Summary

- Most midstream companies remain focused on generating free cash flow and returning cash to investors through dividend growth and opportunistic buybacks.

- Weaker oil and natural gas prices were a headwind for broader energy in 2023. It is difficult to identify significant upside drivers for energy commodity prices in 2024.

- Midstream/MLPs could once again be a bright spot in energy in 2024 given generous yields and their defensive qualities.

MLPs and broader midstream were a bright spot within energy in 2023 with total returns of 23.8% and 14.0%, respectively, based on the Alerian MLP Infrastructure Index (AMZI) and the Alerian Midstream Energy Index (AMNA). Midstream gained while the energy sector benchmark ended the year slightly negative on a total-return basis. Defensive businesses and generous shareholder returns could help MLPs and midstream repeat their outperformance relative to broader energy this year. The company-level picture for midstream/MLPs in 2024 is relatively clear, while the macro perspective is more uncertain. This note discusses the 2024 outlook for energy infrastructure and why macro uncertainty likely favors midstream/MLPs.

For a broader discussion, be sure to join our 2024 Midstream/MLP Outlook Webcast on Wednesday, January 10, 2024 at 2 p.m. ET (Register here).

Midstream Poised for Continued Execution on Free Cash Flow and Shareholder Returns

The company-level outlook for midstream/MLPs does not require a crystal ball. Most companies remain focused on generating free cash flow and returning cash to investors through dividend growth and opportunistic buybacks. Fee-based business models and the growing adoption of capital allocation frameworks make the year ahead much less mysterious. Instead, companies simply need to continue executing.

Multiple names have already provided financial guidance for 2024, and most others will provide guidance during earnings season. The midstream corporations that have provided outlooks are generally pointing to mid-single-digit EBITDA growth for 2024.

A handful of companies have also provided guidance for dividend increases. Targa Resources (TRGP) at 50% growth and Plains All American (PAA/PAGP) at 19% are both outliers on the high side (read more). For most names, dividend growth in the low-to-mid-single-digits is a more likely run rate. Importantly, companies can continue to build on positive dividend track records in 2024. The last dividend cut for AMZI and AMNA in July 2021 has become a more distant memory.

Commodity Prices May Remain Lackluster

Moving beyond the company-level view, the outlook becomes more unclear. Weaker oil and natural gas prices were a headwind for broader energy in 2023. It is difficult to identify compelling upside drivers for prices in 2024. On the oil front, OPEC+, namely Saudi Arabia and Russia, appear committed to defending a floor in prices. Any demand weakness and additional supply from countries like the U.S. and Guyana can make their task more difficult. A resurgence in the global economy or supply interruptions from geopolitical events (i.e., Red Sea shipping issues) could certainly bolster oil prices. But fundamentally, the oil market looks adequately supplied (looser rather than tighter).

For natural gas prices, weather is a near-term wildcard. It is generally difficult to envision much price improvement until incremental LNG export capacity comes online in the U.S. and boosts demand. With the startup of QatarEnergy and Exxon’s (XOM) Golden Pass LNG facility slipping from late 2024 to 2025, improving natural gas prices may also be a 2025 event. That said, natural gas prices could strengthen later in 2024 in anticipation of the sizable step-up in demand from multiple LNG projects starting up in 2025 (read more).

Assuming subdued oil and gas prices, midstream/MLPs could be the bright spot in energy in 2024, similar to 2023 (read more). Midstream’s generous yields and defensive qualities provided by fee-based business models can be particularly supportive in a challenging energy tape. As of December 29, AMZI and AMNA were yielding 7.5% and 6.1%, respectively.

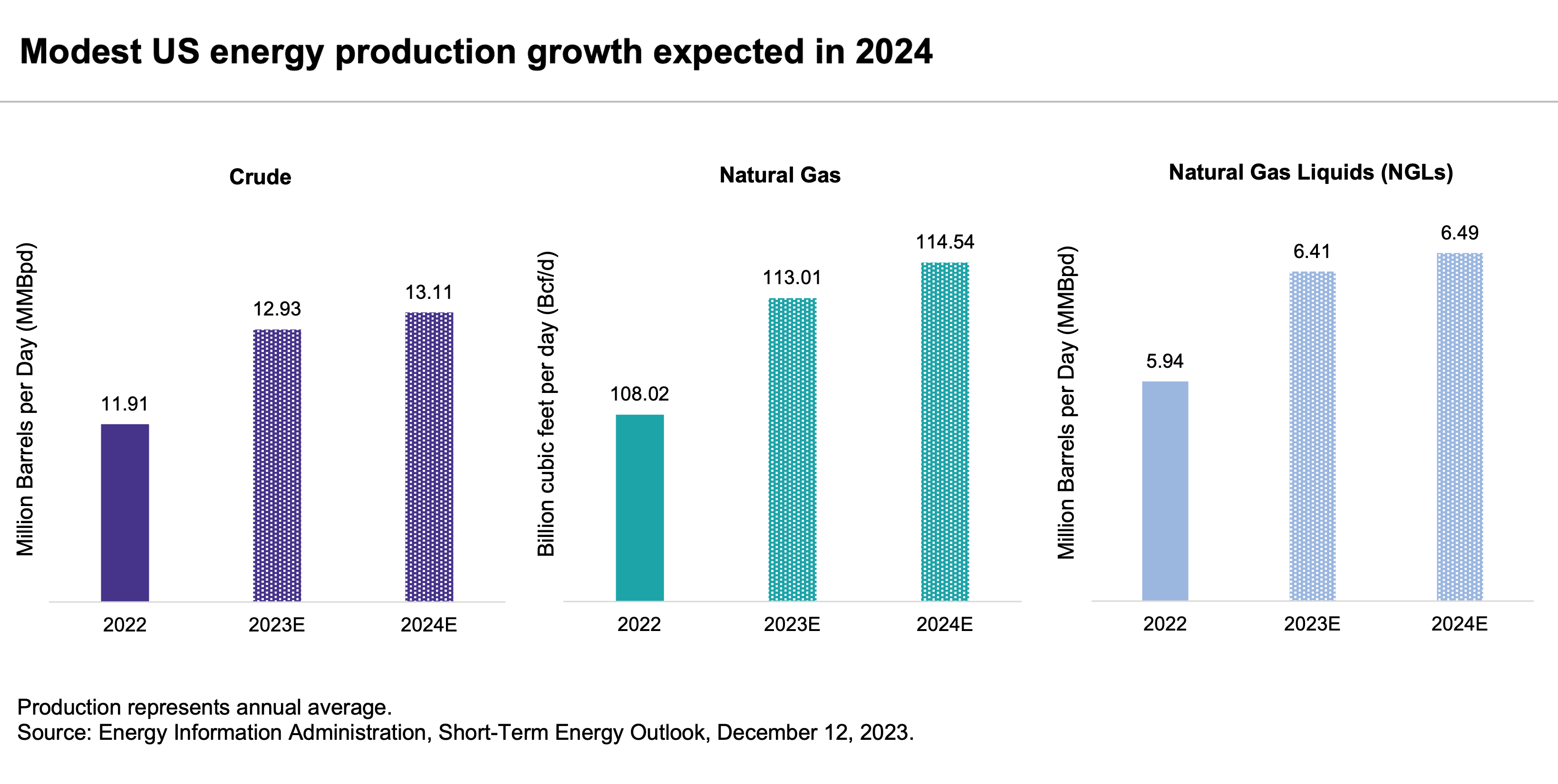

US Energy Production: Modest Growth Expected

U.S. energy production is expected to see modest growth in 2024 after 2023 output was much stronger than initially anticipated. The charts below show estimated annual average U.S. production for oil, natural gas, and natural gas liquids (NGLs) per the Energy Information Administration. Comparing exit rates (i.e., estimated December 2023 and December 2024 output), production is generally more flattish than what the annual averages imply. While production could again surprise to the upside, modest growth can be beneficial for midstream, as it allows for incremental opportunities without burdensome capital spending.

Other Macro Considerations and Midstream: Interest Rates, Inflation, Recession, Election

Beyond commodity prices and production trends, macroeconomic conditions could certainly have an impact on midstream in 2024. With the Fed pointing to interest rate cuts this year, lower rates could benefit corporations that faced headwinds in 2023 due to their higher debt burdens (Enbridge, TC Energy) or their exposure to floating rate debt (Kinder Morgan). Lower interest rates would also make midstream C-Corp yields more competitive with bonds.

Inflation will likely continue to ease in 2024. For midstream, inflation has been a tailwind, given real asset exposure and annual inflation adjustments in contracts. That said, there are lingering benefits of past inflation for midstream. Pipelines that follow the Federal Energy Regulatory Commission’s Oil Pipeline Index were able to increase rates by up to 13.3% on July 1, 2023. That will support year-over-year revenue growth for 1H24. Based on data through November, pipelines that use the index may see a much smaller increase in the fees they can charge beginning on July 1, 2024. However, cost pressures should also be easing.

The potential for a recession remains topical heading into 2024. In a recession, oil prices may be under pressure due to demand concerns, but midstream would be expected to hold up better than other energy subsectors given relative insulation from commodity prices. Weakened energy and equity market sentiment in a recession could weigh on performance for midstream/MLPs, though the space would be expected to continue providing generous dividends.

While a recession may or may not happen, there will be an election in November. However, the election is unlikely to have a significant impact on the midstream space. More broadly, checks and balances (including the courts) tend to support the status quo in the U.S. energy sector regardless of the president’s policy position on oil and natural gas.

Bottom Line:

Midstream MLPs and corporations are expected to continue generating free cash flow and returning cash to shareholders through growing dividends and opportunistic buybacks in 2024. A tempered outlook for oil and natural gas prices could lead midstream to once again be a bright spot among energy subsectors this year.

For more, please join our 2024 Midstream/MLP Outlook Webcast on Wednesday, January 10, 2024 at 2 p.m. ET (Register here).

AMZI is the underlying index for the Alerian MLP ETF (AMLP) and the ETRACS Alerian MLP Infrastructure Index ETN Series B (MLPB). AMNA is the underlying index for the ETRACS Alerian Midstream Energy Index ETN (AMNA).

Related Research:

Led by MLPs, Midstream is Energy Bright Spot in 2023

US Natural Gas: Winter Weather, Prices, and Production

3Q23 Midstream Dividend Recap: MLPs Bring the Growth

US LNG Projects Advance Even as Global Prices Slump

2022’s Inflation Has Silver Lining for Midstream/MLPs

Vettafi.com is owned by VettaFi LLC (“VettaFi”). VettaFi is the index provider for AMLP, MLPB, and AMNA, for which it receives an index licensing fee. However, AMLP, MLPB, and AMNA are not issued, sponsored, endorsed, or sold by VettaFi, and VettaFi has no obligation or liability in connection with the issuance, administration, marketing, or trading of AMLP, MLPB, and AMNA.

For more news, information, and strategy, visit the Energy Infrastructure Channel.