Summary

- Nine constituents in the broad Alerian Midstream Energy Index (AMNA) spent a combined $1.1 billion on equity repurchases in 2Q23.

- Corporations were more active with buybacks this quarter than MLPs, with some companies prioritizing other uses of capital over equity repurchases.

- As companies continue to generate excess free cash flow, buybacks remain an important tool for returning capital to investors.

With midstream MLPs and corporations generating significant free cash flow, buybacks have complemented growing dividends as companies prioritize returning cash to investors. Aggregate buybacks picked up in 2Q23 with corporations leading the way. Today’s note discusses 2Q23 buyback activity in midstream, including which companies were most generous with repurchases and why some chose not to pursue buybacks.

Buyback activity picked up in 2Q23, led by familiar names.

After a dip in 1Q23, midstream/MLP buyback activity rebounded in 2Q23, with a combined $1.1 billion in buybacks from Alerian Midstream Energy Index (AMNA) constituents[1]. For context, total repurchases were $850 million in 1Q23, below the $1.4 billion spend seen in each of the previous three quarters (read more).

Cheniere Energy (LNG) continued to lead the pack in buybacks, spending $337 million in 2Q23 after spending $450 million in 1Q23. Kinder Morgan (KMI) spent $203 million on buybacks in 2Q23, bringing its total for the first half of the year to $316 million. Targa Resources (TRGP) upped its buyback spend in 2Q23 to $149 million – almost three times the amount spent in 1Q23. Enbridge (ENB CN) repurchased $125 million in shares in 2Q23 after staying on the sidelines the prior quarter.

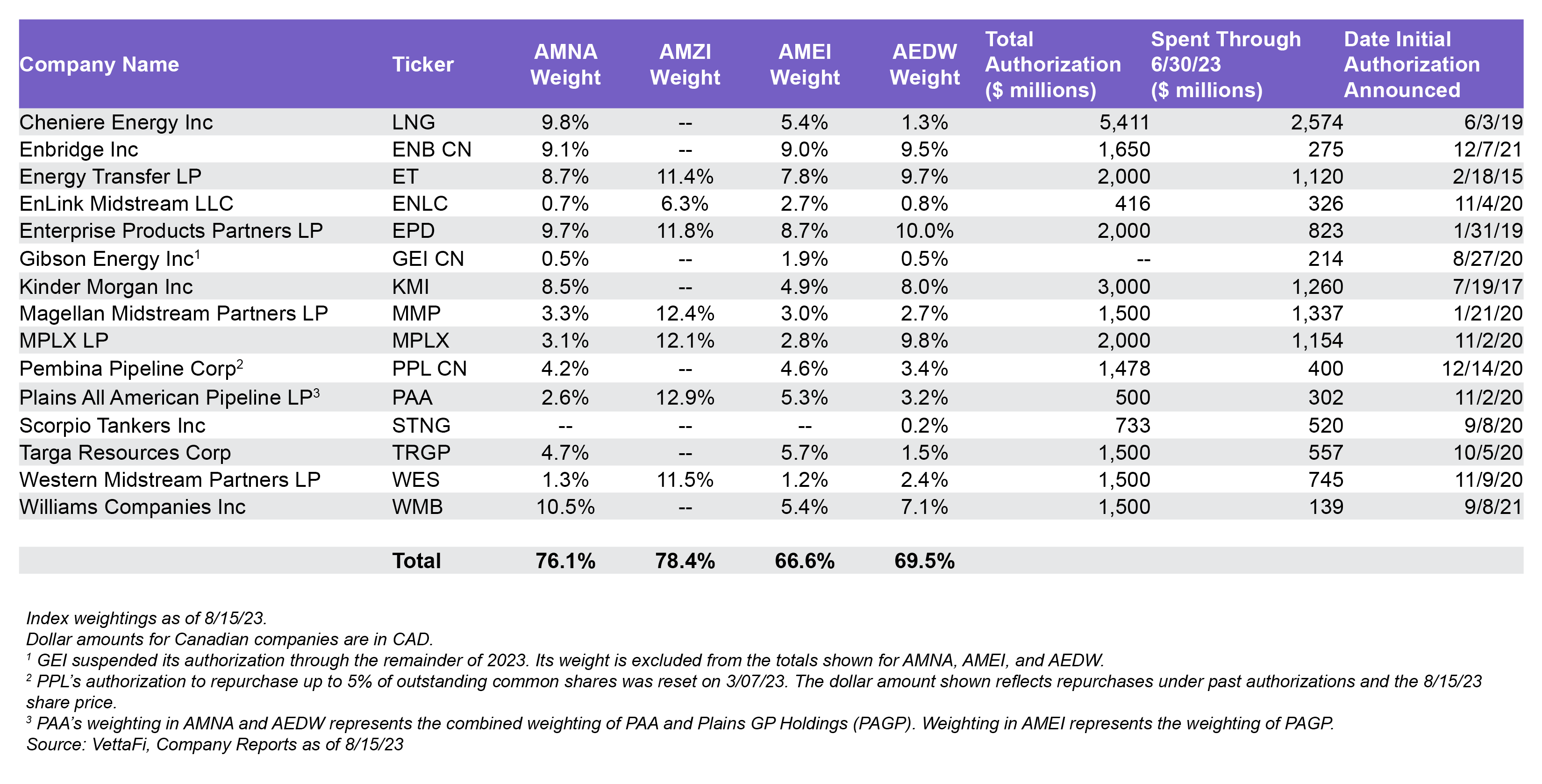

The table below shows the energy infrastructure companies with buyback authorizations in place, how much each has spent on repurchases, and each company’s weighting in AMNA, the Alerian MLP Infrastructure Index (AMZI), the Alerian Midstream Energy Select Index (AMEI), and the Alerian Midstream Energy Dividend Index (AEDW). More than 65% of the indexes by weighting have buyback authorizations in place.

Some companies pause buybacks given other capital priorities.

MLP repurchases were muted again in 2Q23. Enterprise Products Partners’ (EPD) $75 million constituted the only MLP buyback during the quarter. The lack of MLP repurchases could be explained by a couple of things. Companies may be prioritizing distribution growth or other capital priorities over buybacks. Also, with a solid performance this year (read more), those with an emphasis on opportunistic repurchases may not have seen many attractive windows to buy equity.

MPLX (MPLX), which led MLP buyback activity in 2022 with nearly $500 million spent (read more), has not repurchased equity so far this year. MPLX reiterated in its 2Q23 earnings call that its distribution remains the primary tool for returning capital to investors, supplemented by opportunistic buybacks. In recent years, MPLX has increased its payout with its November distribution. Therefore, investors will likely be closely watching the next distribution announcement.

Western Midstream (WES) has also been active with buybacks in the past but did not have repurchases in 2Q. Notably, WES announced a 12.5% distribution increase in July. During 2Q23, the company also reduced debt by repurchasing $118 million in senior notes and bought back another $159 million in senior notes after quarter end.

Others have suspended their programs or seen buyback authorizations lapse. Canadian corporation Gibson Energy (GEI) suspended its repurchase program for the rest of this year with its 2Q23 earnings. The announcement follows a bought deal offering used to help fund its acquisition of the South Texas Gateway Terminal. US corporation Antero Midstream (AM) had utilized about half of its $300 million authorization from 2019 before it expired at the end of 2Q23. The company has prioritized reducing debt and lowering leverage.

Bottom Line:

Buyback activity picked back up in 2Q23, driven by midstream corporations. Buybacks remain an important tool for companies to return capital to equity holders. Though companies also must balance buybacks with other capital priorities.

Related Research:

MLP/Midstream Buybacks Slow but Steady in 1Q23

MLPs Shine, REITs Lag in 2022 Performance for Income Investments

Midstream 2Q23 Dividend Recap: MLPs Drive Growth

4Q22 Caps a Strong Year for Midstream/MLP Buybacks

For more news, information, and analysis, visit the Energy Infrastructure Channel.

[1] Aggregate dollar amounts include Canadian dollars for the Canadian corporations with repurchase programs.

AMZI is the underlying index for the Alerian MLP ETF (AMLP) and the ETRACS Alerian MLP Infrastructure Index ETN Series B (MLPB). AMNA is the underlying index for the ETRACS Alerian Midstream Energy Index ETN (AMNA). AMEI is the underlying index for the Alerian Energy Infrastructure ETF (ENFR) and the ALPS Alerian Energy Infrastructure Portfolio (ALEFX). AEDW is the underlying index for the Alerian Midstream Energy Dividend UCITS ETF (MMLP) and the ETRACS Alerian Midstream Energy High Dividend Index ETN (AMND).

vettafi.com is owned by VettaFi LLC (“VettaFi”). VettaFi is the index provider for AMLP, MLPB, AMNA, ENFR, ALEFX, MMLP, and AMND, for which it receives an index licensing fee. However, AMLP, MLPB, AMNA, ENFR, ALEFX, MMLP, and AMND are not issued, sponsored, endorsed, or sold by VettaFi. VettaFi has no obligation or liability in connection with the issuance, administration, marketing, or trading of AMLP, MLPB, AMNA, ENFR, ALEFX, MMLP, and AMND.