The Alerian MLP ETF (AMLP) has seen strong flows even as investor interest wanes for broad energy ETFs.

AMLP is a composite of energy infrastructure MLPs that earn most of their cash flow from fee-based midstream activities. The fund has $8 billion in assets under management, making it the largest MLP ETF available to investors.

AMLP tracks the Alerian MLP Infrastructure Index (AMZI), which is yielding 7.26% as of February 20.

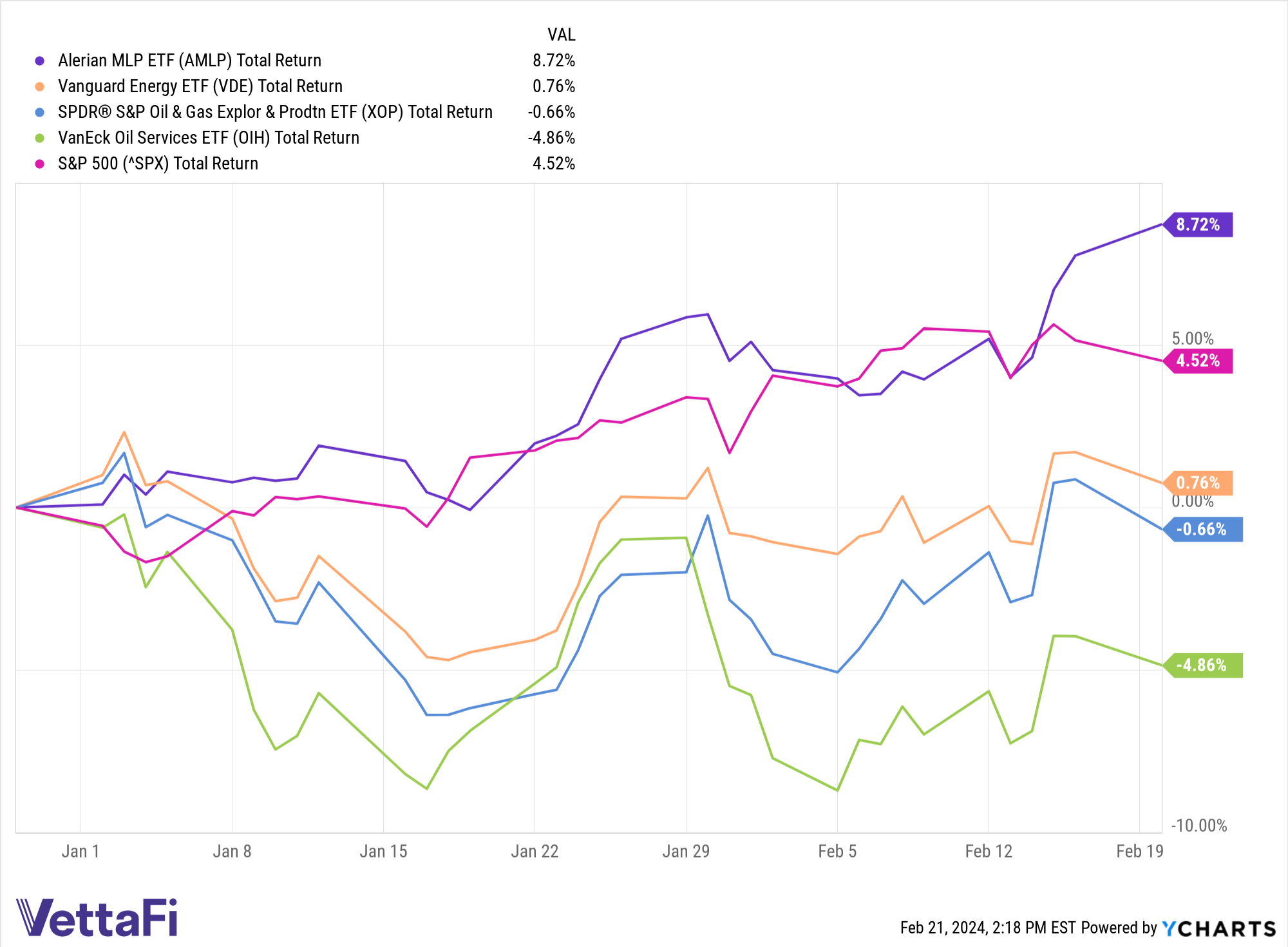

AMLP has seen $115 million in net flows year to date through February 20. Meanwhile, the Vanguard Energy ETF (VDE), a broad energy ETF of similar size with $8.1 billion in assets, has accrued $25 million during the same period.

Additionally, other energy subsector ETFs have seen outflows. The $3.6 billion SPDR S&P Oil & Gas Exploration & Production ETF (XOP) and the $1.9 billion VanEck Oil Services ETF (OIH), two large upstream ETFs, have seen $37 million and $242 million in year-to-date outflows, respectively.

Why Investors Are Looking to Midstream for Exposure to Energy ETFs

The midstream segment is compelling as it tends to provide attractive income and returns.

MLPs are currently providing more generous yields than other segments of the energy sector and other income-oriented investments. AMLP’s 30-day SEC yield is 7.14% as of January 31, while VDE’s yield is 3.05%. Meanwhile, XOP is yielding 1.99% and OIH is yielding 1.19%, each as of January 31.

See more: “Midstream Free Cash Flow Yields Beat Other Income-Generating Sectors”

The midstream segment also tends to be more defensive than other energy subsectors, showing less sensitivity to commodity price or interest rate movement.

While broader energy has largely held steady in 2024, AMLP has provided attractive returns on a total return basis and is even outpacing the S&P 500 as of February 20.

For more news, information, and analysis, visit the Energy Infrastructure Channel.

vettafi.com is owned by VettaFi LLC (“VettaFi”). VettaFi is the index provider for AMLP, for which it receives an index licensing fee. However, AMLP is not issued, sponsored, endorsed, or sold by VettaFi, and VettaFi has no obligation or liability in connection with the issuance, administration, marketing, or trading of AMLP.