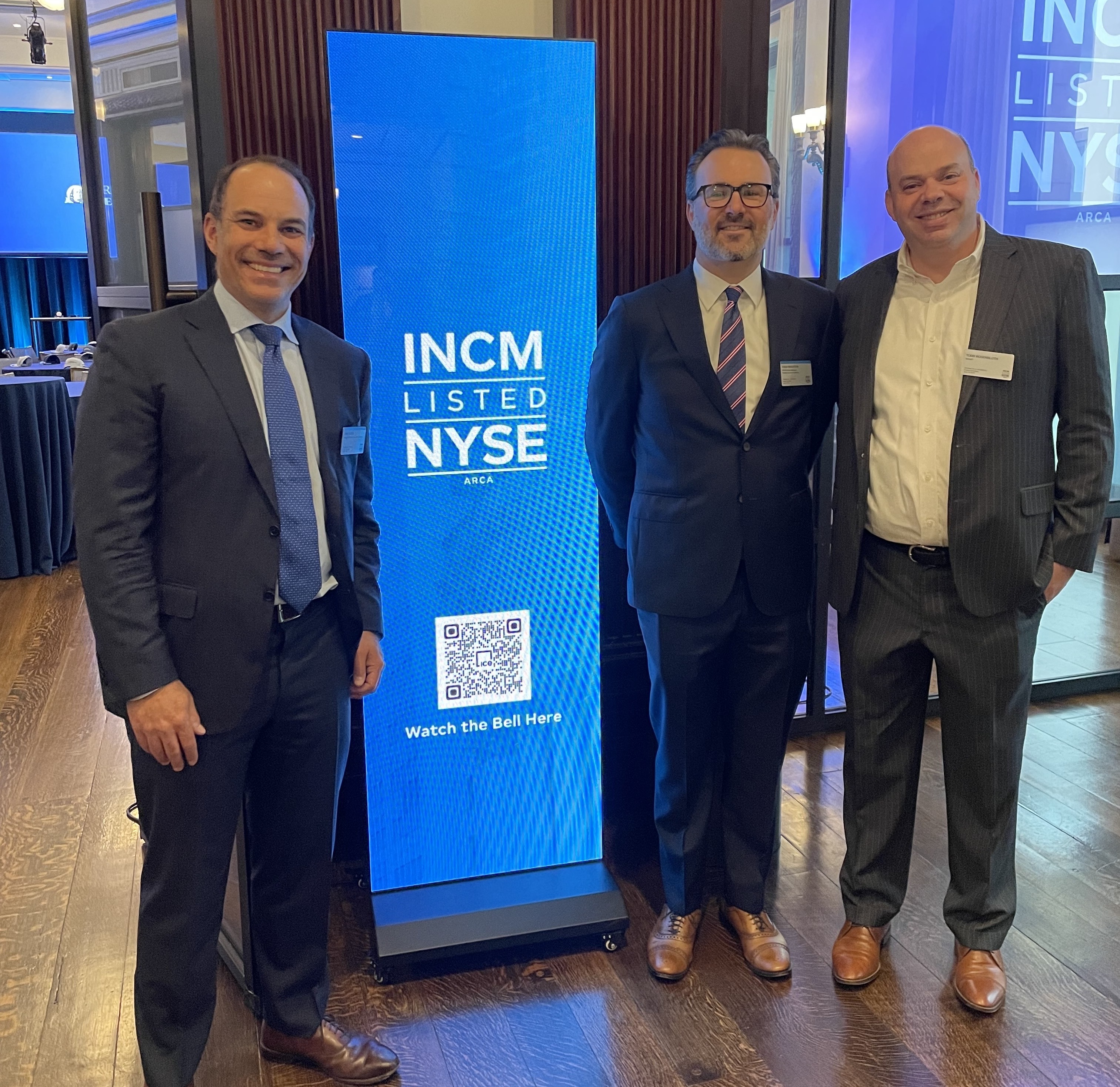

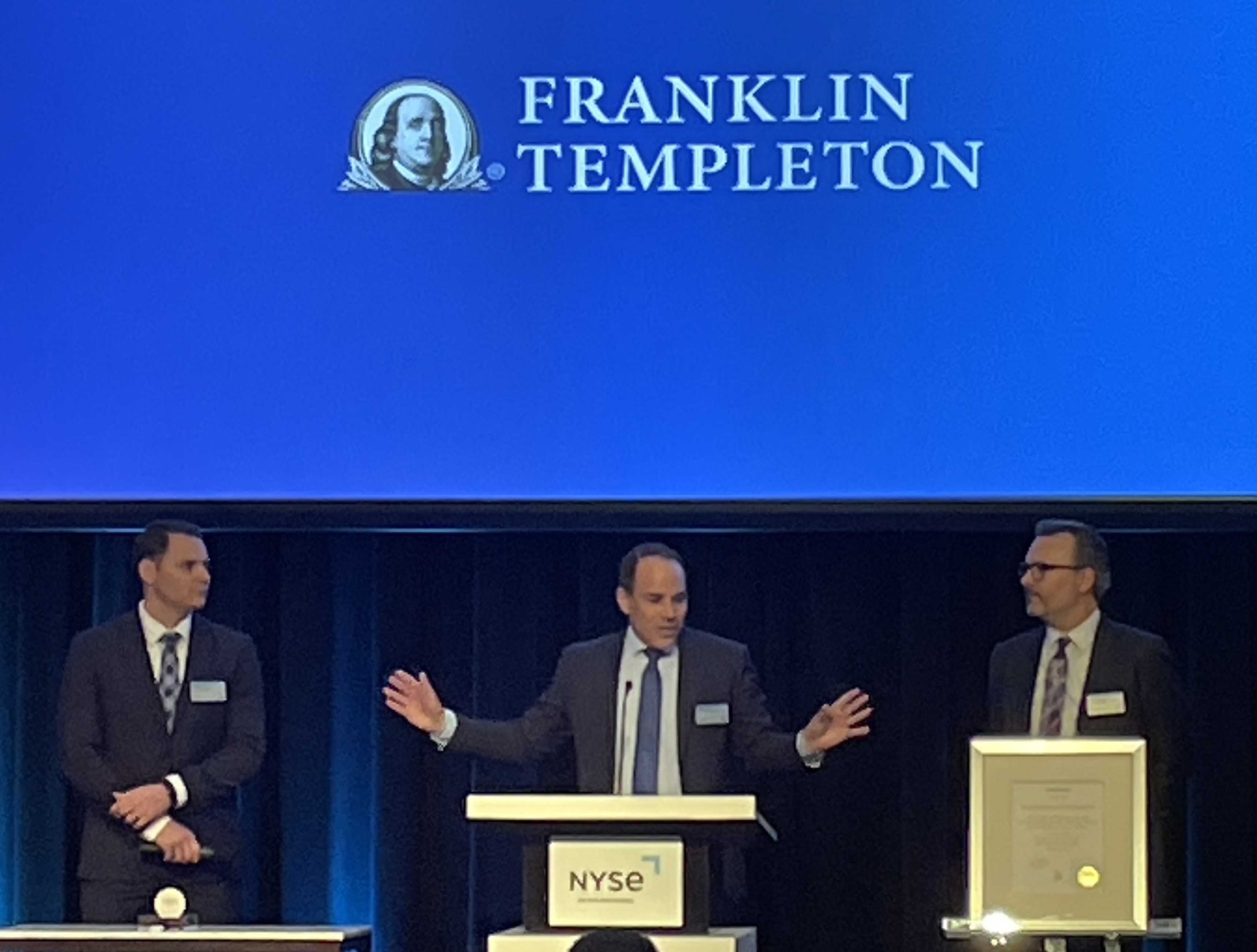

For nearly 75 years, Franklin Income, the mutual fund, has helped advisors and end clients. Through bull, bear, and even boring markets, the $70 billion portfolio provided uninterrupted income from equity and fixed income securities. However, I’m more excited about the great grandchild of this mutual fund, the Franklin Income Focus ETF (INCM). INCM began trading in June, and leaders from Franklin Templeton rang the opening bell at the New York Stock Exchange this week.

“Since we launched our ETF platform in 2016, we heard from clients that they wanted an ETF from Ed Perks and the Franklin Income Investors team,” explained David Mann, Franklin Templeton’s head of ETF product and capital markets. “We built INCM using the same philosophy, same research, same team as Franklin Income Fund. There are some key differences that take advantage of the ETF structure’s liquidity and transparency features. We see this as a core part of an ETF investor’s portfolio.”

Franklin Income Has a Long Record of Success

Between August 1948 and April 2023, the Franklin Income mutual fund generated an annualized total return of 9.8%. The fund recently had 62% of assets in traditional fixed income, including Treasury securities. Additionally, 20% was in equities, including dividend-paying companies like Bank of America and Chevron. What makes Franklin Income distinct from other asset allocation funds is its 17% stake in convertibles and equity-linked notes.

“We’ve seen a very unpredictable and volatile market environment over the past year and a half. Last year, we saw the negative correlation between equities and fixed income completely erode, and this year, fixed income is finally producing income. It’s a difficult environment for investors to effectively navigate, and we hear from clients that they are looking for steady income and stable returns,” added Mann.

Franklin Templeton Has Other Strong Active ETFs

While INCM taps into an investment approach with a strong heritage, it is not Franklin’s first active ETF. Indeed, Todd Brighton, who co-manages INCM with Ed Perks and Brendan Circle, also actively runs the Franklin US Low Volatility ETF (FLLV). FLLV launched in 2016 and has 26% in information technology stocks like Accenture and Oracle.

Another strong active ETF in the family is the Franklin High Yield Corporate ETF (FLHY). FLHY takes a fundamental approach to actively selecting high yield credits and has outperformed the iShares iBoxx $ High Yield Corporate Bond (HYG) in the last three years by 135 basis points on an annualized basis.

The Benefits of Active ETFs

“We believe strongly in the strength of active management, particularly on the fixed income side, where markets tend to be more opaque. Index weighting tends to favor heavy debtors, and active management allows managers to make decisions based on duration, credit quality, and real-time bond prices — not just index composition. Overall, we have always believed that investors can get more out of the ETF than just low-cost beta. We will continue to offer compelling products from experienced teams that fill that need in client portfolios,” commented Mann.

There has been strong demand for active management in the ETF structure in 2023. We celebrate when established providers bring their best strategies to meet this generation’s advisors where they are.

For more news, information, and analysis, visit VettaFi | ETF Trends.