Issuers of high yield bonds remain resilient going into the second half of 2023, with their balance sheets still well-positioned. And according to BondBloxx, the credit quality breakdown within high yield remains better than before previous downcycles. Nearly half of the bonds within the high yield market are rated double-B.

High yield bonds currently offer investors the potential to generate high income. They can also offer investors’ portfolios a cushion for potential spread widening and lower expected volatility than equities.

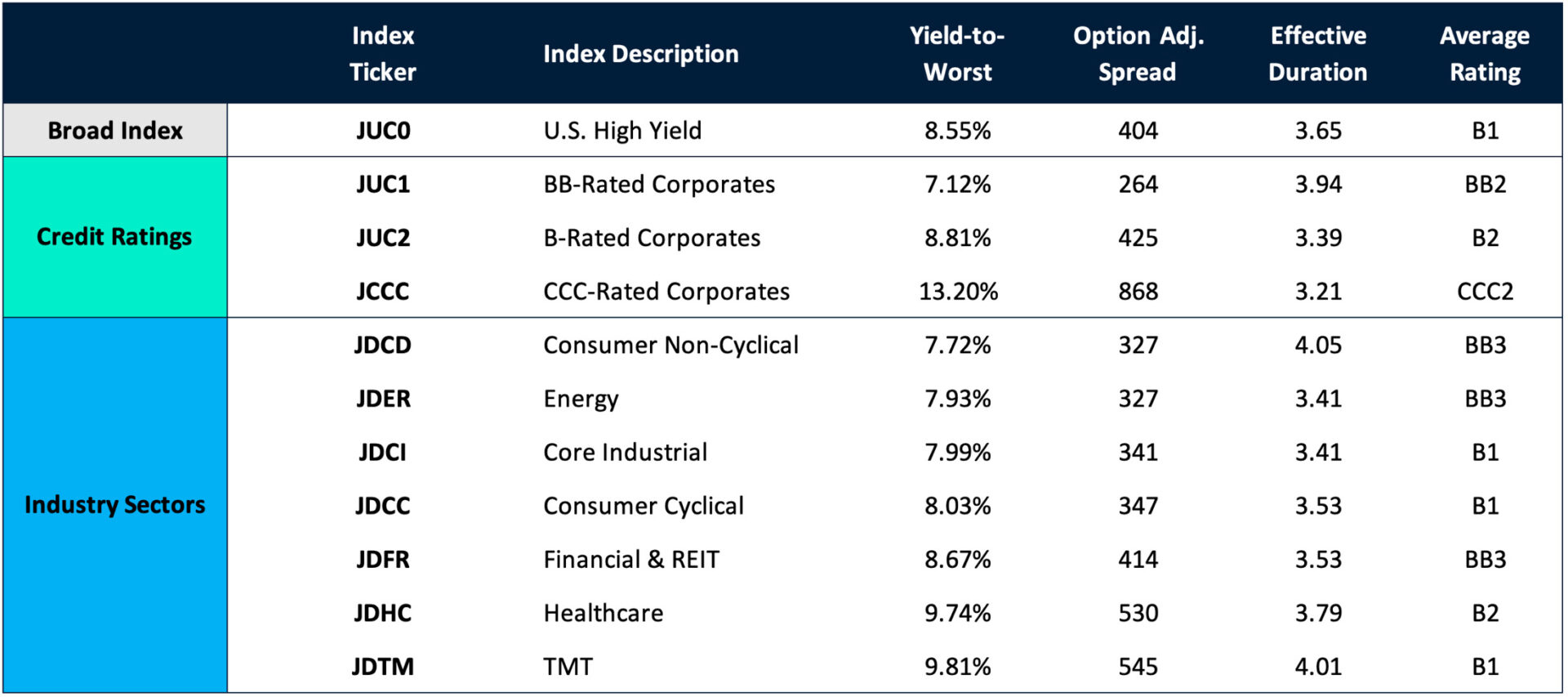

“The dispersion of returns across credit rating categories and industry sectors has continued during the first half of 2023,” according to the BondBloxx 2023 Midyear Fixed Income Market Outlook. “We believe this variance will continue, creating opportunities for outperformance versus broad high yield market indices, based upon credit quality and industry sector selection.”

See more: “BondBloxx 2023 Midyear Fixed Income Market Outlook”

U.S. High Yield Index Characteristics

Source: BondBloxx Investment Management / ICE Data Services, as of 6/30/2023

Multiple Entry Points into High Yield

When investing in high yield, credit rating category positioning matters. For investors looking to allocate to high yield fixed income, BondBloxx has three ratings-specific high-yield bond ETFs. These funds can serve as good entry points into high yield, depending on an investor’s risk tolerance—and what they expect for the U.S. economy.

For investors concerned about weakening economic conditions in the U.S., they should consider double-Bs. The BondBloxx BB-Rated USD High Yield Corporate Bond ETF (XBB) seeks to invest in bonds rated BB1 through BB3. XBB has the lowest default risk in high yield, with an average default rate of 1%, according to Moody’s.

If investors believe that the talk of a recession occurring in the second half of 2023 is overblown, they may want to consider single-Bs. The BondBloxx B-Rated USD High Yield Corporate Bond ETF (XB) seeks to invest in bonds rated B1 through B3.

And for investors who think the U.S. will avoid a deep recession this year, triple-Cs may be their thing. The BondBloxx CCC-Rated USD High Yield Corporate Bond ETF (XCCC) seeks to invest in bonds rated CCC1 through CCC3.

A Growing Suite of Fixed Income ETFs

BondBloxx was launched in October 2021 to provide precision ETF exposure for fixed income investors. Its first funds — a suite of seven sector-specific high-yield bond funds — were launched in February 2022.

Now, BondBloxx offers 19 ETFs that span U.S. Treasuries, industry- and credit rating-specific high-yield bonds, and emerging markets bonds. The firm exceeded $2 billion in assets under management in early August.

VettaFi’s head of research Todd Rosenbluth called BondBloxx “one of the more innovative providers of fixed income ETFs.”

“They offer advisors and investors the opportunity to target duration with risk-off government bonds,” Rosenbluth said. “In addition, they have a suite of credit quality focused high yield ETFs for those willing to take on additional risk for higher rewards.”

For more news, information, and analysis, visit the Institutional Income Strategies Channel.