Summary

- Midstream/MLPs have outperformed the broader energy sector so far this year as weaker commodity prices weighed on other energy subsectors.

- Performance within midstream has varied, with MLPs largely outpacing their C-Corp counterparts.

- Looking to 2024, midstream’s defensive qualities and continued free cash flow generation should be broadly supportive as companies continue to prioritize dividend growth and opportunistic buybacks.

Despite volatile energy prices, geopolitical tensions, and an uncertain economic outlook, the North American energy infrastructure space has seen year-to-date gains. Meanwhile, the broader energy sector has struggled amid lower oil and natural gas prices. Within midstream, performance has varied by company structures and geography. Today’s note looks at midstream performance this year. It also examines some of the underlying factors driving MLP outperformance relative to U.S. and Canadian corporations.

Midstream Outperforms Broader Energy in 2023

Midstream or energy infrastructure encompasses a subset of the energy sector that handles the transportation, processing, and storage of energy products. Services are largely provided under long-term, fee-based contracts. These fee-based business models result in more stable cash flows regardless of the commodity price environment. This results in more defensive energy exposure. Midstream also offers more generous yields than broader energy, which contributes to differences in total return.

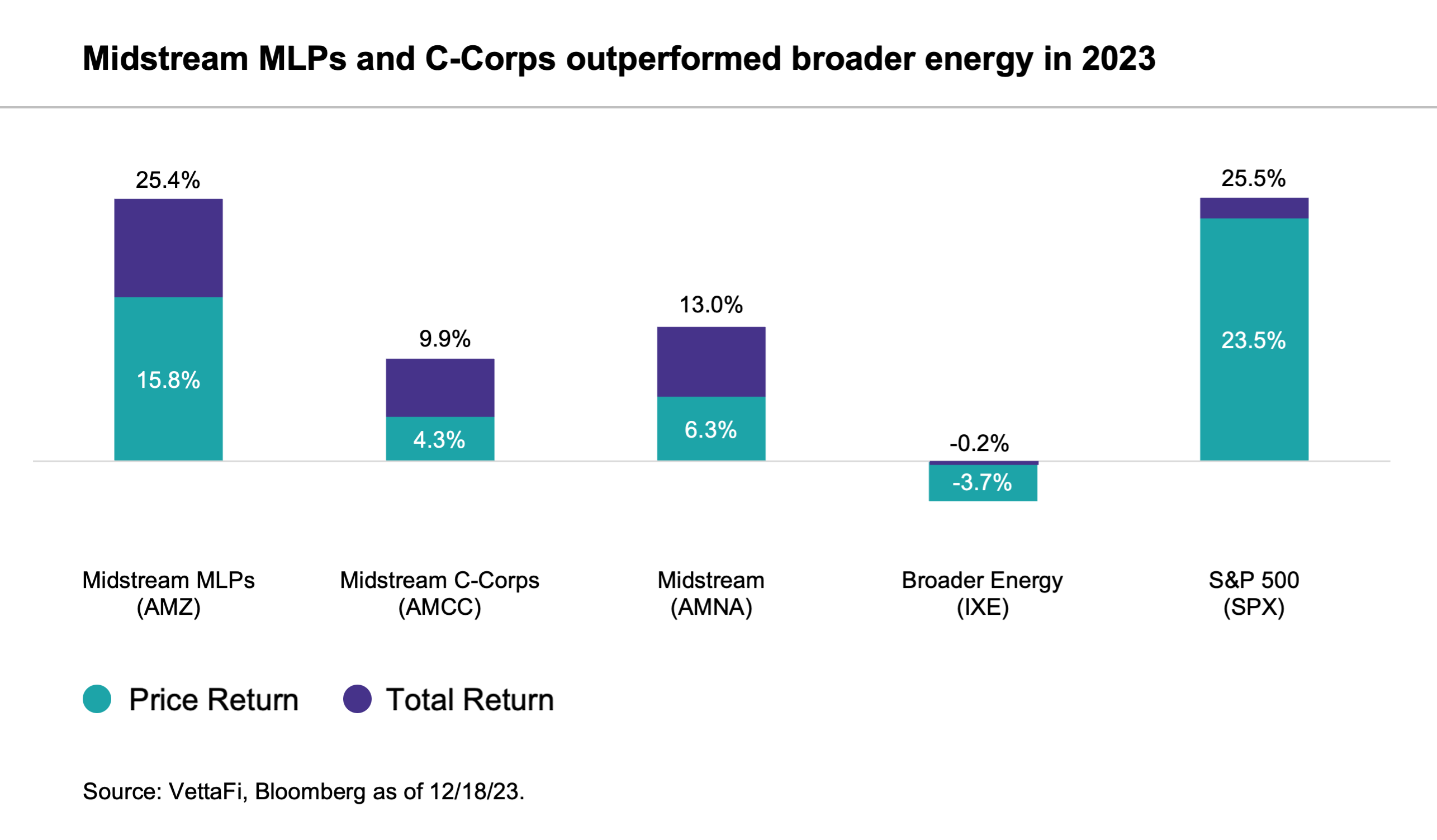

With weaker oil and natural gas prices this year, midstream has handily outperformed broader energy thus far in 2023. The Alerian Midstream Energy Index (AMNA), the broad North American benchmark for energy infrastructure companies, has gained 13.0%. The S&P Energy Select Sector Index (IXE) was down 0.2% on a total-return basis as of December 18.

Midstream MLPs Outpace Their C-Corp Counterparts

While midstream broadly benefits from fee-based business models, performance from energy infrastructure companies has varied. This delineation can be seen by comparing an index of MLPs with an index of U.S. and Canadian corporations. The Alerian MLP Index (AMZ) has gained 25.4% on a total-return basis year to date. The Alerian Midstream Energy Corporation Index (AMCC) has gained 9.9% on a total-return basis through December 18. AMZ is performing in line with the S&P 500, which was up 25.5% year to date.

The outperformance of MLPs can be attributed to a few factors. These include M&A and higher MLP yields. MLP indexes saw outsized benefits from Magellan Midstream Partners’ acquisition by ONEOK at a 22% premium, which closed in late September (read more). Magellan had a significant weighting in MLP indexes. That boosted their returns. Meanwhile, other MLPs traded up in connection with the Magellan news as investors speculated about other potential targets.

While MLPs Holly Energy Partners and Crestwood Equity Partners were also acquired in 2H23, the deals did not include performance-boosting premiums. That said, with fewer public midstream MLPs, dedicated MLP funds have a narrowed pool of investment options. That can support performance for the MLPs that remain.

MLPs’ more generous yields have also contributed to outperformance relative to midstream C-Corps. Given MLPs’ pass-through structure, they can typically provide a higher yield than midstream C-Corps. As of December 18, the AMZ was yielding 7.3%, while AMCC was yielding 5.3%. Strong dividend growth trends have added to the appeal of midstream/MLPs for investors. But MLPs generally provided more pronounced dividend growth in 2023 (read more).

Interest Rates Weigh on Midstream C-Corp Performance

Some of the underperformance by C-Corps relative to MLPs can be attributed to higher interest rates. With their lower yields, corporations face greater competition from bonds when yields rise. Additionally, select corporations tend to have higher debt burdens or more exposure to floating debt.

For example, the large Canadian midstream names Enbridge (ENB CN) and TC Energy (TRP CN) carry higher debt loads and leverage ratios compared with U.S.-based peers as they work through significant project backlogs (read more). With their greater use of debt, these companies have been more sensitive to higher interest rates and lagged for much of 2023. Even with a notable rebound since November on improving prospects for rate cuts in 2024 and positive company outlooks for next year, ENB is down 3.6% and TRP is up 2.2% year to date through December 18 on a total-return basis.

Large U.S. corporation Kinder Morgan (KMI) faced scrutiny this year for its exposure to floating rate debt. Coming into the year, KMI had ~$7.5 billion of floating rate debt. By the 1Q23 earnings call in April, management had eliminated short-term rate exposure on half of its floating rate debt for 2023. KMI is up 3.7% on a total-return basis through December 18.

What Factors May Impact Performance Into 2024?

Energy infrastructure performed defensively amid oil and gas price weakness this year, while MLPs particularly benefited from M&A activity and generous yields. Looking to 2024, midstream’s defensive qualities and continued free cash flow generation should be broadly supportive as companies continue to prioritize dividend growth and opportunistic buybacks. (Stay tuned for our 2024 midstream outlook on January 3, and join our outlook webcast on January 10 – register here.)

Whether MLPs will continue to noticeably outperform corporations is less clear. MLPs’ long-standing yield advantage relative to corporations should remain intact. The headwind from higher interest rates for select companies could reverse in 2024, benefiting corporations. M&A activity is less predictable. Media reports have pointed to a potential sale of U.S. midstream C-Corp Equitrans (ETRN), but the overall performance impact may be relatively muted given its small weighting in indexes and gains already seen this year on the rumor.

Bottom Line

MLPs are set to outperform their C-Corp counterparts in 2023 for the second straight year, although corporations outperformed MLPs in 2020 and 2021. The macro environment and M&A activity are some of the factors that could determine whether MLPs or corporations see a stronger 2024.

For more news, information, and strategy, visit the Energy Infrastructure Channel.

AMZ is the underlying index for the JP Morgan Alerian MLP Index ETN (AMJ) and the ETRACS Quarterly Pay 1.5x Leveraged Alerian MLP Index ETN (MLPR). AMNA is the underlying index for the ETRACS Alerian Midstream Energy Index ETN (AMNA).

Related Research:

OKE Acquiring MMP: Valuation Nice, Taxes Add Wrinkle

MLP M&A Continues: ET to Acquire CEQP

Midstream Sees Strong Free Cash Flow Generation in 2023

3Q23 Midstream Dividend Recap: MLPs Bring the Growth

Examining Midstream/MLP Dividend Growth by Company

Midstream/MLPs Raising the Bar With Lower Leverage

Vettafi.com is owned by VettaFi LLC (“VettaFi”). VettaFi is the index provider for AMJ, MLPR and AMNA, for which it receives an index licensing fee. However, AMJ, MLPR, and AMNA are not issued, sponsored, endorsed, or sold by VettaFi, and VettaFi has no obligation or liability in connection with the issuance, administration, marketing, or trading of AMJ, MLPR, and AMNA.