Summary

- Liquefied natural gas (LNG) has an important and growing role to play in the global energy mix, which was further underscored by Russia’s invasion of Ukraine.

- The global LNG market is expected to grow by upward of 60% through 2040.

- The Roundhill Alerian LNG ETF (LNGG) tracks the Alerian Liquefied Natural Gas Index (ALNGX), which includes companies that are materially engaged in the LNG industry.

Liquefied natural gas has an important and growing role to play in the global energy mix, which was further underscored by Russia’s invasion of Ukraine. Today’s note discusses the basics of LNG, expectations for global demand growth, and a new way for investors to gain exposure to this space.

LNG 101

Liquefied natural gas is simply natural gas that has been cooled to a liquid state. Natural gas becomes a liquid at around -260 degrees Fahrenheit or -160 Celsius. Liquefying natural gas is key for transporting the commodity around the world. As a liquid, natural gas is roughly 600 times smaller than in a gaseous state. That makes it more suitable for transportation and storage.

The process for exporting liquefied natural gas is fairly straightforward. Liquefaction facilities super-cool natural gas into liquid form, which can then be loaded onto ships. LNG tankers or carriers store the liquefied gas in large, cryogenic tanks and transport the gas to import terminals. At the terminal, the LNG is unloaded and ultimately regasified or brought back to a gaseous state. After regasification, the natural gas can then be distributed through a pipeline to end users.

Constructive Long-Term Outlook for LNG

The global liquefied natural gas market is expected to see significant growth in the coming years. S&P Global has estimated global LNG demand will reach 627 million tons in 2035, implying nearly 60% growth from 2022. In its 2023 LNG Outlook, Shell (SHEL) cited forecasts for the LNG market to reach 650 or potentially more than 700 million tons in 2040 — up from 397 million tons in 2022. In a recent fireside chat, Williams (WMB) CFO cited similar forecasts and discussed the tailwinds for natural gas as a coal replacement and as a backup power source for intermittent renewables (read more).

For additional context to this growth, some countries have explicit targets for increasing their use of natural gas. As an example, India is targeting 15% natural gas in its energy mix by 2030 from around 6% in 2022. China is similarly targeting 15% natural gas in its energy mix by 2030 compared to 9% in 2021. Achieving these goals will require additional iquefied natural gas imports.

Other countries imported LNG for the first time this year for varying reasons, including Germany, the Philippines, and Vietnam. Germany quickly built liquefied natural gas import capacity as it looked for alternatives to Russian gas supplies. The depletion of the Philippines’ only gas field is expected to drive greater LNG imports for the country over time. Vietnam plans to build 13 power plants by 2030 to be fueled by imported liquefied natural gas , albeit the plan comes with challenges. Though the drivers vary, growing global LNG demand is part of a broader secular trend.

On the supply side, the U.S. will play a meaningful role in meeting incremental global demand, with export capacity expected to grow by more than 75% through 2028 based just on projects under construction (read more). Additional projects under development likely provide upside to U.S. capacity. In the first half of 2023, the U.S., Australia, and Qatar led global iquefied natural gas exports.

Introducing the Alerian Liquefied Natural Gas Index (ALNGX)

Up until very recently, investors wanting exposure to the positive global trends for LNG had limited options. Investors could pick individual stocks in this area. Or, they could use energy infrastructure products, which provide less direct exposure to LNG growth trends. However, the investing landscape has changed with the launch of the world’s first dedicated LNG ETF in late September. The Roundhill Alerian LNG ETF (LNGG) tracks the Alerian Liquefied Natural Gas Index (ALNGX).

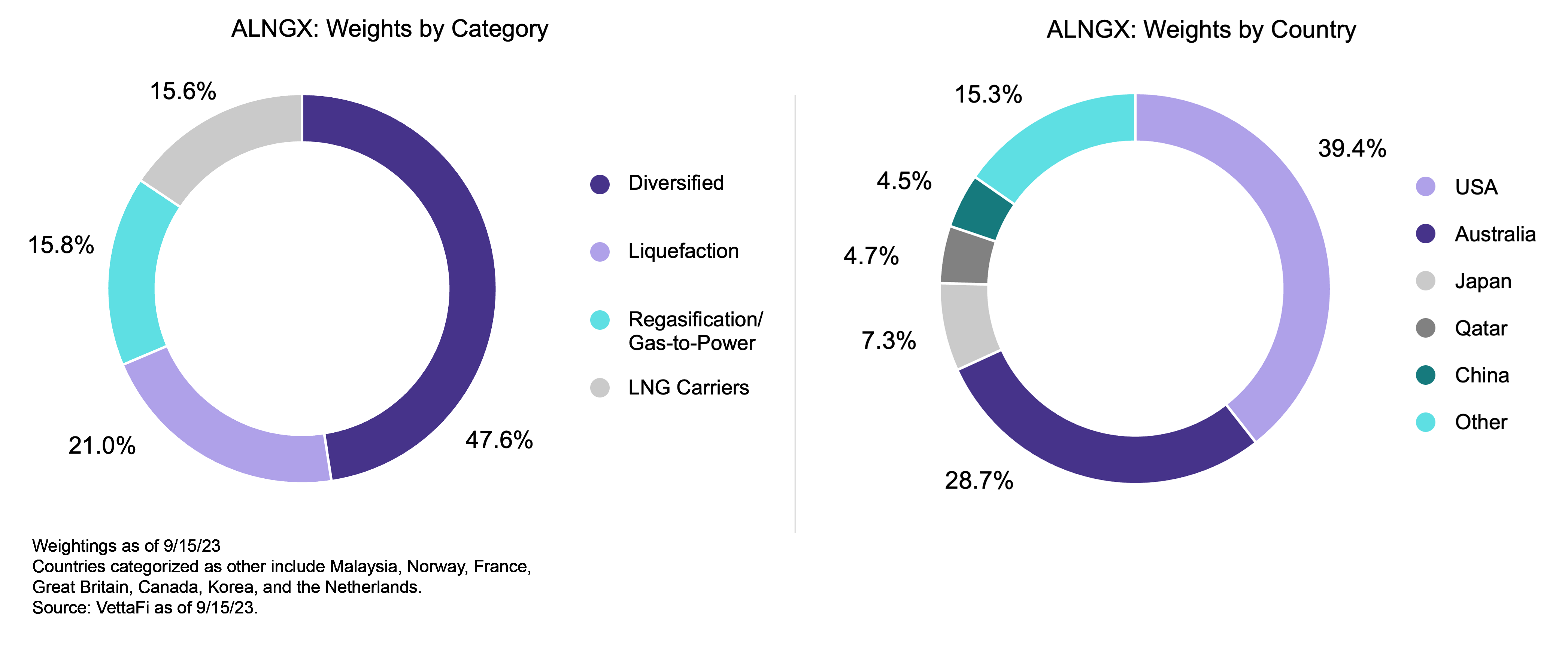

ALNGX consists of companies that are materially engaged in the liquefied natural gas industry. ALNGX includes pure-play companies focused on liquefaction, shipping LNG (LNG carriers), and regasification, as well as diversified LNG players that participate in more than one of the three segments. Diversified companies represent just under half of the index by weighting as shown below. Pure-play U.S. liquefaction name Cheniere Energy (LNG) is the largest constituent, followed by Australian companies Santos (STO AT) and Woodside (WDS AT). The global index includes 28 constituents and is ~40% U.S. companies and ~30% Australian companies by weighting as shown below.

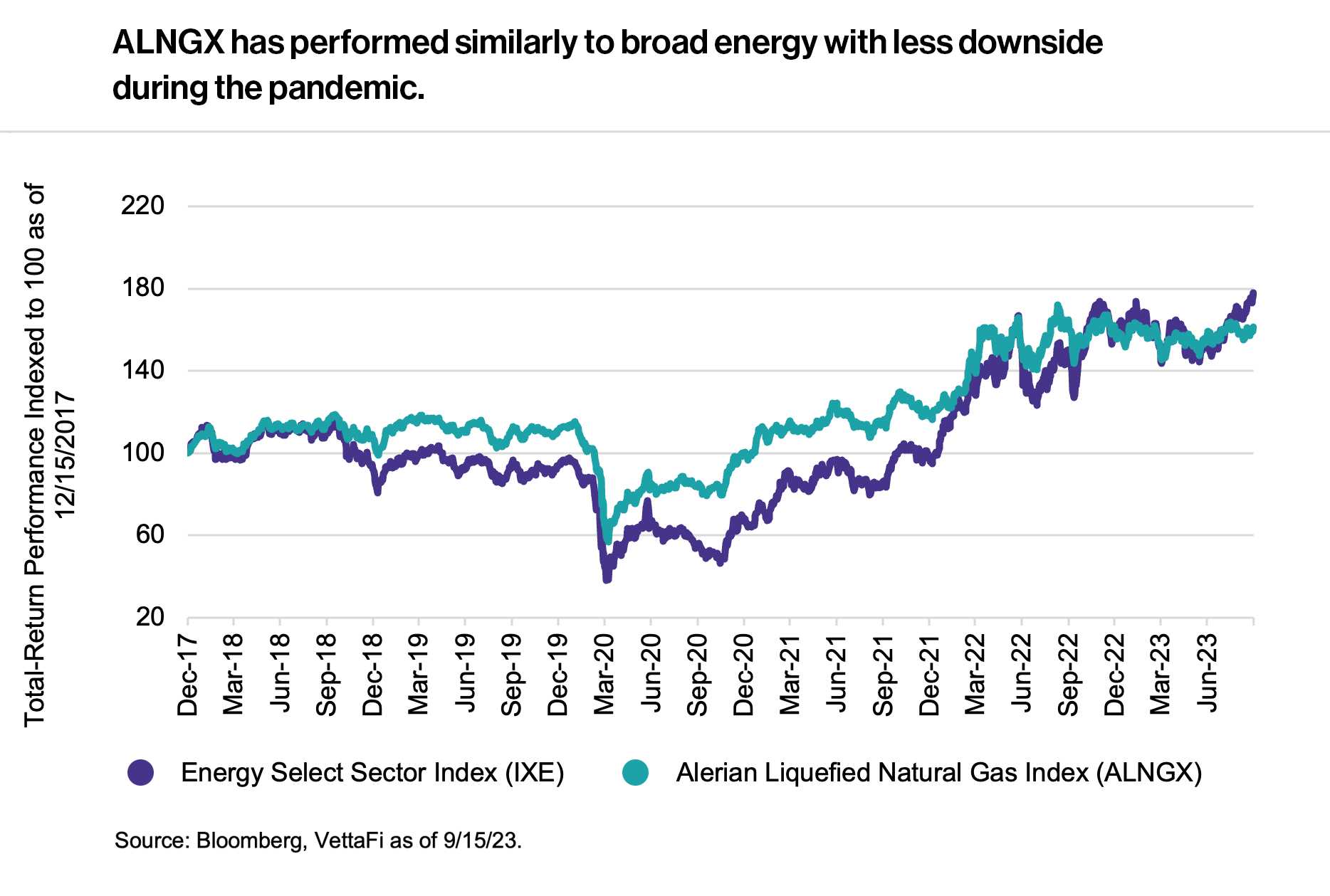

Since late 2017, the total-return performance for ALNGX has often outpaced the Energy Select Sector Index (IXE) — the U.S. energy benchmark. Notably, during the early days of the pandemic, ALNGX saw less downside in its March 2020 bottom than IXE. More recently, as global oil prices have rallied to their highest levels this year, IXE has outpaced ALNGX given its greater exposure to oil. As of September 15, ALNGX was yielding 3.3% compared to the IXE’s 2.9%.

Bottom Line

With the global liquefied natural gas market poised for significant growth over the next two decades, ALNGX provides tailored exposure to global companies participating in the LNG value chain.

ALNGX is the underlying index for the Roundhill Alerian LNG ETF (LNGG).

Related Research:

U.S. LNG Projects Advance Even as Global Prices Slump

Williams (WMB) and the Golden Age for Natural Gas

LNG Has Haynesville Humming – Benefits Midstream/MLPs

Vettafi.com is owned by VettaFi LLC (“VettaFi”). VettaFi is the index provider for LNGG, for which it receives an index licensing fee. However, LNGG is not issued, sponsored, endorsed, or sold by VettaFi, and VettaFi has no obligation or liability in connection with the issuance, administration, marketing, or trading of LNGG.