It’s been a very good year for U.S. high yield. In fact, BondBloxx Investment Management has noted that riskier fixed income assets have outperformed U.S. Treasuries.

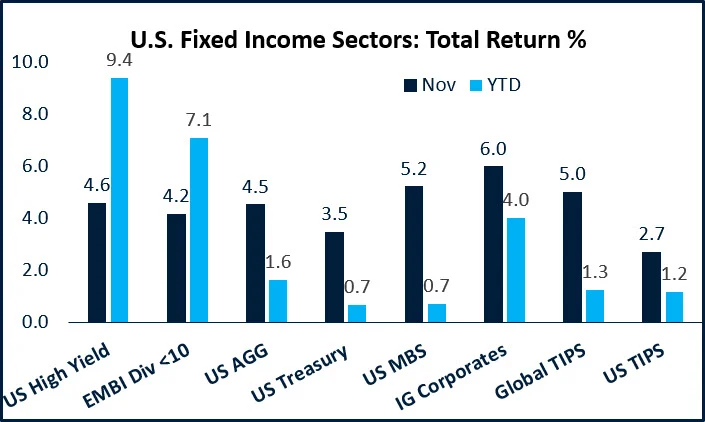

As noted in the fixed income manager’s monthly update, a historic bond rally in November pushed the total return for so-called junk bonds to 9.4% year to date. This is significantly above both the U.S. Aggregate Index (1.6%) and the Treasury Index (0.7%).

Source: Bondbloxx via ICE Data Services, JP Morgan, Bloomberg | Data as of 11/30/2023

See more: “Harvest Emerging Markets Bond Tax Losses With XEMD”

The boost in high yield is part-and-parcel with the bond rally that occurred last month.

“Market sentiment improved dramatically,” according to BondBloxx, “reflecting the Federal Reserve’s decision to pause on further rate hikes.” The boost was also partially driven by “the most recent CPI print showing moderating inflation and a slowing labor market.”

Choose Your High Yield Entry Points With Precision

For investors looking to get in on these sweet high yields, BondBloxx offers a few (OK, several) options. For example, investors may want to gain high yield exposure through a specific sector. BondBloxx offers seven sector-specific high yield bond funds. The sectors represented range from energy to healthcare to consumer cyclicals.

Or if a client would rather target high yield bonds via ratings, BondBloxx offers three ratings-specific high yield bond ETFs.

A Rapidly Growing Fixed Income Manager

BondBloxx offers 20 ETFs (soon to be 21) that span U.S. Treasuries, industry- and credit-rating-specific high yield bonds, and emerging markets bonds. The firm exceeded $2 billion in assets under management in early August.

VettaFi’s Head of Research Todd Rosenbluth called BondBloxx “one of the more innovative providers of fixed income ETFs.”

“They have a suite of credit-quality-focused high yield ETFs for those willing to take on additional risk for higher rewards,” he added.

For more news, information, and analysis, visit the Institutional Income Strategies Channel.