Brinker Capital Investments

Omaha, NE 68130

Phone: (402) 493-3313

Articles by Brinker Capital Investments

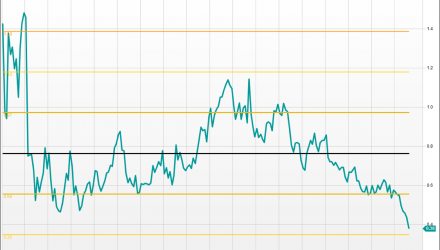

When Value and Momentum Intersect

By Grant Engelbart, CFA, CAIA – Senior Portfolio Manager, Brinker Capital Investments There has been no shortage of ink spilled…

Rusty VannemanCFA, CMT, BFA, Chief Investment Officer

Rusty Vanneman serves as the Chief Investment Officer for Orion Advisor Solutions. An industry veteran with more than 30 years of investment philosophy, process, and personnel. Rusty chairs both Orion’s Investment Committee and Asset Allocation Committee.

Rusty also creates relevant market-and platform-related content that supports deeper, more engaging conversations with advisors and investors, educating key internal and external audiences on Orion Portfolio Solutions’ strategies and resources to help deliver favorable investor outcomes, and helps identify new investment offerings to meet growing marketplace demand.

Rusty is a host of Orion’s The Weighing Machine podcast and authored the book “Higher Calling: A Guide to Helping Investors Achieve Their Goals.” Rusty has also managed multiple mutual funds and hedge funds during his career and was named one of the Top 10 Portfolio Managers to Watch by Money Management Executive in 2017.

Previously, Rusty was the President and Chief Investment Officer of CLS Investments. Before joining Orion in 2012, Rusty served as the Chief Investment Officer and Managing Director for a multi-billion RIA in the greater Boston area. His 11-year tenure at the RIA included a five-year span when the firm was owned by E*TRADE Financial where he also served as the Senior Market Strategist for E*TRADE Capital. Prior, Rusty was a Senior Analyst at Fidelity Management and Research in Boston.

Rusty received his Bachelor of Science in Management from Babson College in Wellesley, Massachusetts where he graduated with high distinction. He holds the Chartered Financial Analyst (CFA®) designation and is a member of the CFA Institute. He is also a Chartered Technician® (CMT) and is a member of the Market Technician’s Association (MTA). Rusty is also a Behavioral Finance Advisor (BFA).

Nicholas C. CodolaCFA, Senior Portfolio Manager

Nick manages portfolios for Orion where he conducts individual equity as well as manager research and analysis. He also serves as a portfolio manager for the State 529 Plans that Orion has purview over. He has previously served as a due diligence specialist for Orion specializing in alternative strategies, as well as a research analyst for CorePlus, AdvisorOne mutual funds, State 529 Plans, and the Biotech direct indexing strategy.

Prior to joining Orion, Nick worked at WealthPlan Group where he served as a senior research analyst and portfolio manager for the advisor base, managing over $2B invested in a combination of concentrated stock portfolios, and risk-based models. Morningstar awarded the Dividend Aristocrat Stock SMA that he managed a five star rating. In addition, all portfolios under his management accrued higher star ratings compared to their rating when he took over.

Nick holds the Chartered Financial Analyst (CFA®) designation and is a member of the CFA Institute and Nebraska CFA society. Nick received a Bachelor's of Arts in Neuroscience from Amherst College, where he was also captain of their Track and Field team.

Francisco RodriguezInvestment Research Analyst

Francisco Rodriguez is an investment analyst at Brinker Capital Investments, a brand entity of Orion Advisor Solutions. In this role, Francisco has portfolio management and research duties for a suite of Brinker Capital ETF strategies. Francisco is involved in all aspects of the investment process for these multi-asset and asset class focused models, including asset allocation, portfolio construction, ETF research, and due diligence.

Prior to assuming his current role, Francisco worked extensively in Brinker’s and CLS investments capital markets group, where he was the head trader. In this role, he led the trading group in market executions and all trading aspects. Prior to joining Brinker Capital Investments, a brand entity of Orion Advisor Solutions in 2019, Francisco was a derivatives trader at TD Ameritrade. He has over 6 years of industry experience.

Francisco graduated from the University of Nebraska-Kearney with a Bachelor’s of Science in Business Administration with a dual focus in accounting and finance.