It’s the end of the year, so for investors, that means seeking tax-loss harvesting opportunities. And emerging markets bond investors in particular should really consider tax-loss-harvesting their positions. After all, the J.P. Morgan EMBI Global Diversified Index is down 18% over the last two years.

Investors can potentially capture losses in existing positions and replace the exposure with the BondBloxx JP Morgan USD Emerging Markets 1-10 Year Bond ETF (XEMD). The fund targets short- to intermediate-term U.S.-dollar-denominated, EM bonds. It excludes bonds with maturities longer than 10 years. The fund tracks the J.P. Morgan EMBI Global Diversified Liquid 1-10 Year Maturity Index.

See more: “High Yield Outperforms All Other Fixed Income”

A Shorter-Duration Approach

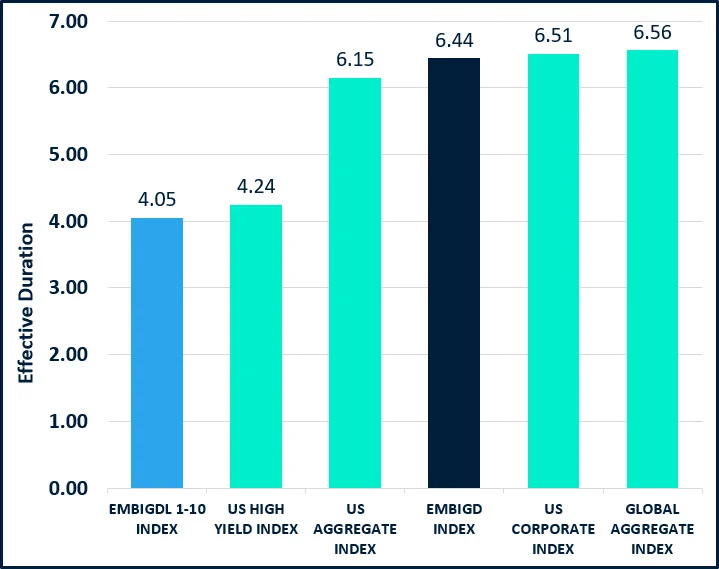

XEMD’s index was built without making significant country or sector deviations from the full index. The index is also shorter in duration than other broad market emerging markets bond benchmarks. This results in potential relative performance advantages during a rising rate environment.

“XEMD is designed to give fixed income investors the ability to better manage their duration exposure when investing in emerging markets debt,” said JoAnne Bianco, client portfolio manager at BondBloxx.

The ETF’s index is shorter in duration than most broad market bond benchmarks. This results in historically lower volatility.

Sources: J.P. Morgan, ICE Data Services, Bloomberg, as of 9/30/2023. Past performance does not guarantee future results.

XEMD is one of 20 fixed income ETFs that BondBloxx has launched since February 2022, which include seven industry sector-specific high yield bond ETFs, three ratings-specific high yield bond ETFs, eight target-duration U.S. Treasury ETFs, and an active high yield bond sector rotation fund.

BondBloxx was launched in October 2021 to develop precision fixed income ETFs. The issuer offers funds that span U.S. Treasuries, high yield bonds, and emerging markets bonds. The firm recently crossed the $2 billion asset mark.

For more news, information, and analysis, visit the Institutional Income Strategies Channel.