Summary

- After years of hefty spending to facilitate tremendous US energy production growth, midstream companies are reaping cash flows from past projects and spending a lot less, leading to excess cash.

- Large midstream companies are expected to generate billions of dollars in free cash flow this year, with many expected to have cash leftover even after sizable dividend payments.

- Unlike other energy subsectors, midstream can generate steady free cash flow through different commodity price backdrops.

Free cash flow (FCF) has been a key theme in the energy infrastructure space in recent years. Excess cash flow has facilitated debt reduction as well as generous returns to shareholders. Today’s note takes a deeper look at FCF generation at the company level and the importance of this tailwind for midstream.

Midstream/MLPs went from cash-strapped to generating excess cash flows.

In the years leading up to the pandemic, midstream companies spent billions of dollars on capital projects to facilitate growing US energy production. As production soared, the US also became a major global energy exporter, which required more investment in infrastructure. Capital spending for midstream peaked in 2018 or 2019 and was already declining at the onset of the pandemic. However, as US oil and gas production temporarily fell in 2020 in the wake of extremely low oil prices, capital spending plans were further slashed.

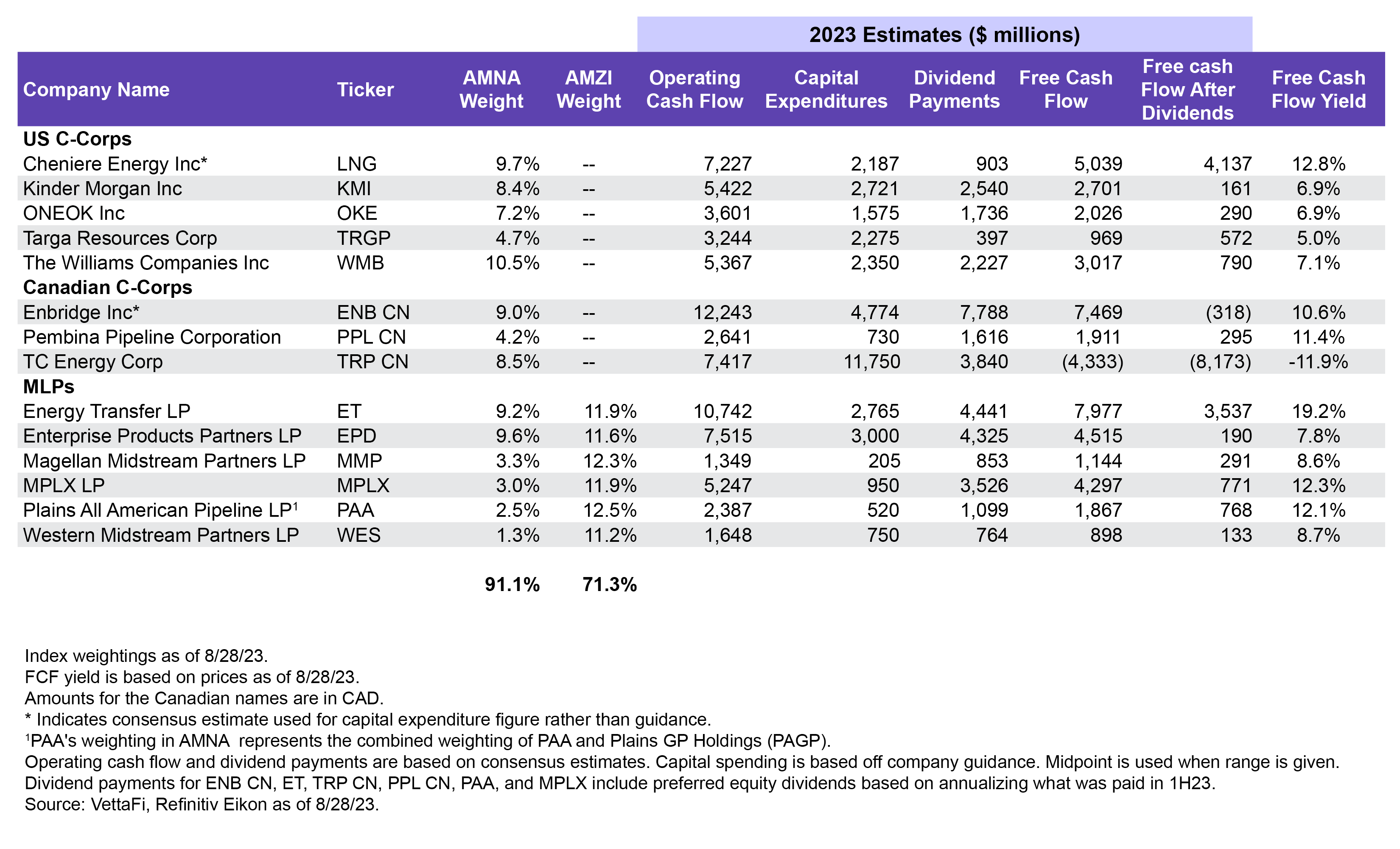

Coming out of the pandemic, US oil and gas production growth moderated, with oil production particularly slow to recover to pre-pandemic levels. Lower production growth has resulted in lower capital spending requirements for midstream (read more). For the 14 companies included in the table below, capital spending fell by $1.7 billion on average between 2019 and 2021, or about 62.9% (read more). With the projects started before the pandemic now in service, midstream companies are reaping cash flows from those investments while capex has fallen meaningfully, leading to excess cash.

Midstream free cash flow remains robust.

Large midstream companies are expected to generate billions of dollars in free cash flow this year, with many expected to have excess cash even after sizable dividend payments. The table below shows a selection of larger constituents of the Alerian MLP Infrastructure Index (AMZI) and Alerian Midstream Energy Index (AMNA), and their forecasted FCF for 2023. The analysis uses consensus estimates for operating cash flow and dividend payments from Refinitiv Eikon, while capital expenditures are based on company guidance, except where noted.

Among the large-cap energy infrastructure companies in the table, MLPs lead from a FCF yield standpoint. The average FCF yield for MLPs shown is approximately 11.4% based on 2023 estimates and market caps as of August 28. Average FCF yield for US large cap C-Corps is still healthy at 7.9%. FCF yields for the large Canadian C-Corps are mixed, with TC Energy (TRP CN) standing out for negative FCF, while Pembina (PPL CN) and Enbridge (ENB CN) boast double-digit FCF yields. TRP has the largest capex budget by far with plans to spend $30 billion in capital expenditures for 2023 through 2026 as it pursues several growth opportunities.

Looking more at the individual companies, Energy Transfer (ET) stands out for having the highest FCF yield at 19.2%. Note that this does not account for the $900 million cash consideration for ET’s acquisition of Lotus Midstream (read more). Cheniere Energy (LNG) has the second-highest FCF yield at 12.8%. Liquefaction capacity is expensive to build but can generate significant cash flows once completed, with LNG expecting over $20 billion of available cash through 2026 as outlined in September 2022.

Why does midstream FCF matter?

Significant free cash flow generation from midstream has marked an important sea change. In the 2010s, companies were spending a lot of money and heavily reliant on outside capital to finance their growth projects. They were often strapped for cash. Today, companies are enjoying greater financial flexibility and have been able to use excess cash to strengthen their balance sheets. Free cash flow is fueling returns to shareholders through growing dividends and buybacks.

It’s important to note that while all energy companies have been pursuing FCF, midstream’s fee-based business model helps companies generate similar levels of FCF through different commodity price environments. Oil and gas producers saw FCF climb in 2022 with higher energy prices, but FCF is noticeably lower in 2023 with weaker commodity prices. Midstream’s ability to generate FCF is not as tied to oil and natural gas prices. The FCF tailwind seen in midstream is expected to remain intact even through commodity price volatility.

Bottom Line:

Before the pandemic, midstream companies spent billions of dollars building the energy infrastructure that facilitated significant US oil and gas production growth. Today, with much lower capex requirements, midstream companies have been generating significant free cash flow, much of which is being returned to investors. The trend is expected to continue independent of commodity price moves.

AMZI is the underlying index for the Alerian MLP ETF (AMLP) and the ETRACS Alerian MLP Infrastructure Index ETN Series B (MLPB). AMNA is the underlying index for the ETRACS Alerian Midstream Energy Index ETN (AMNA).

Related Research:

US Production Outlook: Modest Growth Could Be Just Right

Midstream/MLPs: Free Cash Flow Powerhouse

Better Together: Energy Consolidation Continues

Midstream 2Q23 Dividend Recap: MLPs Drive Growth

Midstream Buybacks Picked Up in 2Q23

For more news, information, and analysis, visit the Energy Infrastructure Channel.

Vettafi.com is owned by VettaFi LLC (“VettaFi”). VettaFi is the index provider for AMLP, MLPB, and AMNA, for which it receives an index licensing fee. However, AMLP, MLPB, and AMNA are not issued, sponsored, endorsed, or sold by VettaFi, and VettaFi has no obligation or liability in connection with the issuance, administration, marketing, or trading of AMLP, MLPB, AMNA.