Summary

- Several factors had a hand in the -49.9% decline in natural gas prices from the end of November through January 13, 2023.

- Natural gas prices will likely remain volatile, with near-term prices driven by weather forecasts and any news around the restart of Freeport LNG.

- The combination of steady production growth, growing exports through pipelines and LNG facilities, and solid domestic demand has led to midstream growth opportunities favoring natural gas.

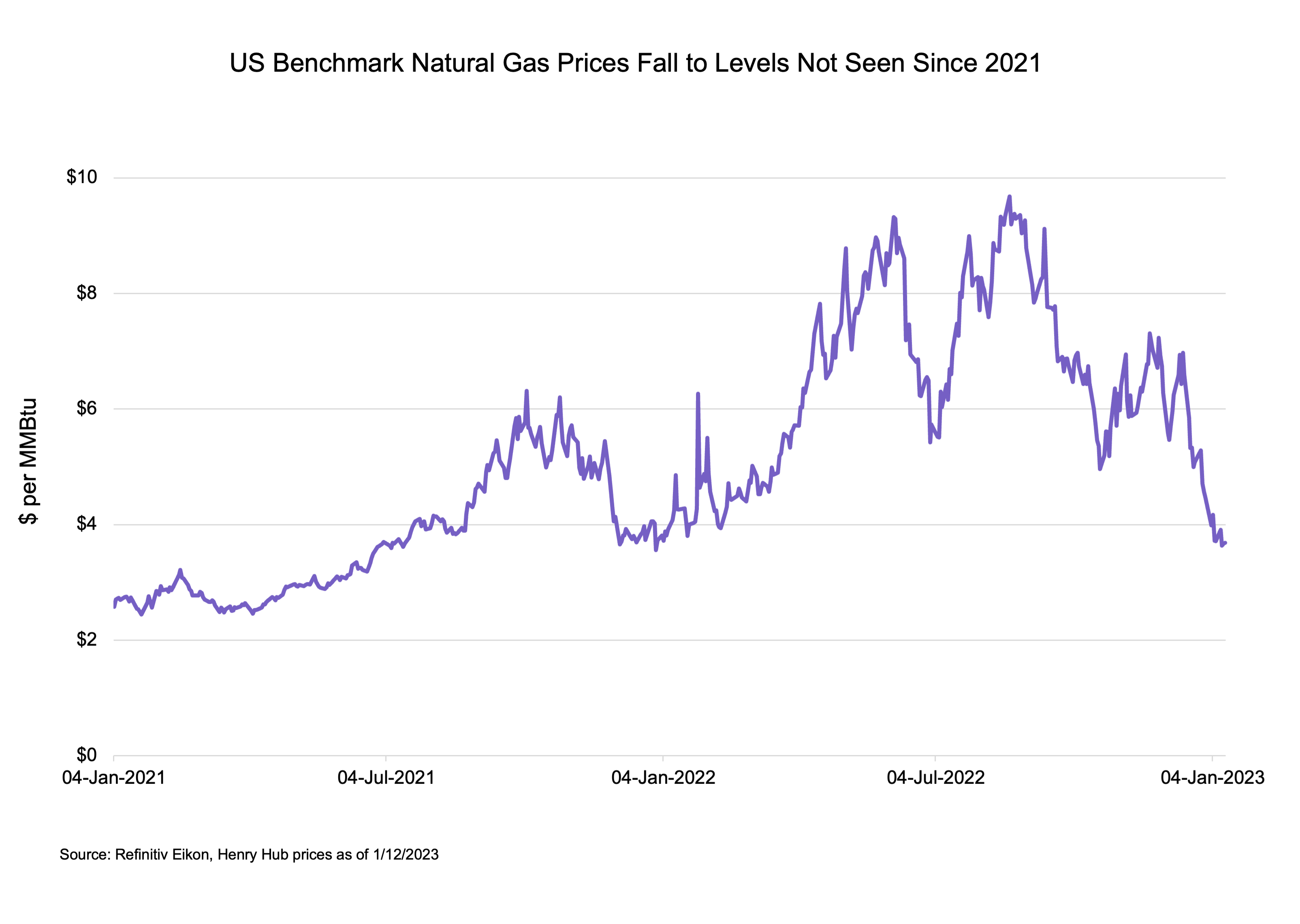

While warmer weather this January in several parts of the US may be welcome by many, it has been one of a few factors continuing to weigh on natural gas prices after a notable sell-off in December. Last week, US benchmark natural gas prices at Henry Hub were trading at levels not seen since 2021. Today’s note discusses some of the factors that have driven natural gas prices from ~$7 per million British thermal unit (MMBtu) at the end of November to under $4/MMBtu recently, what may be in store from here, and how this impacts midstream. While there are a number of regional price markers for natural gas, this discussion focuses on Henry Hub as the US benchmark.

Unhappy holidays for natural gas prices.

Several factors had a hand in the -49.9% decline in natural gas prices from the end of November through January 13, 2023. Warm weather has certainly lowered demand for heating purposes. (Higher temperatures have similarly caused European natural gas prices to lose about half their value since late November.) Also on the demand side, the delayed restart of the Freeport LNG export facility has weighed on prices. Following a fire on June 8, 2022, the export facility was initially expected to begin a partial restart in October 2022, but the timeline has been pushed back multiple times. Based on the company’s last announcement, the initial restart is expected in the second half of January. For context, Freeport has a baseload nameplate capacity of 2.0 billion cubic feet per day (Bcf/d) across its three trains or liquefaction units. Despite demand headwinds, natural gas inventories for the week ended January 6, 2023 were slightly below their 3-year and 5-year averages for this time of year.

On the supply side, natural gas production has been increasing, which can also pressure prices. Due to lags with monthly production data (October latest available), we use the Energy Information Administration’s (EIA) Drilling Productivity Report (DPR) to look at natural gas production trends in the chart below. The DPR covers the seven major onshore producing regions in the Lower 48, thereby excluding Alaska and the Gulf of Mexico, but capturing the bulk of US production. Natural gas production based on the DPR shale plays is estimated to have increased by 7.4 Bcf/d or 8.4% year-over-year for January 2023. On an annual basis, total US marketed natural gas production is estimated to have increased by 4.3 Bcf/d in 2022 based on EIA data.

What could be in store for natural gas prices?

Natural gas prices will likely remain volatile, with near-term prices driven by weather forecasts and any news around the restart of Freeport LNG. More broadly, the supply-demand picture for 2023 suggests a looser US natural gas market than last year based on EIA projections – even with production growth moderating. In its January Short-Term Energy Outlook, the EIA estimates domestic natural gas consumption will fall by 2.0 Bcf/d, production will grow by 2.5 Bcf/d, imports will fall by 0.7 Bcf/d, and exports (pipeline and LNG) will increase by 2.3 Bcf/d in 2023. That would imply inventories building for the year. In short, volatility will continue to characterize natural gas prices, but there seems to be a bias for 2023 prices to ease from the 2022 average of $6.42/MMBtu but likely stay above the long-time range of $2-3/MMBtu seen for much of the last decade if production growth does not overshoot. For its part, the EIA estimates natural gas prices will average $4.90/MMBtu this year.

What does this mean for midstream?

A significant portion of the midstream space is predominantly focused on activities related to natural gas, whether it be transporting natural gas through pipelines, gathering & processing, or liquefaction. Companies that primarily make money from these businesses represent 61.4% of the Alerian MLP Infrastructure Index (AMZI) and 75.7% of the Alerian Midstream Energy Index (AMNA) by weighting as of January 12. Natural gas prices have less direct impact on the midstream space, though processing contracts can sometimes have exposure to the commodity price. The combination of steady production growth, growing exports through pipelines and LNG facilities, and solid domestic demand has led to midstream growth opportunities favoring natural gas (and natural gas liquids). Indeed, several projects are underway to alleviate natural gas pipeline constraints from the Permian and add capacity from the Haynesville to the Gulf Coast to supply LNG facilities. For midstream, a price backdrop that supports moderate production growth would arguably be ideal. Benchmark Henry Hub prices do not have to be north of $5/MMBtu to see growth, but a sustained $2 or $3-handle on prices likely puts growth in greater jeopardy.

Bottom Line:

Natural gas prices have started 2023 on the wrong foot thanks in part to warmer-than-normal weather. Price volatility will likely continue, but it seems likely that prices in 2023 can again be strong relative to the levels seen for most of the last decade, which would bode well for producers and to a lesser extent, midstream.

AMZI is the underlying index for the Alerian MLP ETF (AMLP) and the ETRACS Alerian MLP Infrastructure Index ETN Series B (MLPB). AMEI is the underlying index for the Alerian Energy Infrastructure ETF (ENFR) and the ALPS Alerian Energy Infrastructure Portfolio (ALEFX). AMNA is the underlying index for the ETRACS Alerian Midstream Energy Index ETN (AMNA).

Related Research:

LNG Has Haynesville Humming – Benefits Midstream/MLPs

US LNG Projects a Mixed Bag Despite Strong Backdrop

Midstream and Natural Gas: More Growth in the Pipeline

Strong NGL Outlook Drives Growth Opportunities for Midstream

For more news, information, and analysis, visit the Energy Infrastructure Channel.