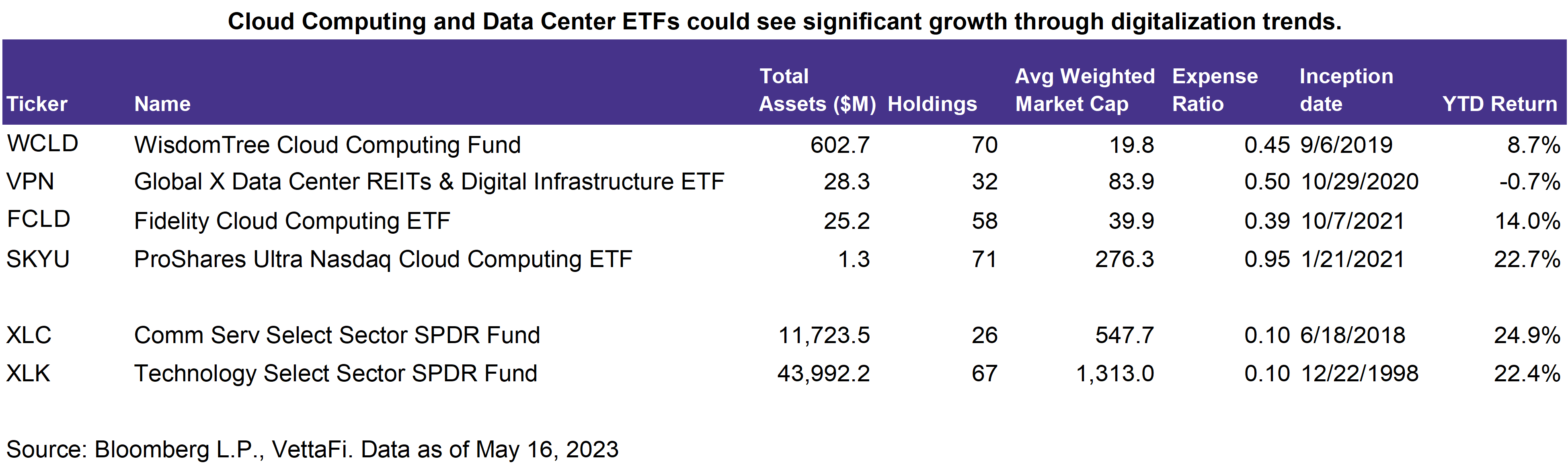

Could computing and data center ETFs

Cloud computing has been a significant trend for corporations.

The push toward cloud gaming is part of a larger trend toward overall cloud computing which has increased significantly over the past few years. Cloud computing, much like cloud gaming, involves storing and delivering data through remote servers rather than a local network. This has helped companies scale globally and allow for more virtual work. Cloud computing ETFs hold companies in three broad categories:

- Infrastructure-as-a-Service (IaaS)

- Software-as-a-Service (SaaS)

- Platform-as-a-Service (Paas)

Cloud computing and data center ETFs

Bottom Line:

The video gaming industry, entertainment industry, and overall communications services sector are all shifting toward cloud-based streaming technologies. Cloud gaming could be a significant growth avenue for video gaming companies and ETFs as video games shift to digital, subscription-based models.

For more news, information, and analysis, visit the Modern Alpha Channel.

vettafi.com is owned by VettaFi LLC (“VettaFi”). VettaFi is the index provider for BNGE, for which it receives an index licensing fee. However, BNGE is/are not issued, sponsored, endorsed, or sold by VettaFi, and VettaFi has no obligation or liability in connection with the issuance, administration, marketing, or trading of BNGE.