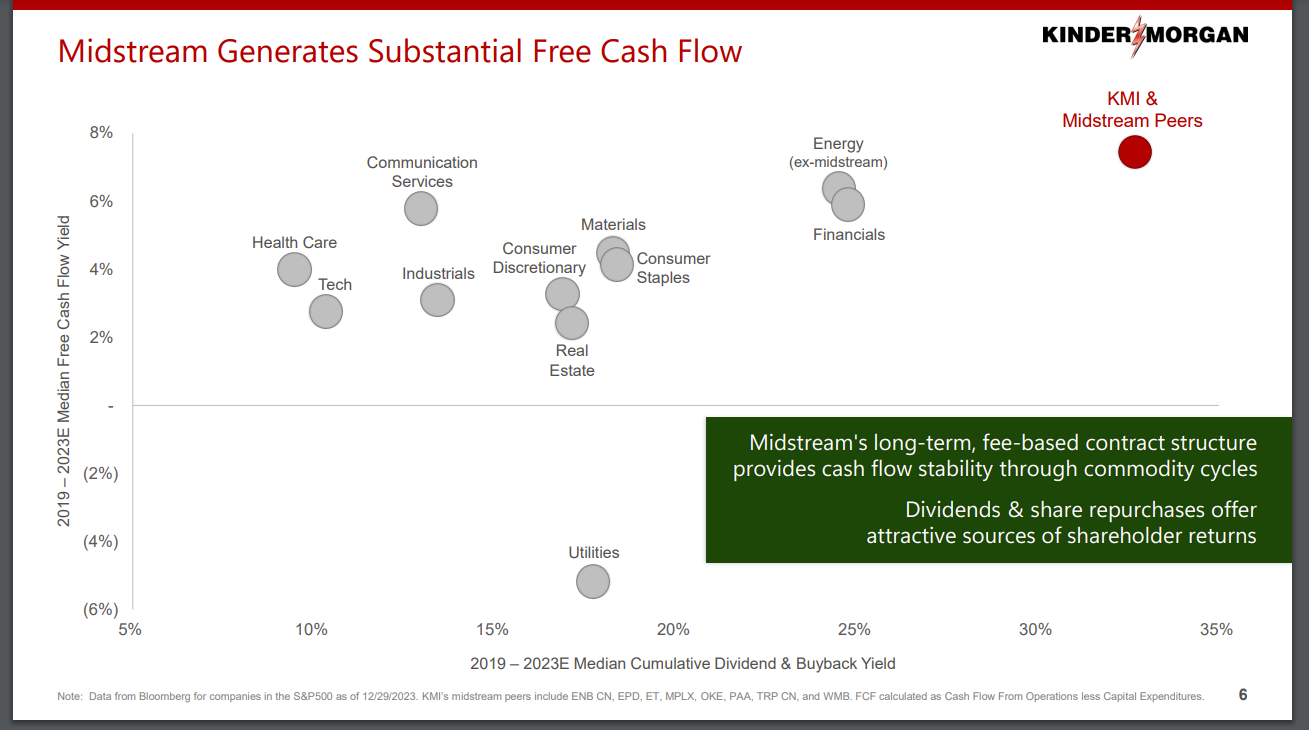

Midstream companies generate substantial free cash flow relative to other income-generating investments.

Kinder Morgan Inc. (KMI), as well as its midstream peers, has a higher median free cash flow yield than any of the 11 GICS sectors, according to data shared during Kinder Morgan’s investor day on January 24. This includes other income-generating sectors such as broader energy, real estate, and utilities.

Additionally, midstream companies offer a more generous cumulative dividend and buyback yield than any of the 11 sectors, according to Kinder Morgan.

Source: Kinder Morgan

Kinder Morgan and the other midstream names included in the chart above are holdings in the Alerian Energy Infrastructure ETF (ENFR). The ETF provides exposure to the Alerian Midstream Energy Select Index (AMEI).

ENFR’s underlying index is a composite of North American midstream energy infrastructure companies. The index includes corporations and MLPs that are engaged in the pipeline transportation, storage, and processing of energy commodities. It is yielding 6.55% as of February 8.

See more: “Why You Should Consider MLPs for Your Income Portfolio”

Why Free Cash Flow Matters in Midstream

Midstream’s long-term, fee-based business model provides cash flow stability through commodity cycles. That means, unlike other energy subsectors, midstream can generate steady free cash flow through different commodity price backdrops.

There are many tailwinds from free cash flow generation. Stable free cash flow enables companies to continue to grow dividends and execute on buyback programs, two attractive sources of shareholder returns.

Free cash flow has been a key theme for midstream companies in recent years. Excess cash flow has facilitated debt reduction as well as generous returns to shareholders.

Midstream’s ability to generate substantial free cash flow is a shift from the prior decade as U.S. energy production boomed. In the 2010s, companies were spending a lot of money and were heavily reliant on outside capital to finance their growth projects. In contrast, midstream companies are now enjoying greater financial flexibility.

For more news, information, and analysis, visit the Energy Infrastructure Channel.

vettafi.com is owned by VettaFi LLC (“VettaFi”). VettaFi is the index provider for ENFR, for which it receives an index licensing fee. However, ENFR is not issued, sponsored, endorsed, or sold by VettaFi, and VettaFi has no obligation or liability in connection with the issuance, administration, marketing, or trading of ENFR.