- Eight constituents in the broad Alerian Midstream Energy Index (AMNA) spent a combined $780 million on equity repurchases in 1Q23.

- Aggregate buybacks declined sequentially as companies with an opportunistic approach were less active, and some stayed on the sidelines altogether.

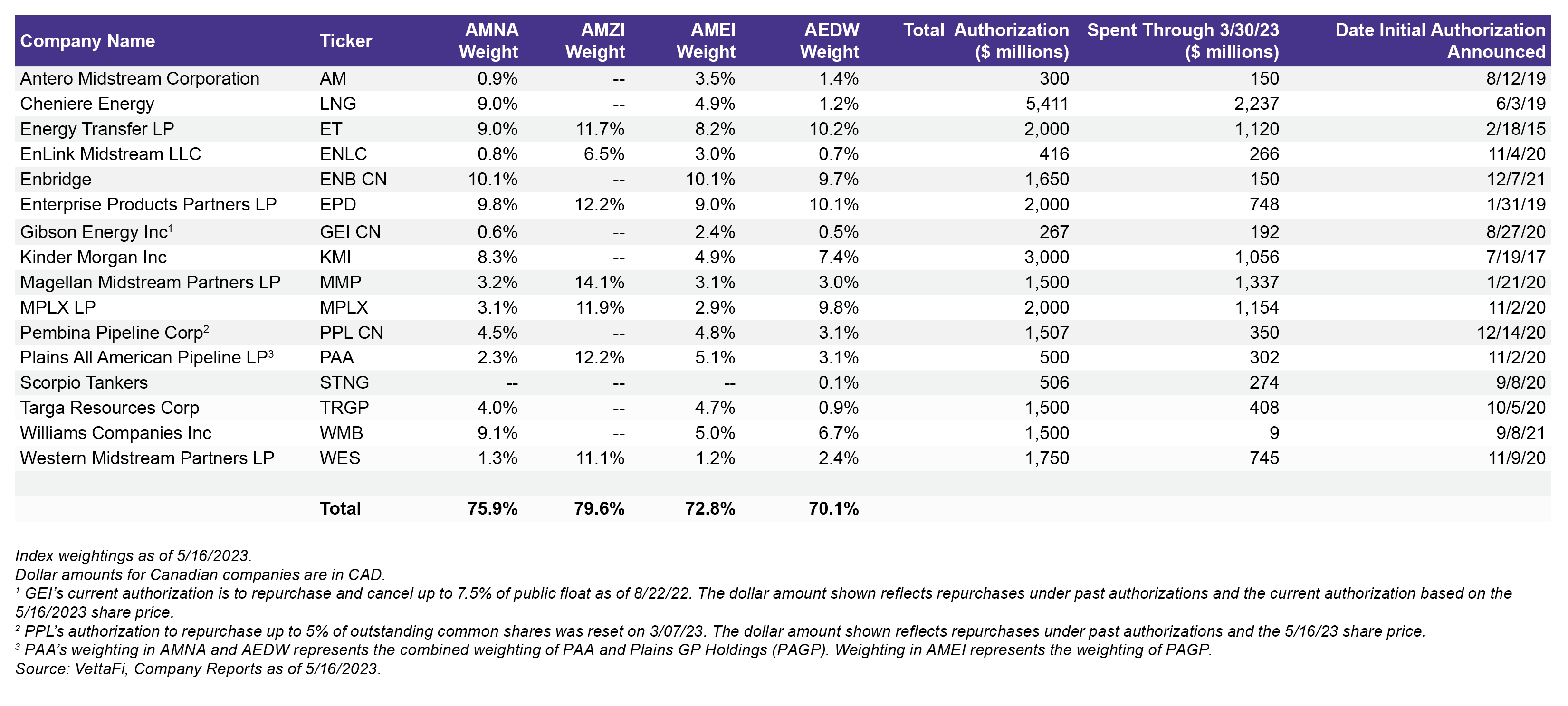

- Almost 76% of constituents in the Alerian Midstream Energy Index (AMNA) by weighting currently have buyback authorizations in place.

Midstream buybacks have been an important complement to growing dividends as companies return excess cash flow to investors. For 1Q23, total buyback spend fell noticeably from levels seen for the last three quarters. Today’s note examines 1Q23 repurchases by company and some of the drivers behind lower buyback levels this quarter. Importantly, the 1% excise tax on buybacks does not seem to have been a factor.

Midstream buybacks dipped in 1Q23.

Eight constituents in the Alerian Midstream Energy Index (AMNA) collectively bought back $780 million of their equity in 1Q23 [1]. This marks a slowdown from the ~$1.4 billion spent on repurchases for each of the last three quarters. However, 1Q23 spend is more than double the $370 million used for repurchases in 1Q22.

Cheniere Energy (LNG) again accounted for the bulk of 1Q23 buybacks at $450 million – down from over $700 million in 4Q22. Kinder Morgan (KMI) was the only other name to spend more than $100 million on buybacks in the quarter, having repurchased $113 million. Targa Resources (TRGP) bought back $52 million in equity during 1Q23 and announced board approval of a new $1 billion authorization.

The table below shows the energy infrastructure companies with buyback authorizations in place, how much each has spent on repurchases, and each company’s weighting in AMNA, the Alerian MLP Infrastructure Index (AMZI), the Alerian Midstream Energy Select Index (AMEI), and the Alerian Midstream Energy Dividend Index (AEDW). More than 70% of the indexes by weighting have buyback authorizations in place.

MLP buybacks slow as MPLX pauses.

Some of the larger MLPs saw a sequential decline in buyback spending. Magellan Midstream Partners (MMP) repurchased $64 million in units during 1Q23 — down from $95 million in 4Q22. MMP’s generous buybacks and solid dividend track record will likely be missed by investors in the wake of its pending acquisition (read more).

Enterprise Products Partners (EPD) highlighted the opportunistic nature of its repurchase program on its earnings call. EPD spent $17 million on buybacks in March when the banking crisis was pressuring energy stocks, including midstream (read more). The short-lived, broad weakness in MLPs/midstream in mid-to-late March provided a narrow window when repurchases may have been particularly attractive, even as midstream held up better than other energy subsectors.

MPLX, which led MLPs with nearly $0.5 billion in equity repurchases in 2022, did not have any buybacks in 1Q23. MPLX management expects the distribution to be the primary vehicle for returning capital to unitholders in 2023 as discussed on the 1Q23 earnings call. Plains All American (PAA) also did not have any buybacks in the quarter.

Is the 1% excise tax on buybacks taking a toll?

Recall, the Inflation Reduction Act included a 1% excise tax on stock buybacks for corporations beginning January 1, 2023. Though this was the first quarter with the tax in place, it did not seem to be a factor in 1Q23’s lower buyback spend. Importantly, the buyback tax does not apply to MLPs. Corporations LNG and KMI were clearly comfortable spending hundreds of millions of dollars on buybacks despite the tax, which is arguably negligible.

Bottom Line

Buyback activity slowed in 1Q23 as companies with a more opportunistic approach were generally less active or stayed on the sidelines. Cheniere (LNG) continues to drive the bulk of buybacks having accounted for more than half of aggregate 1Q23 repurchase spend. Buybacks will fluctuate each quarter depending on a variety of factors, including equity prices, but buybacks remain an important tool for returning cash to investors.

For more news, information, and analysis, visit the Energy Infrastructure Channel.

AMZI is the underlying index for the Alerian MLP ETF (AMLP) and the ETRACS Alerian MLP Infrastructure Index ETN Series B (MLPB). AMNA is the underlying index for the ETRACS Alerian Midstream Energy Index ETN (AMNA). AMEI is the underlying index for the Alerian Energy Infrastructure ETF (ENFR) and the ALPS Alerian Energy Infrastructure Portfolio (ALEFX). AEDW is the underlying index for the Alerian Midstream Energy Dividend UCITS ETF (MMLP) and the ETRACS Alerian Midstream Energy High Dividend Index ETN (AMND).

Related Research:

1Q23 MLP/Midstream Payouts Are Solid as Equities Wobble

4Q22 Caps a Strong Year for Midstream/MLP Buybacks

OKE Acquiring MMP: Taxes Add Wrinkle, Valuation Nice

Midstream Investors Can Give Thanks for 3Q22 Buybacks

vettafi.com is owned by VettaFi LLC (“VettaFi”). VettaFi is the index provider for AMLP, MLPB, AMNA, ENFR, ALEFX, MMLP, and AMND, for which it receives an index licensing fee. However, AMLP, MLPB, AMNA, ENFR, ALEFX, MMLP, and AMND are not issued, sponsored, endorsed, or sold by VettaFi, and VettaFi has no obligation or liability in connection with the issuance, administration, marketing, or trading of AMLP, MLPB, AMNA, ENFR, ALEFX, MMLP, and AMND.

[1] Aggregate dollar amounts include Canadian dollars for the Canadian corporations with repurchase programs.