Summary:

- US demand for ethane, a natural gas liquid used as a feedstock in plastics manufacturing, increased 9% in 2022 and is projected to continue growing through 2024.

- Additional capacity to convert ethane into ethylene has come online both in the US and globally in recent years, driving demand growth.

- Midstream companies are investing in the processing plants for NGLs and in additional export capacity.

When people think about demand for hydrocarbons, they tend to think about transportation fuels, but petrochemicals are an important area of demand growth that is often overlooked. Even in the pandemic when demand for fuels plummeted, hydrocarbon demand for petrochemicals continued to grow driven by the production of plastics. Midstream companies are positioned to capitalize on this growth in the US and overseas, particularly through their business activities focused on natural gas liquids (NGLs). Among NGLs, ethane has seen standout demand growth – the US consumes more ethane than jet fuel. Today’s note looks at the positive fundamentals for ethane and the midstream players positioned to take advantage of these growth trends.

Demand for ethane is growing faster than any other petroleum product.

Though more obscure to most, NGLs are produced from a well alongside oil and natural gas and have numerous applications. NGLs are separated from natural gas at processing plants and are then sent to fractionation plants to be processed into their components – ethane, propane, isobutane, butane, and pentane (read more). Midstream companies typically operate both natural gas processing plants and fractionation facilities within gathering and processing business segments.

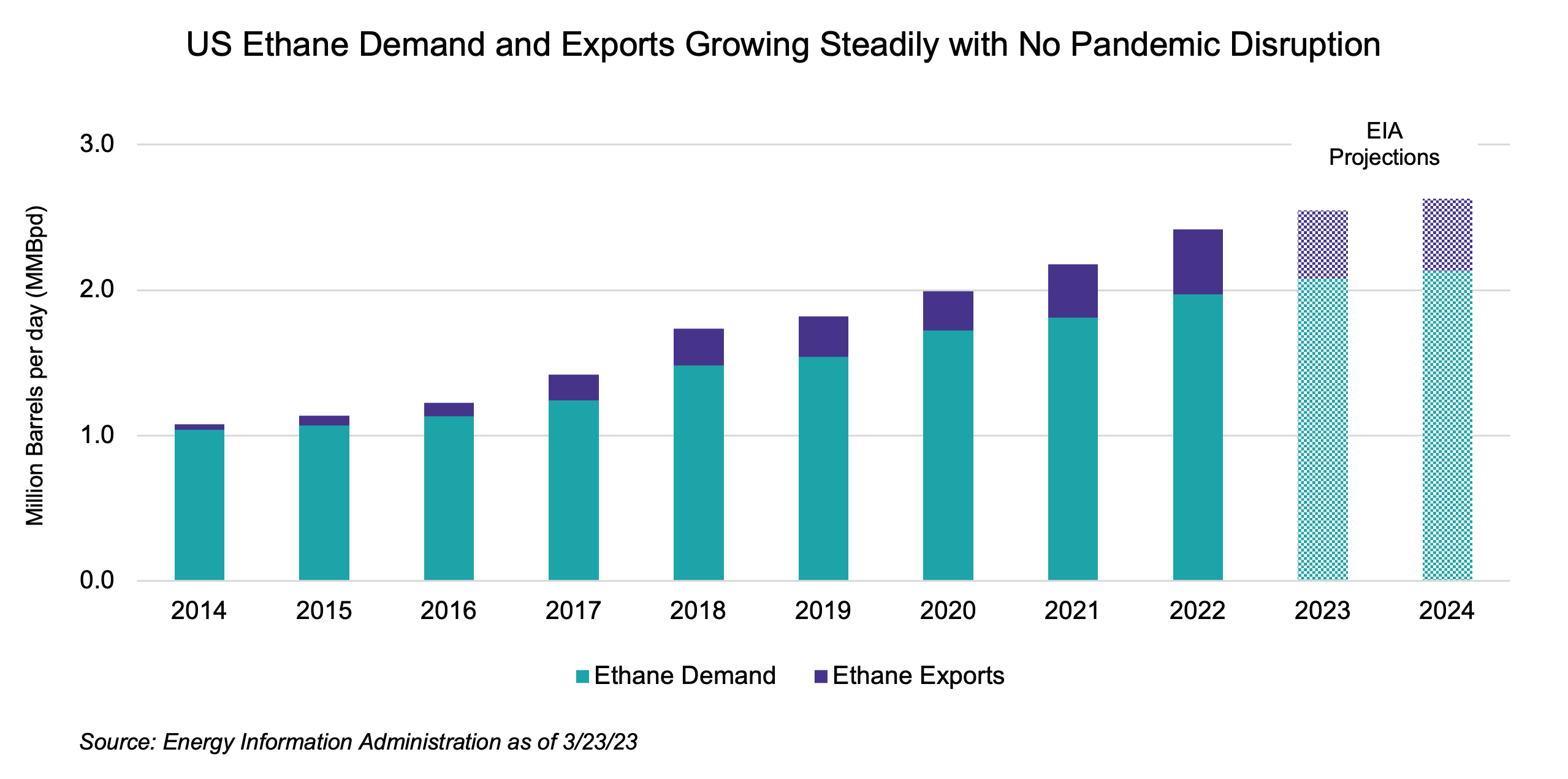

In 2022, US ethane demand increased 9% according to the Energy Information Administration (EIA), reaching nearly 2 million barrels per day (MMBpd). Among all petroleum products, ethane is seeing the fastest growing demand, with consumption doubling since 2014. By comparison, demand for products like diesel fuel and gasoline have been largely flat over the same period. Ethane is converted to ethylene at steam crackers, and ethylene is then used to produce plastics and other materials. Two new cracker facilities with a combined capacity of 156 thousand barrels per day (MBpd) came online in Port Arthur, Texas, and Monaca, Pennsylvania during 2022, building upon the 108 MBpd of ethane cracking capacity added in 2021. Ethane demand is expected to continue growing through 2024 as shown in the chart below, supported by additional cracking capacity.

As shown in the chart, ethane exports have also seen meaningful growth in recent years, with exports increasing by 20% last year alone. Export growth is expected to outpace increases in domestic consumption over the next two years. Ethane exports began with pipeline shipments to Canada through Energy Transfer’s (ET) Mariner West system, and waterborne exports started in 2016. Today, there are three ethane export facilities on the water – ET’s Marcus Hook, PA, and Nederland, TX, terminals, and Enterprise Products Partners’(EPD) Morgan’s Point terminal. (EPD also operates the world’s largest ethylene export terminal at Morgan’s Point.) China and India are often the destination of US ethane exports, accounting for 35.1% and 23.2% of total US ethane exports last year, respectively. Since 2021, large marine ethane carriers capable of transporting up to 1 million barrels and large petrochemical facilities in China have come online. ET loaded the first Very Large Ethane Carrier under its joint venture with Satellite Petrochemical at its Nederland terminal in January 2021.

Companies continue to invest in NGL fractionation and ethane exports.

With growing NGL production and positive demand trends, midstream companies continue to invest in fractionation capacity to process NGLs. ONEOK’s (OKE) 125-MBpd fractionator at Mont Belvieu, TX, is expected to be completed in 2Q23, and its sixth fractionator is expected to be completed in 1Q25. EPD’s twelfth fractionator at Mont Belvieu will come online this year, and ET’s eighth fractionator is expected to startup in 3Q23. Along with its partners Phillips 66 (PSX) and Targa Resources (TRGP), EnLink Midstream (ENLC) announced the restart of Gulf Coast Fractionators’ 145-MBpd facility in Mont Belvieu in 2024. TRGP is also currently constructing its ninth fractionator at Mont Belvieu.

Beyond fractionation, there are also growth opportunities with exports. EPD announced in April of last year that it plans to build a new ethane export terminal in Texas, which is expected to be completed in 2025. The company may provide additional details on this project at tomorrow’s analyst day. EPD loaded 168 MBpd or roughly 61 MMBbls of ethane at Morgan’s Point in 2022, up 7.0% from the prior year.

Including its Mariner West Pipeline, ET has over 1.1 MMBpd of total NGL export capacity and estimates its NGL exports account for 20% of the global market. ET loaded 43 million barrels of ethane at Nederland last year and expects to load more than 60 million barrels this year according to comments made on the 4Q22 earnings call. Note that the second tranche of Satellite Petrochemicals’ contract went into effect in July, doubling volumes relative to the initial contracted amount.

Bottom line:

Strong ethane production and the constructive outlook for demand in the US and abroad highlights the continued growth opportunities for midstream companies related to NGLs.

Please join our next 30-minute LiveCast on Tuesday, April 11, at 12:30 p.m. ET as we discuss the tax efficiency of MLPs (register here).

Related Research:

Strong NGL Outlook Drives Growth Opportunities for Midstream