Hello, VettaFi Voices! We are 10 months into 2023, and we are likely hitting a record number of ETF launches this year. Closures have been going gangbusters as well. Are there any trends you’re seeing that are interesting regarding new ETFs, or any funds in particular that seemed especially exciting when they launched this year? And are there any closures you think stood out?

Active Management Stands Out

Todd Rosenbluth, VettaFi director of research: A major theme of ETF launches this year has been active management. Established mutual fund companies are jumping into the ETF market after initially dipping their toes in. Some are making their entry through covered call strategies after the success of the JPMorgan Equity Premium Income ETF (JEPI). I’m referring to funds like the BlackRock Advantage Large Cap Income ETF (BALI), the Goldman Sachs S&P 500 Core Premium Income ETF (GPIX) and the Parametric Equity Premium Income ETF (PAPI) that offer their own take.

But Morgan Stanley also launched some new active fixed income ETFs like the Eaton Vance High Yield ETF (EVHY) in October. Last month, Calamos, which helped pioneer the convertible mutual fund, launched the Calamos Convertible Equity Alternative ETF (CVRT).

Looking to earlier in the year, T. Rowe Price brought out the T. Rowe Price Capital Appreciation Equity ETF (TCAF), and Franklin Templeton launched the Franklin Income Focus ETF (INCM). Around the same time, the BlackRock Flexible Income ETF (BINC) also came to market. These three funds have well-known actively managed cousins run by the same experienced teams.

In full disclosure, a few ETFs came to market tracking VettaFi indexes that are novel to me. The VictoryShares Free Cash Flow ETF (VFLO) is a more growth-oriented free cash flow ETF, and the Roundhill Alerian LNG ETF (LNGG) is an energy ETF with a focus on the liquefied natural gas market that Stacey Morris could add more color about regarding the index.

LNG in an Index Strategy

Stacey Morris, VettaFi head of energy research: Sure, Todd. Our Alerian Liquefied Natural Gas Index (ALNGX) serves as the underlying index for LNGG and includes companies materially engaged in the LNG industry. The global LNG market is expected to grow by upward of 60% through 2040. Constituents can benefit from these growth trends.

Importantly, the index provides differentiated energy exposure (particularly relative to broad energy ETFs dominated by Exxon and Chevron) and offers a healthy yield at 3.55%.

Rosenbluth: Heather, I think you do a great job tracking the weekly launches and closures. There are more that catch my eye.

Heather Bell, VettaFi managing editor: Thanks, Todd! Active is definitely having its day in the sun! Perhaps an extension of that, for me, is that the most interesting thing about the launches this year has been all the options-based strategies. They’re everywhere. Lots of covered call strategies are launching. I suppose JEPI (an actively managed fund) kind of paved the way for that with its incredible success. But also, the single-stock ETFs using options are interesting. None of them is truly huge yet, but some are gathering assets. Right now, it looks like YieldMax is dominating that space, and Kurv is just getting started there.

Rosenbluth: Yes, it’s good to see Kurv offering competition and perhaps making the case that the income in a covered call ETF is not the same.

A Swarm of Crypto ETFs

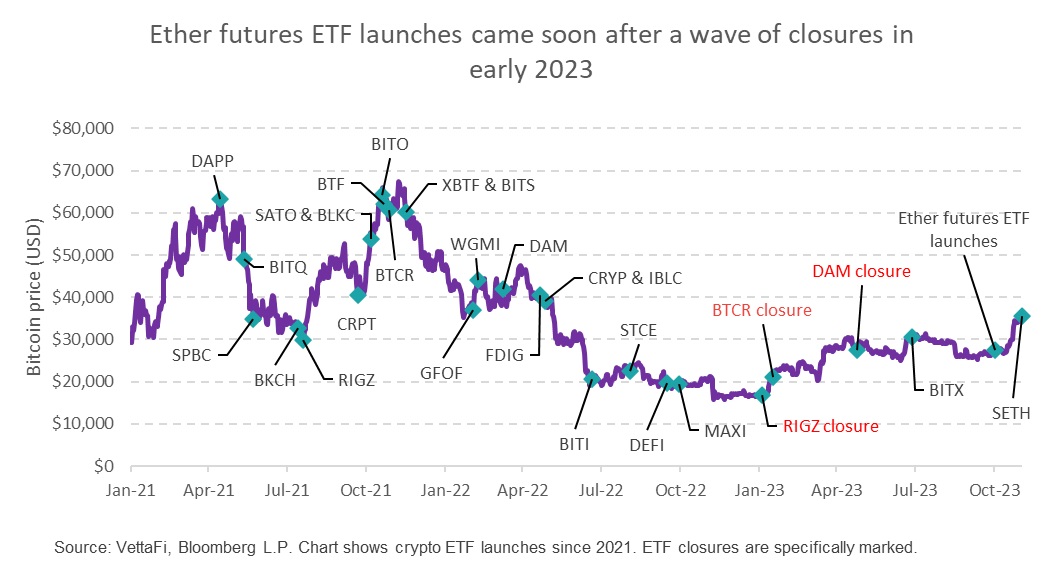

Roxanna Islam Swan, VettaFi associate director of research: I thought crypto ETF launches were interesting this year. We saw the start of a wave of closures in early 2023, and it seemed like crypto ETFs were running out of steam. But then we saw a leveraged bitcoin futures product launch in June, several ether futures ETFs in early October, and an inverse ethers future product on Thursday. Now spot bitcoin ETFs are expected in early 2024.

Rosenbluth: Good point, Roxanna. We had the wave of ether ETFs, as well as ETFs that combined bitcoin and ether exposure, like the Bitwise Bitcoin and Ether Equal Weight Strategy ETF (BTOP) and the ProShares Bitcoin & Ether Market Cap Weight Strategy ETF (BETH). I know some people can’t believe we have an inverse ether futures ETF before we have a spot bitcoin ETF.

Bell: Yes, the ProShares short ether ETF is trading under the ticker SETH.

Rosenbluth: My best friend growing up who was the best man at my wedding is named Seth. He works at a different asset management company as a lawyer, so this is not named for him. But I’m jealous. Where’s the ticker “TODD”?

Bell: It looks like the ticker is free. I too am puzzled by the fact that no one has thought of using TODD for an ETF. It’s a mystery!

Rosenbluth: A “go anywhere” ETF where what’s inside matters — and perhaps changes a lot from week to week. Come on, asset managers, I even know a good index partner.

The Return of Target Date ETFs

Bell: Another interesting set of launches was the target date funds launched by iShares a couple weeks ago. A whole suite of 10 funds at once is a lot! The concept didn’t really take off in prior attempts. However, these are actively managed, so that may make them more appealing — they can shift allocations to accommodate market movements, right?

Rosenbluth: Yes, Heather, the iShares target date ETFs can, but I think in a strategic manner every one to two years. These are not tactical active ETFs, in my opinion. And iShares has the ability to expand the pool of ETF investors as the industry leader.

Closures are harder to remember, since they mostly close because of lack of demand (usually under $50 million in assets). Invesco closed the Invesco S&P 600 SmallCap 600 Equal Weight ETF (EWSC) in January. I remember thinking, given the success of the Invesco S&P 500 Equal Weight ETF (RSP) in large-caps, more people should have found equal weighting interested in higher risk areas.

I also miss the NightShares ETFs that closed over the summer. Such a smart concept — to bring liquidity to the after-hours market. But the demand was not there (yet).

Bell: The NightShares were interesting. From what I understand, the timing was just bad — the Night Effect no longer was working, though it’s not clear what may have changed. And it’s not clear if it’s a permanent trend. I was wondering if that might be because, in more recent years, companies have tended to announce bad news after hours. Maybe that skewed the numbers.

The Importance of Timing

Rosenbluth: ETF timing can indeed be bad. We had an the Airline ETF (FAA) for a while before the U.S. Global Jets ETF (JETS) came along. No one cared, and FAA closed. Then COVID-19 hit, and people were looking for recovery plays, and JETS took off.

Jane Edmondson, VettaFi head of thematic strategy: Alternative products are leading the way. As Heather mentioned, option overlay and covered call products have seen lots of flows thanks to their enhanced income characteristics. Defined outcome and buffer products continue to see success as well for companies like Innovator, First Trust, and Allianz. And we are starting to see those products emerge on the fixed income side as well with products like the Cboe Vest 10 Year Interest Rate Hedge ETF (RYSE).

Bell: Similar to the FAA/JETS situation, we had three luxury-goods-focused ETFs launch this year. All the other similar products over the years — and there have been a few — have closed without gathering significant assets. I wonder if the timing is right now.

Tema launched the Tema Luxury ETF (LUX); KraneShares launched the KraneShares Global Luxury Index ETF (KLXY); and Roundhill launched the Roundhill S&P Global Luxury ETF (LUXX).

Rosenbluth: Yes, Heather I remember Emles had the Emles Luxury Goods ETF (LUXE), and it failed to gain sufficient attention. Roxanna Islam Swan was calling for new ETFs, and they are here.

Islam: I was going to mention the luxury ETFs as well. That was an area I was discussing a lot in 1H23 and using proxies like the ALPS Global Travel Beneficiaries ETF (JRNY) and the Global X Millennial Consumer ETF (MILN) to represent the luxury goods market. Then those three luxury ETFs were launched soon after. Of course, since then, luxury hasn’t been as hot — that’s the difficulty of timing launches!

Shifting Trends Create ETF Opportunities

Edmondson: I think the underpinning of a lot of this new innovation is that investors are questioning standard 60/40 asset allocations in light of the last couple of years. ETFs are not just investment products, but solutions to unsatisfied investment needs.

On the thematic side, first-to-market products still have a first-mover advantage, especially with firm support. Again, on the unsatisfied-needs front, they must provide exposure to a theme not yet available in the marketplace.

Bell: Yes, first-mover status is really key. Look what happened with the ProShares Bitcoin Strategy ETF (BITO). It dwarfs all similar funds, even those that launched just days after its debut. If you’re not going to be a first mover, you have to be cheap and have some additional hook to your investment thesis.

And for sure, Roxanna, timing is hard with launches. If conditions change, issuers have to be prepared to support that fund until it has a chance through different market environments.

Edmondson: Heather, I agree that issuer patience is often important. It takes some themes and products time to develop. And sometimes timing is difficult to predict for long-term or recurring themes. Think about all the inflation products that weren’t needed, until they were!

And how long has it been since we have had interest rates at these levels where short-term bonds and money markets are competing with equity income?

Bell: Absolutely, and I agree with you, Jane, on the issue that these things have to solve a problem or at least stake out a unique spot. I do think though that as things like options strategies and inflation-fighting products grow in popularity, more education is imperative.

The First-Mover Advantage

Edmondson: The Amplify Transformational Data Sharing ETF (BLOK) is a similar example to BITO. It was first to market in its category, and despite all the new entrants, remains the dominant player.

Rosenbluth: I ran through a bunch of active ETFs at the top, but there are so many others. I did a webcast this week with PIMCO talking about the PIMCO Ultra Short Government Active Exchange-Traded Fund (BILZ) — an actively managed alternative to the SPDR Bloomberg 1-3 Month T-Bill ETF (BIL). This has been the year of parking money in money markets, but when the Fed pivots, investors will benefit from active.

Edmondson: I agree that active fixed income managers could indeed add value right now. I think about the success the Quadratic Interest Rate Volatility & Inflation Hedge ETF (IVOL) had when inflation reared its ugly head.

It is one of the active fixed income products that has done well recently as the rates market has become increasingly volatile. I love the innovation that is occurring in the market with option-enhanced products like IVOL and the Simplify Interest Rate Hedge ETF (PFIX) seeking to hedge problems like inflation and higher rates. These products are strategic and tactical options for investors.

Rosenbluth: I touched on VFLO earlier but we also have the Astoria US Quality Kings ETF (ROE) and the Global X U.S. Cash Flow Kings 100 ETF (FLOW) that are newer competitors to the highly popular Pacer US Cash Cows 100 ETF (COWZ).

COWZ ETF Offshoots

Edmondson: And there is a covered call version from Amplify that launched this year called the Amplify Cash Flow High Income ETF (HCOW).

Bell: Before COWZ, I don’t think we heard much talk about free cash flow as the basis for an ETF. It was definitely a first mover there.

Edmondson: And now there is a whole herd of “cows”! And HERD is actually another COWZ-related product from Pacer, the Pacer Cash Cows Fund of Funds ETF (HERD).

Rosenbluth: Jane, EQM indexes, now part of VettaFi, helped launch the MUSQ Global Music Industry ETF (MUSQ) this year. This was before you joined us.

Edmondson: Yes, Todd! Music is a first-to-market theme that is really having its day post-COVID with demand for live concerts and music streaming taking over the world. And MUSQ is a first-to-market product that gives exposure to the entire global music industry.

Just goes to show that there are some innovative themes that still have not come to market.

Follow-on products is another interesting trend. There are many COWZ products from Pacer and several MOAT products from VanEck that are sister funds to its VanEck Morningstar Wide Moat ETF (MOAT). And ProShares has built a nice franchise of products with its Dividend Aristrocrats.

Suites are in the sweet spot.

Bell: Absolutely! I find suites really interesting — you get to see where a concept works and where it doesn’t.

Themes for the Future

Edmondson: On the new product front, I would not be surprised to see more “modern” plays on enduring themes, like dividends, but even on things like defense, where technology is transforming an industry.

The Global X Defense Tech ETF (SHLD) comes to mind. There is a similar product in Europe, the Future of Defence Ucits ETF (NATO). Note the British spelling. NATO tracks an EQM index.

Rosenbluth: SHLD is a great ticker, and that ETF launched in September too (along with a lot of others). I agree there’s going to be more innovation for thematic ETFs in 2024

We have also see more mutual-fund-to-ETF conversions. People think of Dimensional Funds as leading the charge for these. They certainly did in 2021 and 2022, but have not converted any mutual funds in 2023. However, we had a few from JPMorgan, like the JPMorgan Equity Focus ETF (JPEF), the Neuberger Berman Global Real Estate ETF (NBGR) from Neuberger Berman, and the Hartford Quality Value ETF (QUVU) from Hartford. And Fidelity plans to convert $13 billion of mutual funds to ETFs in November. These have existing records but are new ETFs.

The ETF ‘Fringe’ Arrives

Dave Nadig, VettaFi financial futurist: Late to the discussion, but I’m with Jane: I think the innovation we’ve seen in more “fringe” corners — particularly those using derivatives — is astounding. Simplify’ s lineup is full of these products, like the recently launched Simplify Market Neutral Equity Long/Short ETF (EQLS) — an actual honest-to-goodness long/short equity ETF. It uses total return swaps to pull it off, but the engineering is sound. It’s just another example of the incredible flexibility of the ETF structure. Or the Return Stacked Bonds & Managed Futures ETF (RSBT).

While these kinds of products (100% bonds/100% managed futures per 100% invested using leverage), seem fringe, they solve genuine problems for more sophisticated advisors and institutions. We’re going to see a lot more of these kinds of products.

Essentially the “structured note” business has come to retail ETFs. While that may scare some folks, I think there’s real value here.

Rosenbluth: I believe the General Electric pension invested in EQLS, which is not your typical investor for a new ETF.

Nadig: But similar to how the early factor-based ETFs got launched — on the back of existing institutional demand.

Rosenbluth: Institutional investors are often the cause of an ETF launch. Well, not many of the thematic ones, but others.

Bell: The Arizona State Retirement System seeded multiple single-factor iShares ETFs when they launched in 2014.

Rosenbluth: But remember, ETF launches are more notable than ETF closures. We have largely run past this year’s ETF graveyard in this discussion.

Surprising ETF Closures

Bell: Todd, were there any closures that disappointed or surprised you this year?

Rosenbluth: The closure of the Tuttle Long Cramer Tracker ETF (LJIM) — which launched to much publicity alongside the Tuttle Inverse Cramer Tracker ETF (SJIM) in March — closed this year. I did not initially believe there would be demand for investing for or against the CNBC pundit. But I expected they would both survive longer than just months, though SJIM is still trading.

We also had some active equity ETFs from JPMorgan close recently — the JPMorgan ActiveBuilders U.S. Large Cap Equity ETF (JUSA) and the JPMorgan ActiveBuilders International Equity ETF (JIDA). JPMorgan is the second-largest active ETF provider and has had success with JEPI and others. But they also converted some active equity mutual funds. The decision to close those funds was likely was a refocusing

Edmondson: Product rationalization in the industry is normal, especially if it makes room for new and innovative products.

Rosenbluth: Agreed, Jane. If we hit a record in ETF closures and we see strong launches, that’s a good sign to me. Not everything that launched in 2020-2022 or before that still makes sense to offer.

Edmondson: Themes like SPACs and MEME stocks have played out, and in retrospect, were maybe too niche in focus.

Bell: I think it also relates to how well investors understand the product. Does everyone understand how a SPAC works?

Meme stocks aren’t hard to understand, but they were very flash in the pan.

Rosenbluth: Why am I the only one that has to search their memory for an ETF that closed in 2023?

Closures Good for the Industry

Nadig: In general, I celebrate all the closures of small funds. It does investors little good to have the fifth launch in a category with $10 million in assets, likely charging too much or offering no real differentiation versus competitors. It’s definitely a healthy thing.

Bell: The closures that surprised me this year was the shutdown of all those iPath ETNs. A lot of them were the only vehicles providing access to certain commodities.

Tin, lead, coffee, cotton… I know those are tactical plays and they didn’t have sticky assets, but I felt like they were nice for investors to have in the toolbox.

Nadig: To me, the roundtrip winner on closure has to be the Parabla Innovation ETF (LZRD), a fund we barely heard about, launched by an active equity stock picker. It started trading in April, and it just closed. Have we ever seen a roundtrip under six months before?

Runway to Success Shrinks for ETFs

Rosenbluth: The time frame for keeping ETFs in market has certainly shrunk over the last couple of years. Smaller asset managers likely have less cash flow at the parent level to keep something alive that is struggling to gain traction — unlike iShares and Invesco.

Bell: I think that smaller firms just getting into the ETF space have a hard row to hoe when they launch their own active strategies. But aren’t a lot of them doing it simply for in-house use?

Rosenbluth: Some are from RIAs that launched an ETF of a long-term strategy like ROE. But Kurv just launched six options-enhanced single-stock ETFs, including the Kurv Yield Premium Strategy Apple (AAPL) ETF (AAPY). I think the firm has experienced former PIMCO people behind it. But this is a competitive market.

Edmondson: Some of these products will succeed, others will fail, but it is still nice to see the entrepreneurial spirit in action in the ETF space.

For more news, information, and analysis, visit VettaFi | ETF Trends.