![]() By Grant Engelbart, CLS Investments

By Grant Engelbart, CLS Investments

“The market is up 100 points today!”

How often do you hear that comment? Some of my family members who have no market knowledge even referenced movements in the Dow Jones Industrial Average (DJIA). There are so many questions that come to mind when I hear that comment. What market? What does 100 points mean? What is the Dow even made up of?

The Dow Jones Industrial Average is a price-weighted index of 30 blue-chip companies in the United States, selected by a committee. The “Dow” is named after Charles Dow, a Wall Street Journal editor and founder of Dow Jones & Co. The “Jones” is actually named after one of Dow’s business associates, Edward Jones (ever heard that name?). The index was first launched in 1896, making it one of the longest running measures of stock market performance we have. Stock market history is intensely fascinating (to me at least). However, given the index’s history, ties to the media, and familiar status in the minds of Americans, it’s easy to see why it’s remained prominent. There is no denying that an investor replicating the index over any reasonable length of time would be handsomely rewarded. But, there are still a number of flaws to consider.

Let’s break down the description I laid out earlier – “a price-weighted index of 30 blue-chip companies in the U.S.”

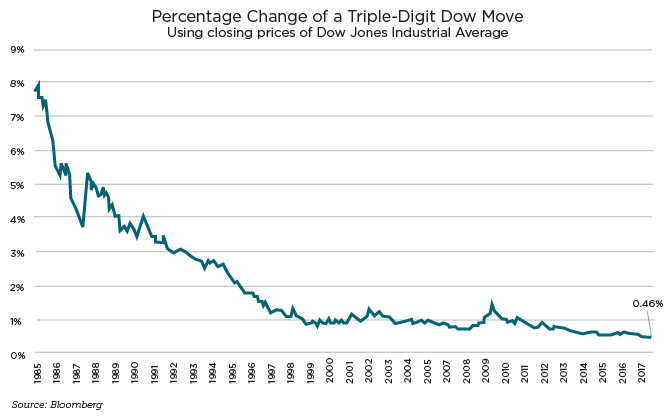

The index is price–weighted. That means stocks with higher share values have a larger weight and impact on the index. For example, Boeing has the largest weight in the Dow (more than 7%) due to its $233/share price. Apple, on the other hand, has a 4.8% weight due to its $153/share price. Meanwhile, the market cap of Apple is almost six times larger than Boeing. Weighting an index by something other than market cap is a good idea (see smart beta), but share price really doesn’t mean much of anything. This price weighting ends up translating into specific point moves for the index. Hearing “Dow up (or down) triple digits” is commonplace and typically elicits some kind of emotion, whether positive or negative, even to the lay person. But, the truth is triple-digit moves are now borderline insignificant. As the price of the index has risen, triple-digit moves represent less than half a percent!