Summary

- Midstream/MLPs continue to generate free cash flow and are returning excess cash to investors through growing dividends.

- On a year-over-year basis, nearly 96% of the broad Alerian Midstream Energy Index (AMNA) increased their dividends. Importantly, there has not been a dividend cut for an AMNA constituent since July 2021.

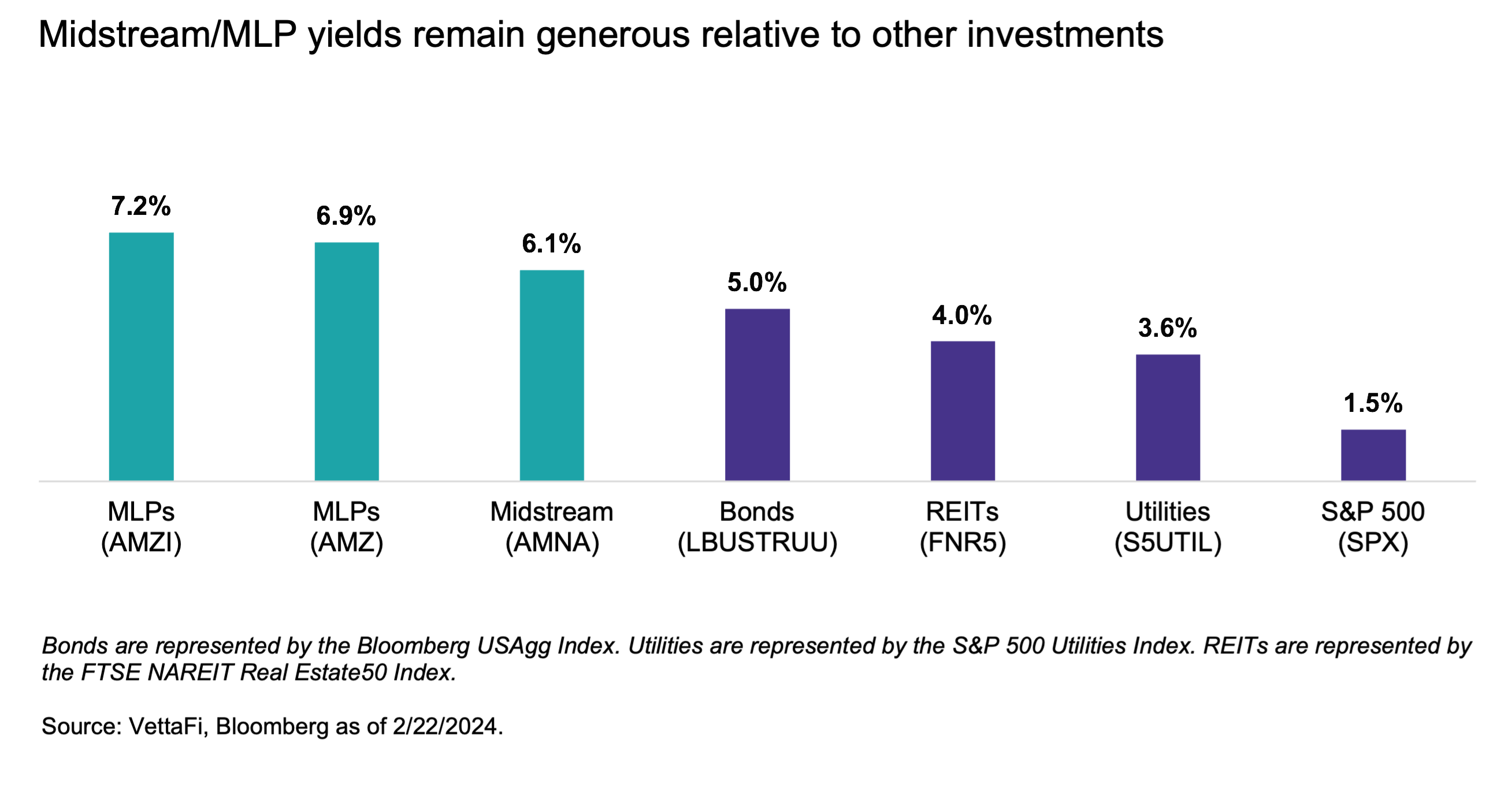

- Generous yields for midstream/MLPs have been enhanced by positive dividend growth trends in recent years.

Dividend growth has been an ongoing theme in the energy infrastructure sector for the last few years, supported by sustained free cash flow generation since 2020. Midstream companies have strengthened their balance sheets. They are now focused on returning excess cash to investors through dividend growth and opportunistic buybacks. Today’s note provides a recap of midstream/MLP dividend announcements for 4Q23. It also examines current yields and discusses dividend growth expectations for specific companies.

4Q23 Dividends: Examples of Sequential Growth

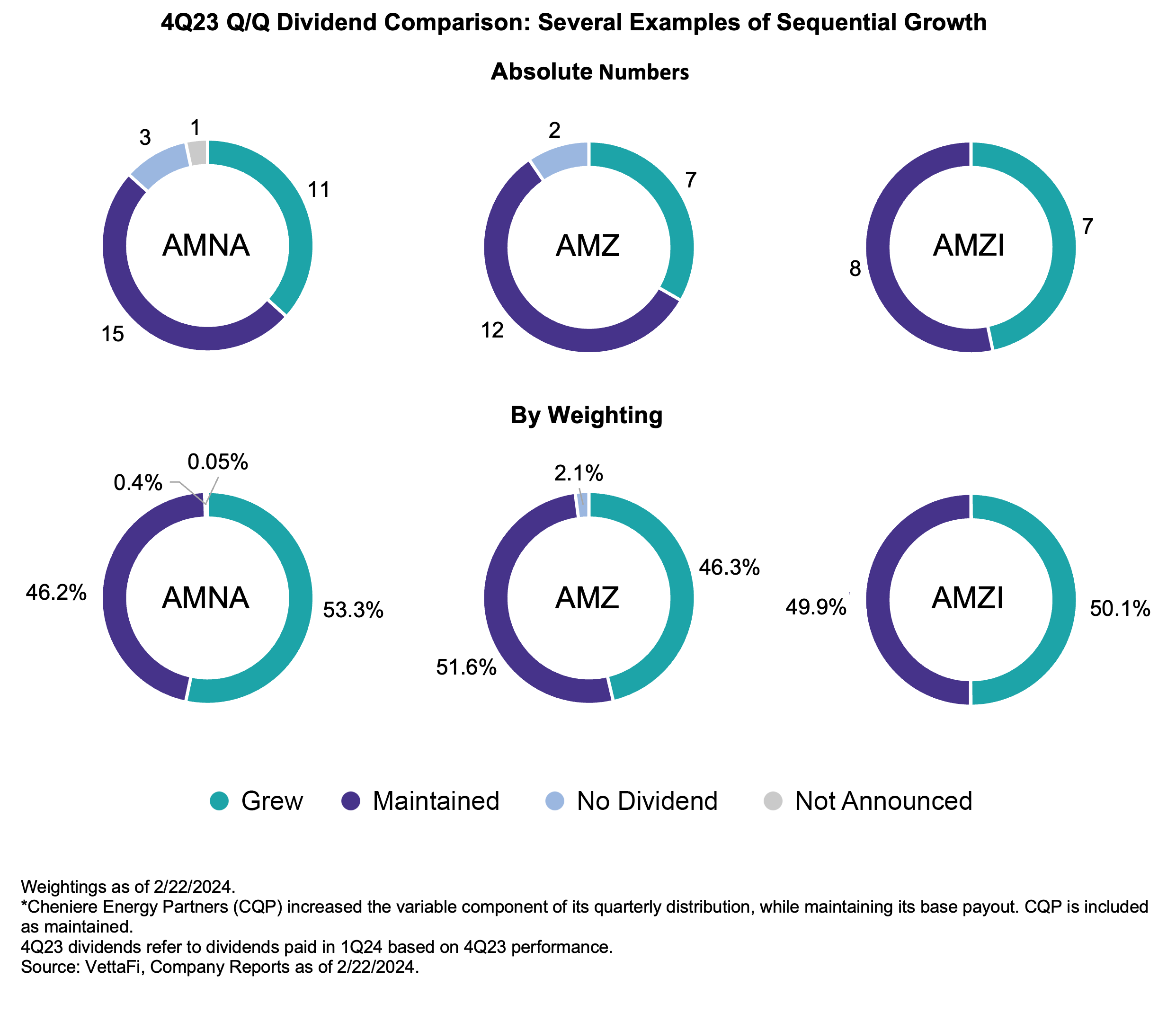

Several midstream companies increased their dividend payouts for 4Q23, building on a solid track record for dividend growth in recent years. Notably, there has not been a dividend cut in the broad Alerian Midstream Energy Index (AMNA) or MLP-focused Alerian MLP Infrastructure Index (AMZI) since July 2021.

Plains All American (PAA/PAGP) saw the largest sequential growth, announcing an 18.7% increase to its payout in line with guidance provided in 2H23. The more pronounced growth for PAA reflects past distribution cuts and thus growth from a lowered base.

Williams Companies (WMB) announced the second-largest sequential increase to its dividend with a 6.1% hike. That was followed closely by EnLink’s (ENLC) 6.0% increase. ONEOK (OKE) grew its dividend for 4Q23 by 3.7% compared to the previous quarter. It announced plans to target 3%-4% annual dividend growth going forward.

Bellwether MLP Enterprise Products Partners (EPD) raised its distribution by 3.0% sequentially. Other notable examples of sequential dividend growth include Enbridge’s (ENB CN) 3.1% increase, Hess Midstream’s (HESM) 2.7% increase, and Energy Transfer’s (ET) 0.8% growth.

The pie charts below show the quarter-over-quarter changes to dividends for AMNA, the Alerian MLP Index (AMZ), and AMZI by comparing 4Q23 payouts to those made for 3Q23. To be clear, 4Q23 dividends refer to the dividends paid in 1Q24 based on operational performance in 4Q23. For AMNA, more than 53% of the index by weighting as of February 22 increased their payout sequentially.

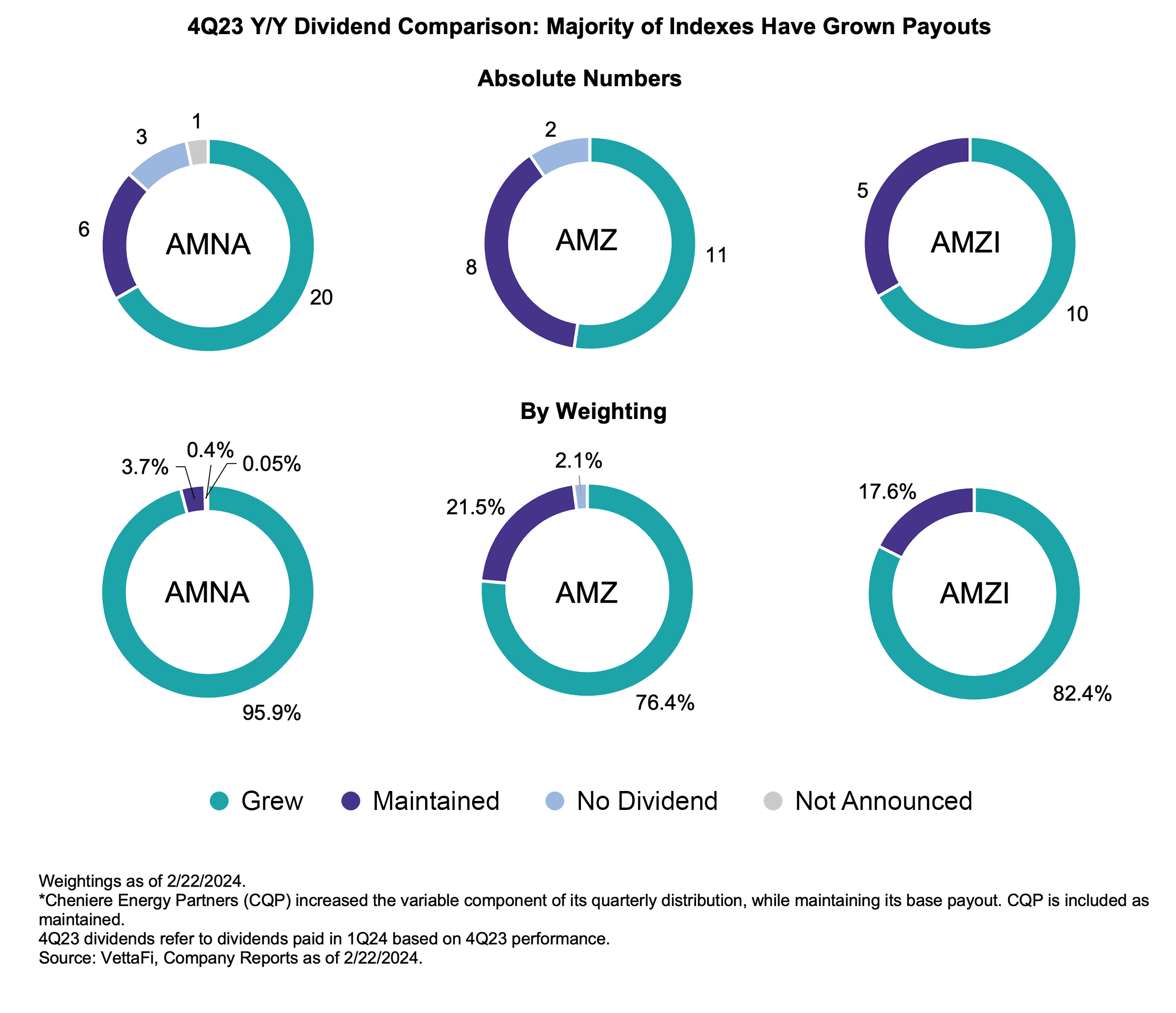

Most Companies Have Increased Dividends Over the Last Year

On a year-over-year basis, there is a clear bias toward dividend growth, particularly when looking at the data by weighting. Nearly 96% of the broad benchmark AMNA by weighting have increased payouts compared to the same period last year. For MLP indexes, 76.4% of AMZ and 82.4% of AMZI by weighting as of February 22 have grown their payouts over the past year. While dividend growth tends to be more common for larger companies with higher weightings in these indexes, more constituents have grown their payouts than maintained.

Compelling Yields for Midstream/MLPs Enhanced by Dividend Growth

Midstream/MLPs have typically offered generous yields relative to other income investments. That has continued into 2024, as shown in the chart below. Even as interest rates rose, midstream/MLPs consistently offered higher yields than bonds (read more). Importantly, energy infrastructure yields are independent of interest rate moves (read more). If interest rates fall in 2024 as is widely expected, midstream/MLP yields could be even more favorable relative to other income investments.

More Dividend Growth on the Horizon

The long-term outlook for midstream/MLP dividend growth is constructive. Tailwinds such as strong free cash flow generation are expected to remain intact (read more). A handful of companies have provided guidance for dividend growth in 2024 and beyond (read more). Western Midstream (WES), for example, announced it plans to recommend a 52% increase to its base distribution for 1Q24 in its 2024 guidance. Targa Resources (TRGP) reiterated its intention to recommend a 50% increase to its dividend for 1Q24 in its 4Q23 dividend announcement. DT Midstream (DTM) announced a dividend increase of 7% for 1Q24 in its 4Q23 earnings release.

HESM has provided long-term guidance for distribution growth, targeting at least 5% annual growth through 2026. TC Energy (TRP CN) also has a long-term dividend growth target of 3%-5%. These are just a few examples of the companies with guidance. More names are expected to grow their payouts even if explicit targets have not been provided. Midstream/MLP investors can expect continued positive momentum in midstream/MLP dividend growth.

AMZ is the underlying index for the JP Morgan Alerian MLP Index ETN (AMJ), which matures in May 2024, and the JPMCFC Alerian MLP Index ETN (AMJB), which matures in 2044. AMZ is also the underlying index for the ETRACS Quarterly Pay 1.5x Leveraged Alerian MLP Index ETN (MLPR). AMZI is the underlying index for the Alerian MLP ETF (AMLP) and the ETRACS Alerian MLP Infrastructure Index ETN Series B (MLPB). AMNA is the underlying index for the ETRACS Alerian Midstream Energy Index ETN (AMNA).

Related Research:

Why You Should Consider MLPs for Your Income Portfolio

3Q23 Midstream Dividend Recap: MLPs Bring the Growth

Examining Midstream/MLP Dividend Growth by Company

Is Your Income Stream Too Dependent on the Fed?

2024 Outlook: Macro Uncertainty Favors Midstream/MLPs

Beyond 2024: Examining Multi-Year Guidance for Midstream

Vettafi.com is owned by VettaFi LLC (“VettaFi”). VettaFi is the index provider for AMJ, AMJB, MLPR, AMLP, MLPB and AMNA, for which it receives an index licensing fee. However, AMJ, AMJB, MLPR, AMLP, MLPB, and AMNA are not issued, sponsored, endorsed, or sold by VettaFi, and VettaFi has no obligation or liability in connection with the issuance, administration, marketing, or trading of AMJ, AMJB, MLPR, AMLP, MLPB and AMNA.

For more news, information, and strategy, visit the Energy Infrastructure Channel.