Summary

- Winter weather can be a significant wildcard for natural gas prices, with last year’s warm weather contributing to weak natural gas prices in 2023.

- Despite weaker prices, natural gas production has continued to climb, creating growth opportunities for energy infrastructure companies.

- The outlook for U.S. natural gas prices generally becomes more constructive as new LNG export capacity is added later in 2024 and into 2025.

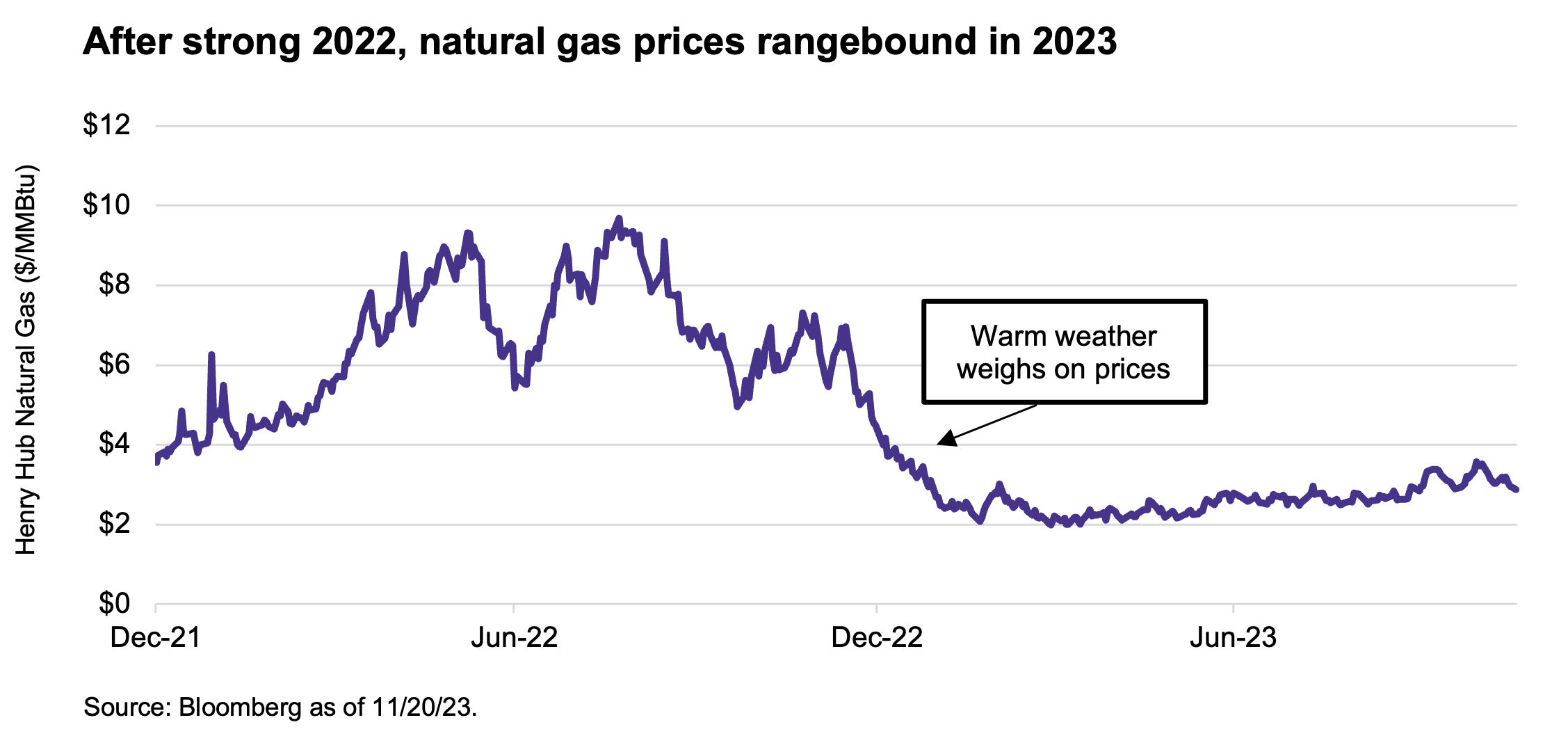

With Halloween in the rearview and sweater weather in full swing, the holiday season is top of mind for many. But for energy observers, this time of year also marks natural gas withdrawal season. After a stellar 2022, natural gas prices in the U.S. have been softer in 2023 after a warm winter sent prices tumbling. Today’s note discusses the outlook for natural gas prices and production growth, with incremental volumes creating opportunities for midstream MLPs and corporations.

Winter Weather Wildcard

Winter weather can be a significant wildcard for natural gas prices, with cooler temperatures more supportive for heating demand. Cold temperatures in producing regions can also interrupt production through well freeze-offs, which can boost prices. On the other hand, a warm winter results in less demand and can lead to bloated inventories when spring arrives. That’s precisely what happened last winter.

U.S. natural gas prices reached multiyear highs in 2022. They averaged over $6.50 per million British thermal unit (MMBtu) for the year. Prices benefited from strong demand trends over the course of the year. However, a warm winter contributed to a collapse in U.S. natural gas prices from mid-December 2022 through January 2023. Subsequently, U.S. benchmark natural gas prices at Henry Hub have had a $2-handle for most of this year as inventories have remained comfortable and production has been resilient.

With the onset of winter, natural gas prices have at times surpassed the $3-mark since October. Prices could temporarily jump with severe cold weather in the coming months. But with Lower 48 inventories still above the five-year average, it may be difficult to see a sustained price rally this winter. That said, the outlook for natural gas prices is likely to improve in late 2024 and into 2025 thanks to new LNG capacity.

LNG Capacity Additions May Support Prices in 2H24 and 2025

The outlook for U.S. natural gas prices generally becomes more constructive as new LNG export capacity is added later in 2024 and into 2025, driving incremental demand for natural gas. The first phases of Qatar Energy and Exxon’s (XOM) Golden Pass export facility and Venture Global’s Plaquemines terminal should come online later in 2024. Additional capacity from these projects is expected to ramp in 2025 (read more).

Meanwhile, Cheniere’s (LNG) Corpus Christi Stage 3 expansion is anticipated to achieve first gas by the end of 2024. Combined, these facilities represent 6.6 Bcf/d of peak nameplate LNG export capacity. That would be meaningful for natural gas demand. However, price improvement will also depend on supply.

Production Growth Expected to Continue

Despite lackluster prices in 2023, U.S. natural gas production has continued to increase. The Energy Information Administration forecasts total marketed natural gas production will be up 5 billion cubic feet per day (Bcf/d) on average for 2023, with another 1.7 Bcf/d of growth anticipated for 2024 as shown below.

Production growth has been broad based, but the Permian has been leading the way. Keep in mind, drilling economics in the Permian are driven more by oil prices. Natural gas prices in West Texas are discounted relative to the Henry Hub benchmark. But natural gas pricing is more of an afterthought. This is an important distinction from gas-focused regions like Appalachia or the Haynesville in Louisiana.

Given the production growth from the Permian, several midstream companies have gas-oriented growth projects in the basin. For example, Enterprise Products Partners (EPD) recently announced two new gas processing plants, which adds to a few plants already under construction for the MLP. Targa Resources (TRGP) is building four processing plants in the Permian, while MPLX is advancing two new processing plants in the Permian and one in Appalachia.

Natural gas pipeline capacity from the Permian to the Gulf Coast has also been under development. Kinder Morgan’s (KMI) Permian Highway Pipeline expansion of 0.55 Bcf/d is expected online by year-end 2023. The company continues to have discussions around a potential expansion of Gulf Coast Express. At the end of 3Q23, MPLX and partners completed the 0.5 Bcf/d Whistler expansion. MPLX and EnLink Midstream (ENLC) are among the companies behind the newbuild 2.5-Bcf/d Matterhorn Express Pipeline, which is expected online in 3Q24.

Steady production growth has created opportunities for energy infrastructure companies. Meanwhile, incremental LNG capacity and other new sources of demand are driving midstream growth as well. Setting aside natural gas, energy infrastructure companies are also pursuing growth opportunities related to natural gas liquids (NGLs), which include ethane and propane. U.S. production growth is moderating relative to years past. But there are still opportunities for growth, particularly related to natural gas and NGLs.

Bottom Line

While cold weather could boost natural gas prices this winter, the long-term upside to prices stems from incremental LNG capacity under development.

Despite price weakness, production has continued to grow, particularly from the Permian, providing growth opportunities for midstream corporations and MLPs.

Related Research

US Natural Gas Prices: Unhappy Holidays but Don’t Lose Cheer

U.S. LNG Projects Advance Even as Global Prices Slump

Propane Helps Fuel Midstream/MLP Growth

MLPs and the Fastest-Growing Hydrocarbon You’ve Not Heard Of

LNG Has Haynesville Humming – Benefits Midstream/MLPs

For more news, information, and strategy, visit the Energy Infrastructure Channel.