Summary

- Midstream’s improved balance sheets and lower leverage ratios have been one of the benefits of excess cash flow.

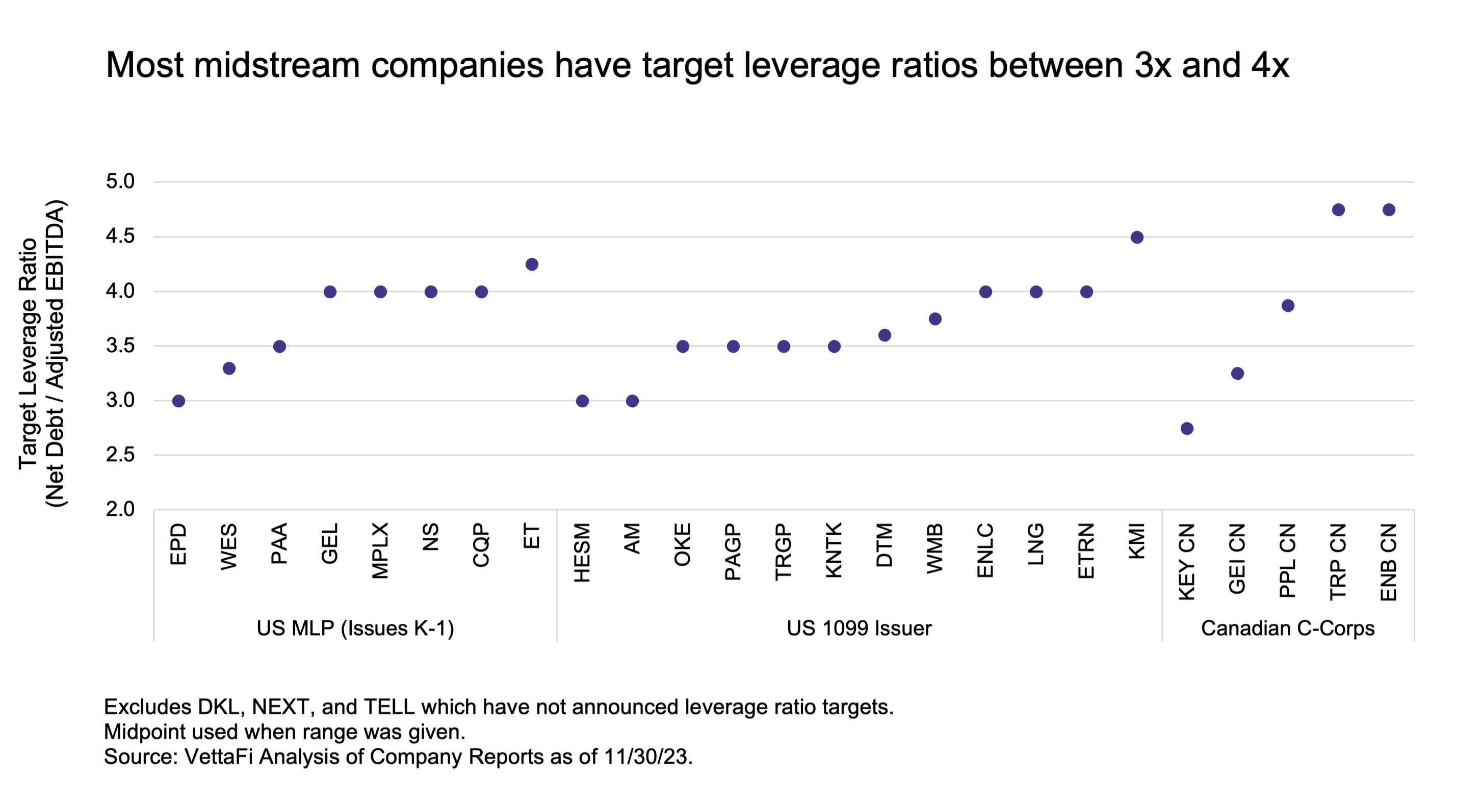

- Constituents of the Alerian Midstream Energy Select Index (AMEI) and the Alerian MLP Infrastructure Index (AMZI) have target leverage ratios between 2.5x and 5x.

- Midstream companies are continuing to lower target leverage ratios as strong free cash flow generation continues.

When it comes to the fruits of free cash flow generation for midstream, dividend growth and buybacks are typically front and center for investors. However, excess cash flow has also supported improved balance sheets and lower leverage. While this trend was underway before the rate hike cycle, reduced leverage can be particularly beneficial in today’s higher rate environment. Today’s note looks at target leverage ratios for midstream MLPs and corporations.

Excess Free Cash Flow Facilitated Debt Reduction

In recent years, midstream MLPs and corporations have seen strong free cash flow generation (read more). Excess cash flow has been used to reduce leverage, and a stronger balance sheet was often a prerequisite to pursuing shareholder-friendly returns like dividend increases and equity buybacks. With enhanced financial flexibility, leverage targets have generally trended lower over time, whereas prior to the pandemic, it was not uncommon for companies to have leverage ratios of 4.5x or more (read more). For clarity, leverage ratio is defined as Net Debt / Adjusted EBITDA.

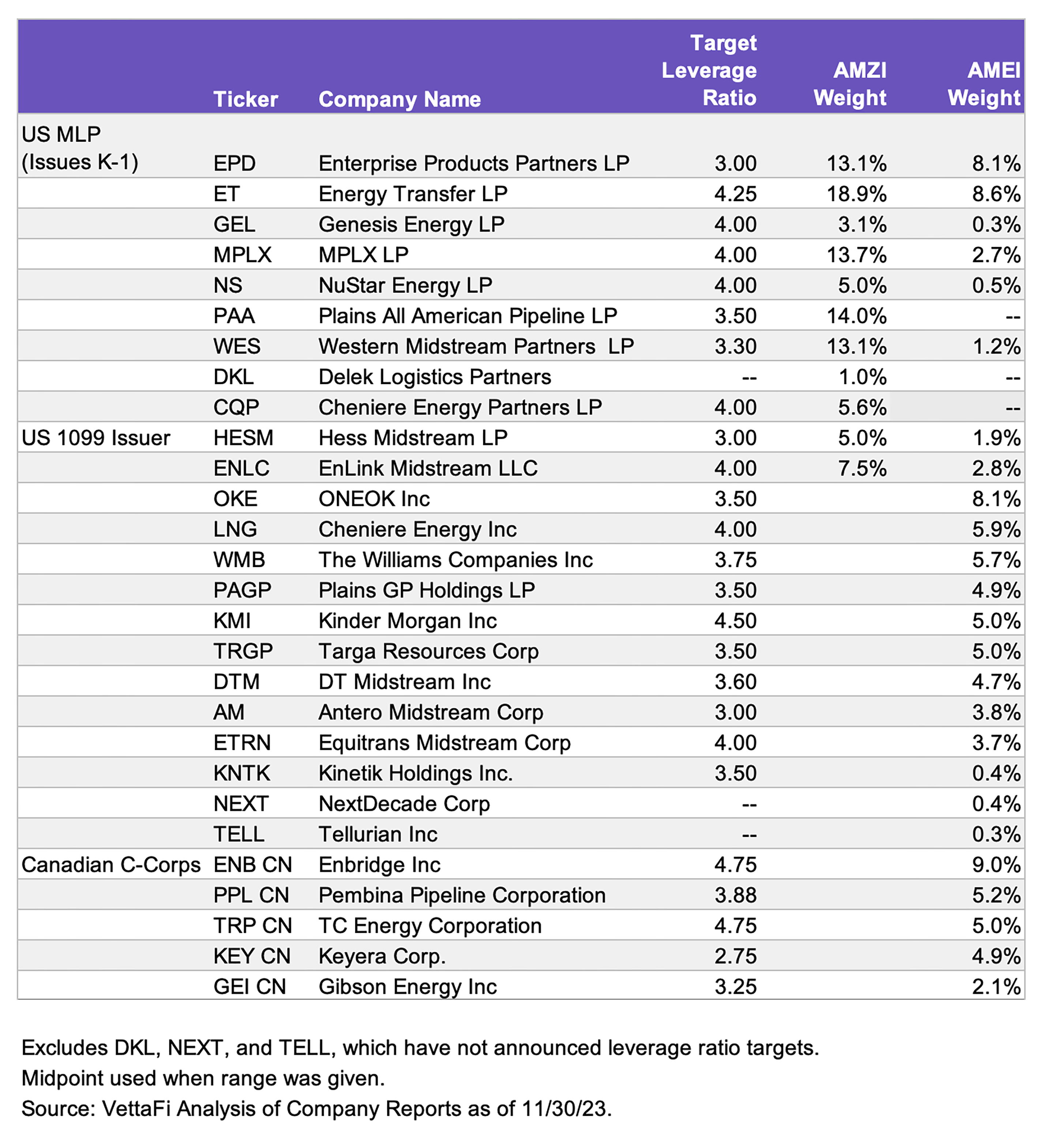

The chart below shows stated leverage ratio targets for constituents of the Alerian Midstream Energy Select Index (AMEI) and the Alerian MLP Infrastructure Index (AMZI). Midstream target leverage ratios fall between 2.5x and 5.0x, while the average across all constituents is 3.71x. Note that the chart shows the midpoint when a range is provided. The appendix below includes the list of constituents, their leverage ratio targets, and their index weightings.

Canadian names have carried higher leverage ratios in recent years. Specifically, large-cap names Enbridge (ENB CN) and TC Energy (TRP CN) have higher target leverage ratios than all other AMEI constituents, which also corresponds to more extensive project backlogs and heavier capital spending. The smaller Canadian names have leverage targets more in line with their U.S. peers.

Constituents Continue to Target Lower Leverage Ratios

With excess cash flow and an ongoing focus on capital discipline, target leverage ratios have continued to move lower. This has been true for both midstream and the broader energy sector. In its 3Q23 earnings release last month, Plains All American (PAA/PAGP) lowered its target leverage ratio by 0.5x to 3.5x at the midpoint. With the announcement, Plains noted a continued commitment to enhancing its balance sheet, and the company expects leverage to end 2023 below 3.5x.

At the start of the year, bellwether MLP Enterprise Products Partners (EPD) lowered its leverage target from 3.5x to 3.0x at the midpoint. During its 4Q22 earnings call, management noted that dividend aristocrats mostly have leverage ratios below 3x, with many below 2x. With EPD’s 25 straight years of distribution growth, the dividend aristocrats are a fitting benchmark. EPD also noted a broader push in the energy sector for stronger balance sheets than were seen historically.

In 4Q22, Cheniere Energy (LNG) lowered its target leverage ratio to approximately 4x as part of its “20/20 Vision” capital allocation plan. Under the plan, LNG’s allocation to debt reduction is paired with equity buybacks on a 1:1 ratio updated from the previous 4:1 ratio.

Bottom Line:

Midstream target leverage ratios have moved lower over time as companies have used excess cash flow to reduce debt and as the broader energy sector pursues stronger balance sheets than in the past.

Related Research:

Midstream Sees Strong Free Cash Flow Generation in 2023

3Q23 Midstream Dividend Recap: MLPs Bring the Growth

3Q23 Midstream/MLP Buybacks: C-Corps Remain More Active

Midstream and MLPs: Leveled Up With Leverage Down

Examining Midstream/MLP Credit Ratings and Yields

AMZI is the underlying index for the Alerian MLP ETF (AMLP) and the ETRACS Alerian MLP Infrastructure Index ETN Series B (MLPB). AMEI is the underlying index for the Alerian Energy Infrastructure ETF (ENFR) and the ALPS Alerian Energy Infrastructure Portfolio (ALEFX).

vettafi.com is owned by VettaFi LLC (“VettaFi”). VettaFi is the index provider for AMLP, MLPB, ENFR, and ALEFX for which it receives an index licensing fee. However, AMLP, MLPB, ENFR, and ALEFX are not issued, sponsored, endorsed, or sold by VettaFi. VettaFi has no obligation or liability in connection with the issuance, administration, marketing, or trading of AMLP, MLPB, ENFR, and ALEFX.

Appendix: AMZI and AMEI Constituents With Target Leverage Ratios

For more news, information, and analysis, visit the Energy Infrastructure Channel.