The Alerian MLP Infrastructure Index (AMZI) has reached a key milestone, climbing to the highest level on a price appreciation basis since February 2019.

AMZI is the underlying index for the Alerian MLP ETF (AMLP) and the ETRACS Alerian MLP Infrastructure Index ETN Series B (MLPB). The index is a capped, float-adjusted, cap-weighted composite of energy infrastructure MLPs. Companies included in the index earn most of their cash flow from midstream activities.

As AMZI hit a five-year high on a price return basis last week, AMLP, the largest MLP ETF available to investors, reached a four-year high in assets under management. The fund last week closed above $8 billion in assets for the first time since January 2020, demonstrating strong investor interest in MLPs.

See more: “Midstream Interest Climbs as Broad Energy ETFs Struggle”

AMZI has continued to climb higher year to date despite volatility in crude oil prices, reaching its highest price level in over five years despite oil prices remaining rangebound.

MLPs’ defensiveness is a particularly helpful quality when oil prices are volatile. Importantly, MLPs are less sensitive to moves in commodity prices given their fee-based business models.

Midstream’s long-term, fee-based business model provides cash flow stability through commodity cycles. That means, unlike other energy subsectors, midstream can generate steady free cash flow through different commodity price backdrops.

Stable free cash flow enables companies to continue to grow dividends and execute on buyback programs, two attractive sources of shareholder returns.

See more: “4Q23 Midstream/MLP Dividend Recap: The Growth Continues”

Free cash flow has been a key theme for midstream companies in recent years. Excess cash flow is responsible for the generous returns to shareholders.

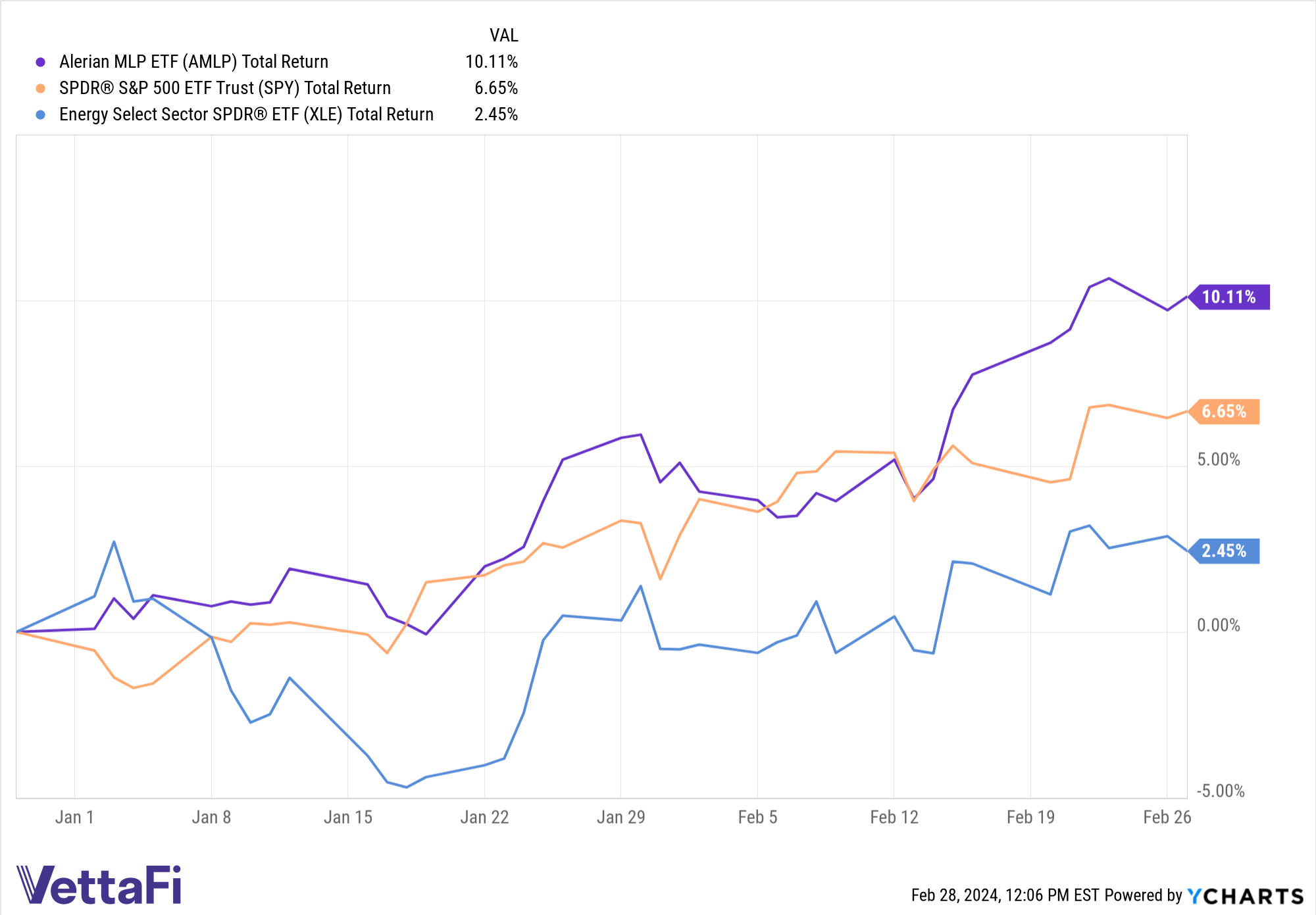

Notably, AMLP is outperforming broader energy, as well as the broader market as measured by the SPDR S&P 500 ETF (SPY), in 2024.

As AMZI Reaches Five-Year High, Valuations Remain Attractive

Even as AMZI has reached a five-year high, the midstream space is still not expensive.

AMZI finished January with a forward EV/EBITDA multiple of 8.49x based on 2025 consensus EBITDA estimates. This figure is notably below its three-year average of 8.84x.

For more news, information, and analysis, visit the Energy Infrastructure Channel.

vettafi.com is owned by VettaFi LLC (“VettaFi”). VettaFi is the index provider for AMLP and MLPB, for which it receives an index licensing fee. However, AMLP and MLPB are not issued, sponsored, endorsed, or sold by VettaFi, and VettaFi has no obligation or liability in connection with the issuance, administration, marketing, or trading of AMLP and MLPB.