Summary

- Dividend trends for energy infrastructure corporations and MLPs remain strong, adding important context to the generous yields this space provides.

- On a year-over-year basis, 94% of the broad Alerian Midstream Energy Index (AMNA) by weighting has grown their dividends.

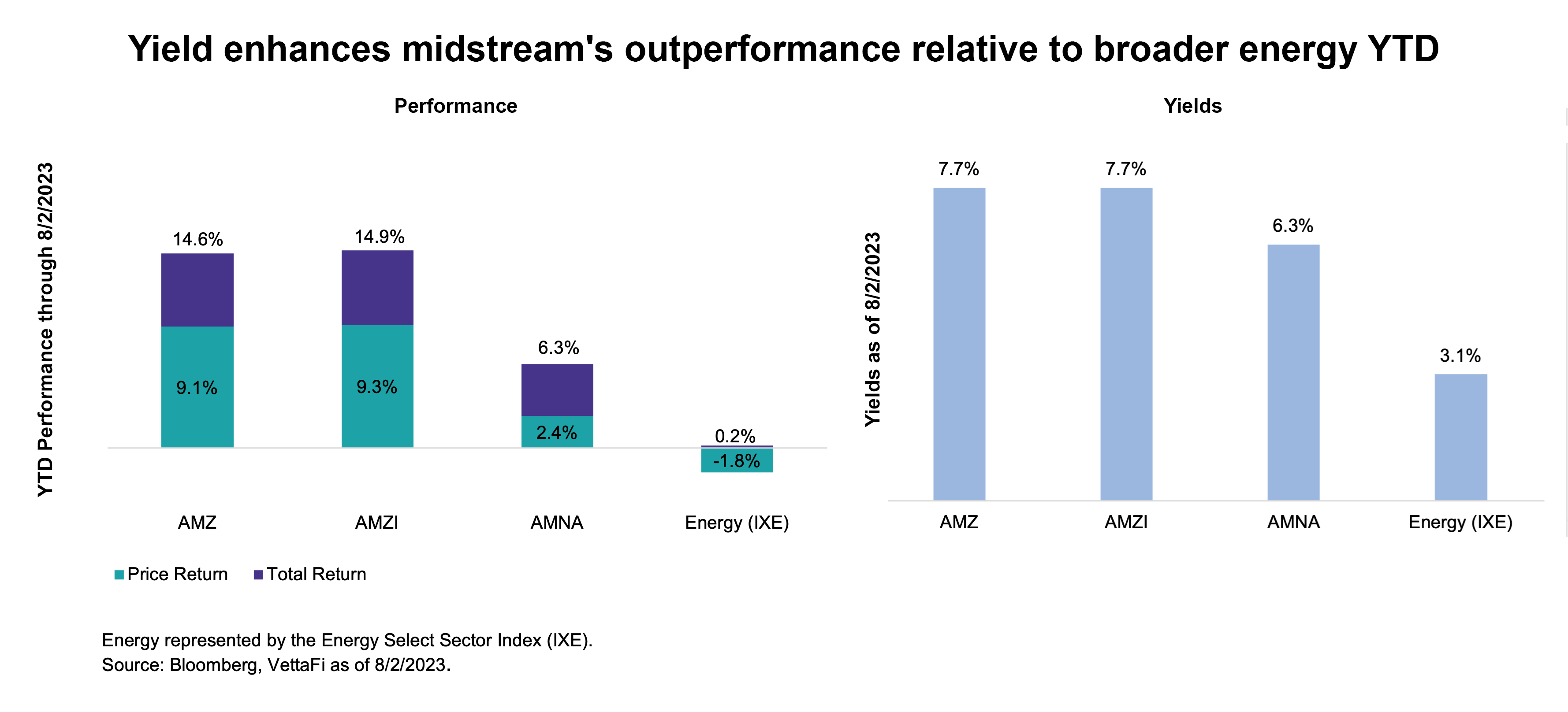

- Midstream’s income profile has also contributed to its significant outperformance relative to broader energy thus far in 2023.

Dividend trends for energy infrastructure corporations and MLPs remain very strong as companies continue to prioritize returning excess cash to shareholders. Notably, it has been over two years since there was a dividend cut in the broad Alerian Midstream Energy Index (AMNA). Today’s note recaps 2Q23 dividend announcements and discusses year-to-date outperformance for midstream benchmarks relative to broader energy.

2Q23 Dividends: MLPs Provide Growth This Quarter

Dividend increases for this quarter predominantly came from MLPs. The most notable increase for 2Q23 was from Western Midstream Partners (WES), which announced a 12.5% increase to its quarterly base distribution to $0.5625 per unit. Recall, WES adopted a framework for paying an enhanced distribution with each 1Q payout based on the prior year’s financial performance. For WES and Cheniere Energy Partners (CQP), which also has a variable component to its distribution, this comparison references base distributions.

Enterprise Products Partners (EPD) announced a 2.0% distribution increase to $0.50 per unit, while also highlighting $75 million in equity repurchases in 2Q23. (Stay tuned for a 2Q23 buyback note in the coming weeks.) EPD has grown its distribution for 25 straight years — a remarkable track record.

Energy Transfer (ET) increased its distribution by $0.0025 per unit, consistent with its planned quarterly progression as it targets 3%-5% annual distribution growth. Hess Midstream (HESM) increased 2.7%, Delek Logistics Partners (DKL) increased 1.0%, and Global Partners (GLP) increased 3.1%.

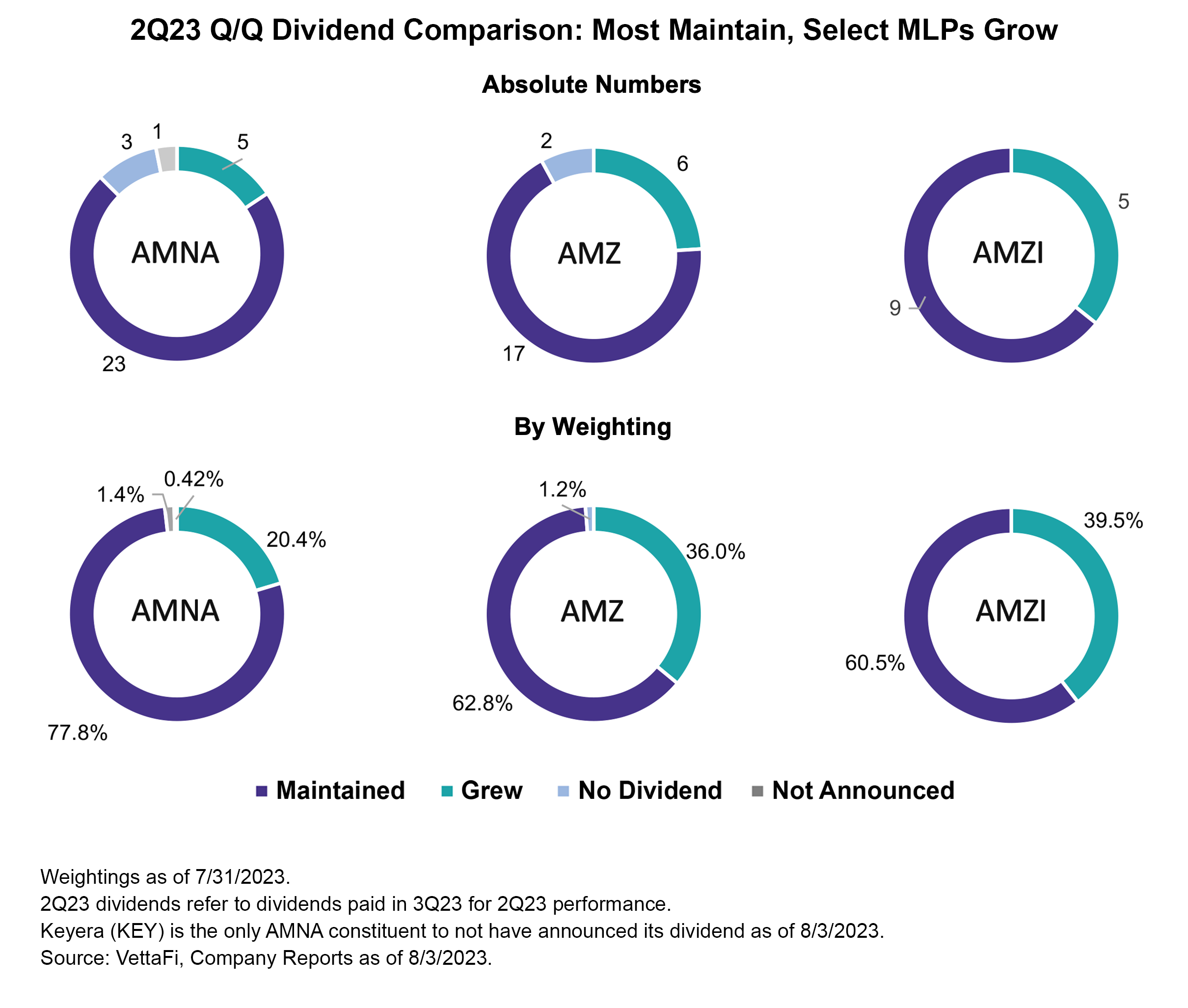

The pie charts below show quarter-over-quarter changes to dividends for the Alerian Midstream Energy Index (AMNA), the Alerian MLP Index (AMZ), and the Alerian MLP Infrastructure Index (AMZI) by comparing 2Q23 payouts to those made for 1Q23. To be clear, 2Q23 dividends refer to dividends paid in 3Q23 based on operational performance in 2Q23.

Most Constituents Have Grown Their Payouts Within the Last Year

While sequential increases are informative, a year-over-year comparison can provide a big-picture view of dividend trends in this space. As shown below, the majority of index constituents across the benchmark Alerian midstream/MLP indexes have grown their payouts over the last year.

For AMNA, which includes MLPs and corporations, 94.0% of constituents by weighting have grown their dividends over the past year. Many corporations (and some MLPs) only increase their payouts once a year, which is better captured in the charts below. For the MLP indexes, AMZ and AMZI, approximately 80% of both indexes by weighting have increased their distributions on a year-over-year basis. The names that have grown their payouts tend to be bigger by market cap and therefore tend to have a higher weighting in the indexes.

It bears noting that this comparison only includes current constituents, which can result in survivorship bias. USD Partners (USDP), the former AMZ constituent that suspended its distribution for 1Q23, was shown as a cut last quarter (read more). However, USDP was removed from the AMZ in June, thus eliminating the cut from this chart.

Midstream Yields Enhance Total Return

The positive dividend trends for midstream, including two years without a dividend cut for AMZI and AMNA, provide important context for the generous yields provided. As of August 2, the AMZ and AMZI were yielding 7.7%, while AMNA was yielding 6.3% — well above most equity income investment categories, corporate bonds (read more), and the broad Energy Select Sector Index (IXE), as shown below.

Midstream’s fee-based business models have provided insulation from commodity price volatility while supporting generous dividends. Dividends (and buybacks) help support total return. As shown in the chart below, midstream has noticeably outperformed broader energy, which has struggled for much of this year. AMZI is up nearly 15% year-to-date, while the IXE is essentially flat even after a strong oil price rally in July. Midstream is well-positioned if commodity price volatility continues or can stand to benefit from improved sentiment if commodity prices move higher. In either scenario, the outlook for midstream dividends is positive.

Bottom Line:

Midstream MLPs and corporations continue to offer compelling income supported by fee-based business models and solid free cash flow generation. Positive dividend trends add confidence to the compelling yields offered by midstream/MLPs.

AMZI is the underlying index for the Alerian MLP ETF (AMLP) and the ETRACS Alerian MLP Infrastructure Index ETN Series B (MLPB). AMZ is the underlying index for the JP Morgan Alerian MLP Index ETN (AMJ) and the ETRACS Quarterly Pay 1.5x Leveraged Alerian MLP Index ETN (MLPR). AMNA is the underlying index for the ETRACS Alerian Midstream Energy Index ETN (AMNA).

Related Research:

Is Your Income Stream Too Dependent on the Fed?

1Q23 MLP/Midstream Payouts Are Solid as Equities Wobble

MLP/Midstream Buybacks are Slow but Steady in 1Q23

Vettafi.com is owned by VettaFi LLC (“VettaFi”). VettaFi is the index provider for AMLP, MLPB, AMJ, MLPR and AMNA, for which it receives an index licensing fee. However, AMLP, MLPB, AMJ, MLPR, and AMNA are not issued, sponsored, endorsed, or sold by VettaFi, and VettaFi has no obligation or liability in connection with the issuance, administration, marketing, or trading of AMLP, MLPB, AMJ, MLPR, and AMNA.

For more news, information, and analysis, visit the Energy Infrastructure Channel.