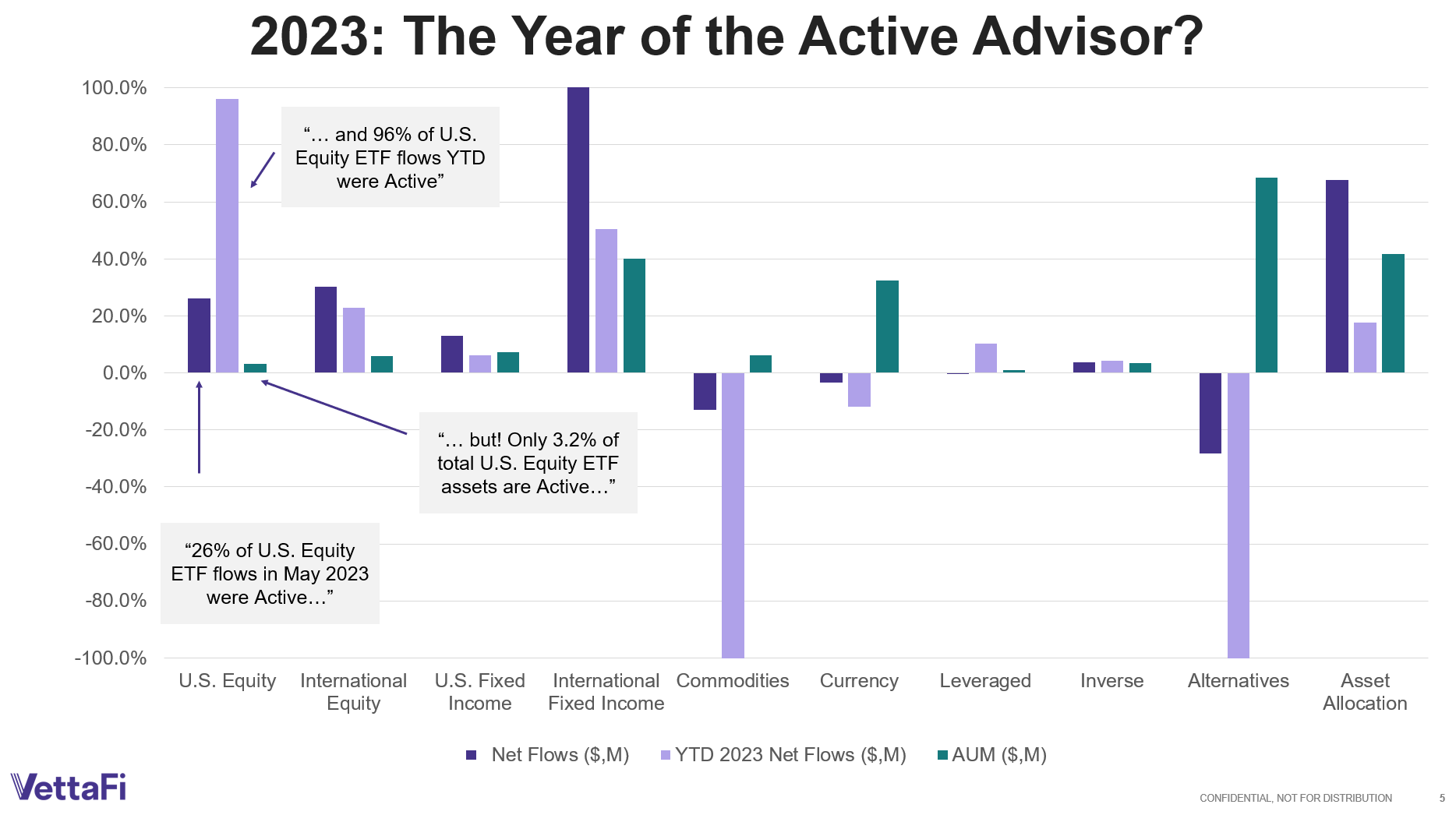

Everyone’s talking about active ETFs this year, but what’s actually going on with their assets? Equities overall are plugging along despite so much rising rate, inflationary, and recession-focused concerns, yes. So what role are active strategies playing? Well, based on the flows active ETFs are seeing compared to their current AUM, 2023 may have already become the year of the active ETF advisor.

Active ETFs are indeed having a strong year.

According to recent research from VettaFi’s financial futurist Dave Nadig, the vast majority of equity ETF flows YTD came for active strategies. While just 3.2% of total U.S. equity ETF assets sit in active funds, actively managed strategies can claim 96% of equity ETF flows YTD. Those numbers draw a stark contrast to the ETF landscape just a few years ago, when active ETF skepticism reigned. Now, it seems, active ETFs have truly arrived.

See more: “Three Keys to Active ETF Investing in 2023”

Taking a Closer Look at Active ETFs

As such, those advisors who aren’t already using actively managed ETFs should probably be taking a closer look at them. They have all kinds of advantages, but now with reams of new flows coming in, they’re taking on passive megafunds in terms of liquidity. That helps address yet another concern some may have about active’s possible drawbacks, while allowing for a chance to talk up its strengths.

Whether active’s capabilities in low or high volatility, or its ability to leverage specialized managers, active strategies deserve a place in advisor portfolios. Now, with the modern benefits of ETFs lowering fees, many active ETFs can charge competitive expenses to some passive funds, as well.

T. Rowe Price offers an active ETFs roster that can benefit from the trend in active. The firm offers active strategies targeting a variety of asset classes, from current and fixed income to standbys in equities. Investors can consider strategies such as the T. Rowe Price Equity Income ETF (TEQI) and the T. Rowe Price QM U.S. Bond ETF (TAGG).

For more news, information, and analysis, visit the Active ETF Channel.