Summary

- Six energy infrastructure companies collectively spent $692 million in buybacks in 4Q23, bringing total buyback spend for the year to approximately $3.7 billion.

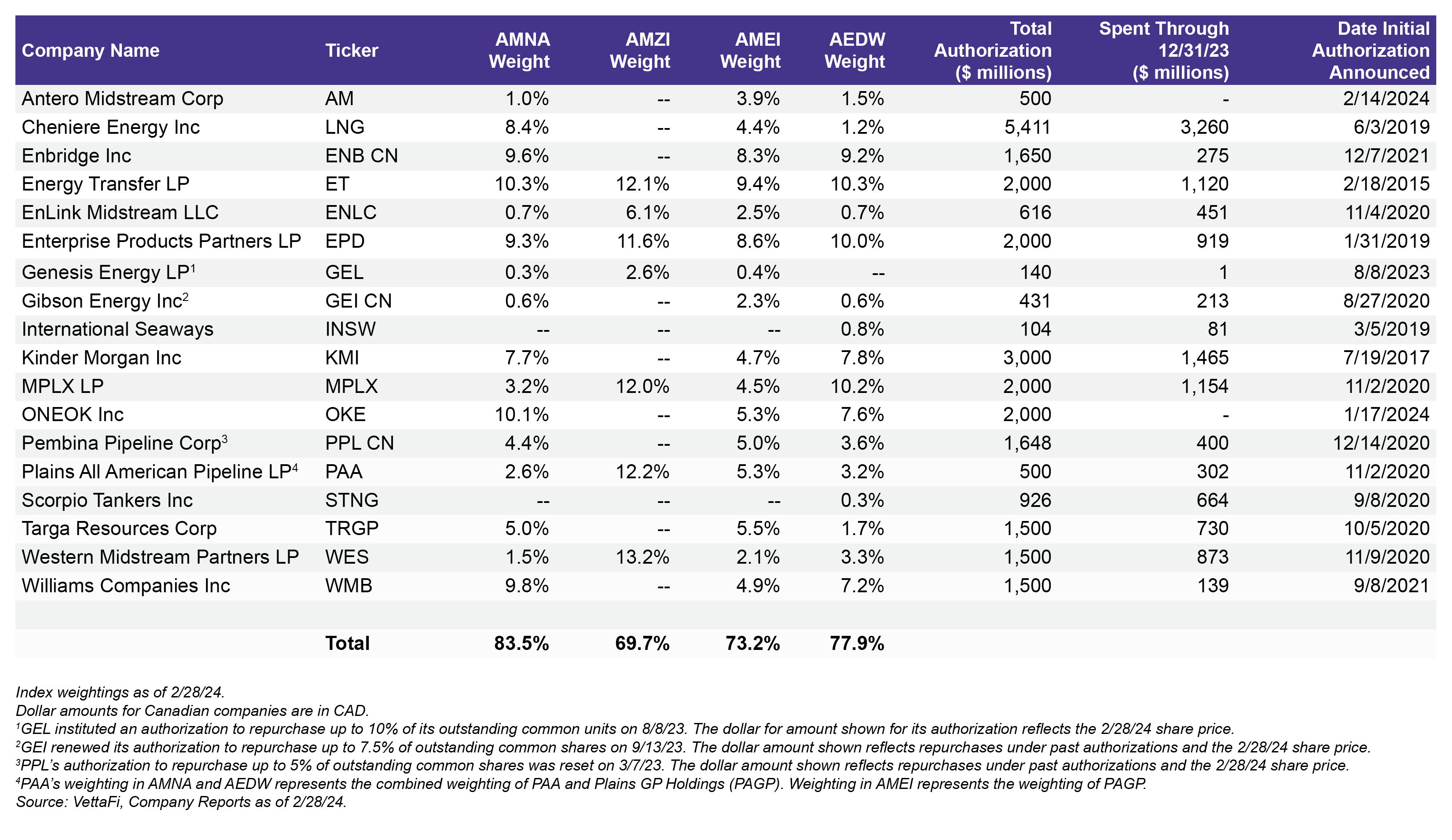

- Over 83% of constituents in the Alerian Midstream Energy Index (AMNA) by weighting currently have equity buyback authorizations in place.

- Buybacks have remained an important tool for returning cash to investors, complementing solid dividend growth.

Strong free cash flow generation from reduced capital spending has helped midstream/MLPs return excess cash to investors through growing dividends and equity buybacks in recent years. A handful of energy infrastructure companies have authorized billions of dollars in buyback programs and have ample room for continued repurchases. Today’s note recaps midstream/MLP equity buyback activity in 4Q and full-year 2023. It also examines companies with existing buyback authorizations.

Companies Slowed Equity Repurchases in 4Q23

With healthy midstream free cash flow generation in 2023, energy infrastructure companies continued to prioritize investor returns. They did this primarily through growing dividends and equity repurchases (read more). Dividend growth has been a broad tailwind for midstream MLPs and C-Corps (read more). But equity buyback activity has been more concentrated. Not all midstream companies have an active buyback authorization. Most use buyback authorizations opportunistically.

Midstream/MLP buyback activity dipped in 4Q23. Just five companies in the broad Alerian Midstream Energy Index (AMNA) collectively bought $680 million in equity in 4Q23. Buyback activity declined from previous quarters. AMNA constituents collectively repurchased $745 million in 3Q23, $1.1 billion in 2Q23, and $850 million in 1Q23 (read more). Total midstream/MLP buyback spend in 2023 declined compared to the year prior. Approximately $3.7 billion was spent in 2023 compared to $4.5 billion in aggregate repurchases seen in 2022 (read more).1

Cheniere Energy (LNG) once again led buybacks for the quarter and year, repurchasing $339 million and $1.47 billion, respectively. Kinder Morgan (KMI) followed, with approximately $132 million spent on buybacks in 4Q23, bringing its 2023 total to $522 million.

Bellwether MLP Enterprise Products Partners (EPD) repurchased $96 million in equity during 4Q23, resulting in a total 2023 buyback spend of $188 million. EnLink Midstream (ENLC), meanwhile, repurchased approximately $72 million in equity in 4Q23 to take its 2023 total to $234.8 million. Additionally, ENLC repurchased $41.5 million in common units held by Global Infrastructure Partners for 4Q23, but the purchase settled on February 19, 2024.

The table below shows the energy infrastructure companies with buyback authorizations in place, how much each has spent on repurchases, and each company’s weighting in AMNA, the Alerian MLP Infrastructure Index (AMZI), the Alerian Midstream Energy Select Index (AMEI), and the Alerian Midstream Energy Dividend Index (AEDW). More than two-thirds of the indexes by weighting have buyback authorizations in place.

New Buyback Authorizations Announced in 2024

For 2024, several names have renewed or initiated a new buyback authorization. In January, ONEOK (OKE) announced a new $2 billion buyback authorization that is expected to be used over the next four years. Antero Midstream (AM) introduced a new $500 million share repurchase program, and ENLC reauthorized its $200 million unit repurchase program for 2024.

Related Research

Midstream Sees Strong Free Cash Flow Generation in 2023

4Q23 Midstream/MLP Dividend Recap: The Growth Continues

3Q23 Midstream/MLP Buybacks: C-Corps Remain More Active

4Q22 Caps a Strong Year for Midstream/MLP Buybacks

AMZI is the underlying index for the Alerian MLP ETF (AMLP) and the ETRACS Alerian MLP Infrastructure Index ETN Series B (MLPB). AMNA is the underlying index for the ETRACS Alerian Midstream Energy Index ETN (AMNA). AMEI is the underlying index for the Alerian Energy Infrastructure ETF (ENFR) and the ALPS Alerian Energy Infrastructure Portfolio (ALEFX). AEDW is the underlying index for the Alerian Midstream Energy Dividend UCITS ETF (MMLP) and the ETRACS Alerian Midstream Energy High Dividend Index ETN (AMND).

vettafi.com is owned by VettaFi LLC (“VettaFi”). VettaFi is the index provider for AMLP, MLPB, AMNA, ENFR, ALEFX, MMLP, and AMND, for which it receives an index licensing fee. However, AMLP, MLPB, AMNA, ENFR, ALEFX, MMLP, and AMND are not issued, sponsored, endorsed, or sold by VettaFi. VettaFi has no obligation or liability in connection with the issuance, administration, marketing, or trading of AMLP, MLPB, AMNA, ENFR, ALEFX, MMLP, and AMND.

1 Aggregate dollar amounts include Canadian dollars for the Canadian corporations with repurchase programs.

For more news, information, and strategy, visit the Energy Infrastructure Channel.