Summary

- Demand for fossil fuels will not grow indefinitely, but it will probably be more resilient than most may expect. Meeting the world’s energy needs will likely require a combination of renewables and fossil fuels for decades to come.

- The long-term outlook for natural gas is constructive given its cleaner burning qualities, while natural gas liquids (NGLs) should be supported by growing global demand for plastics.

- Even in worst-case scenarios, pipelines provide optionality and can be repurposed if no longer serving their original purpose.

Most would probably agree that pipelines have long useful lives. If you live in the Deep South or on the East Coast, there is a good chance your gasoline comes from the massive Colonial Pipeline system, which was built 60 years ago. Often, investors ask us about the remaining useful life for pipelines and whether these assets will become stranded as renewable energy and electric vehicles gain traction. Today’s note addresses that question.

Replacing Energy Sources Takes Time

Without digressing into a full energy transition discussion, replacing energy sources takes time. Coal is the most vilified fossil fuel, yet global coal demand is expected to have reached a new all-time high in 2023. The world has needed more and more energy as the global population has grown and economies have developed. Due to the global growth in energy demand, renewables have generally added to the energy mix, instead of displacing fossil fuels to this point (read more).

Demand for fossil fuels will not grow indefinitely, but demand will probably be more resilient than most may expect. Meeting the world’s energy needs will likely require a combination of renewables and fossil fuels for the foreseeable future. Given that perspectives may differ on this point, it’s worthwhile to dig deeper into North American pipeline dynamics.

North American Oil and Gas Pipelines Have a Lot of Life Left to Live

The long-term outlook for a pipeline depends on the commodity transported, its location, and its function (i.e., supply push or demand pull). Not all pipelines are created equally, but to paint in broad strokes, this discussion looks at pipelines by commodity.

Among fossil fuels, natural gas tends to garner a positive long-term view given its cleaner burning qualities. Notably, coal-to-gas switching has driven more than half of U.S. emission reductions since 2005 (read more). Globally, natural gas has an important role to play as a coal replacement and as a backup power source for renewables (read more). The U.S. will play a major role in satisfying global natural gas demand through exports of liquefied natural gas (LNG). New LNG export facilities coming online in the U.S., Canada, and Mexico typically have 20-year pipeline contracts in place to match their offtake agreements. Midstream assets like gathering pipelines. Processing facilities will be needed to get natural gas to the pipelines ultimately supplying LNG facilities. Domestic demand for natural gas is likely to remain resilient for industrial use and power generation.

Many midstream growth opportunities in recent years have centered on natural gas or NGLs, which include ethane and propane. Ethane and propane are used to produce ethylene and propylene — essential petrochemical building blocks for plastics and other applications. With strong U.S. NGL production and growing global demand, U.S. NGLs are increasingly exported. Energy Transfer’s (ET) NGL exports alone account for ~20% of the global market. A significant portion of U.S. ethane and propane exports are going to China. That country has expanded its petrochemical production capacity in recent years. The International Energy Agency expects global oil demand to continue growing through 2028 due largely to petrochemical demand. Assuming continued population growth, it’s difficult to imagine global demand for plastics, and thereby NGLs, slowing anytime soon.

Investors tend to be more concerned about oil pipelines given electric vehicles (EVs) and stated bans of internal combustion engines taking effect in coming years. Setting aside any challenges to EV adoption (range, grid, charge points, etc.), changing the complexion of the global vehicle fleet will take time. In 2022, EVs and plug-in hybrids were just 1.2% of the U.S. vehicle fleet. And the average life of a passenger car in the U.S. is currently 13.6 years, and almost 12 years for light trucks. Looking beyond EVs, displacing jet fuel for planes, diesel for heavy trucks, and diesel or fuel oils for marine shipping are likely to prove more difficult.

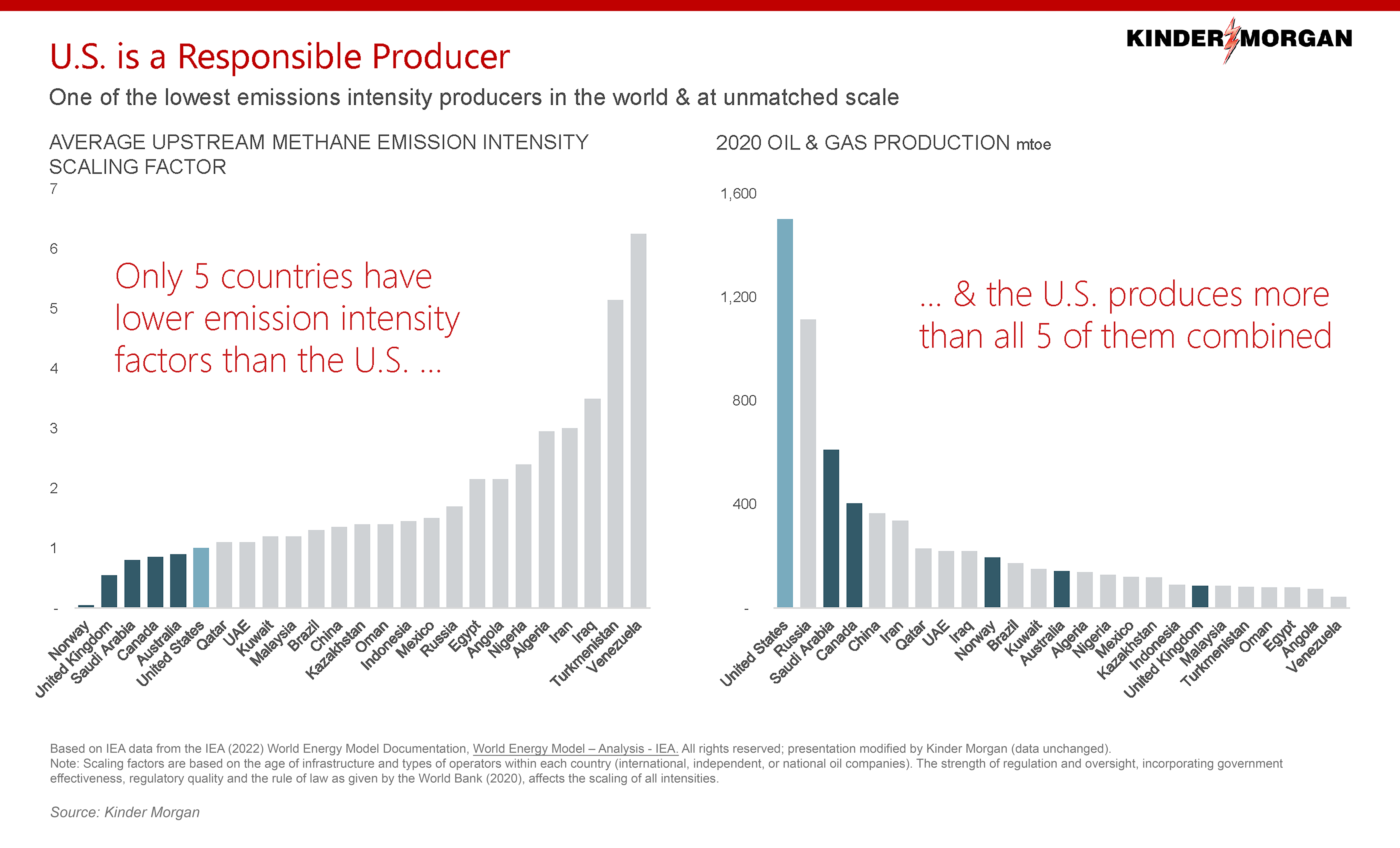

Global oil demand continues to grow, but for this analysis, let’s assume demand is shrinking. In that environment, there is reason to believe U.S. and Canadian oil production will be advantaged relative to other parts of the world. First and foremost, these countries boast significant reserves, infrastructure, geopolitical stability, and lower emissions intensity for production, as shown in the slide below from Kinder Morgan’s (KMI) 2022 ESG Report. The U.S. is home to significant, complex refining capacity. That capacity benefits from cost-advantaged feedstocks (North American oil prices are generally lower than global benchmarks) and lower operating costs (due in part to cheaper natural gas). Even if global oil demand is falling, the outlook for U.S. production and exports of oil and refined products like gasoline and diesel is arguably stronger due to these competitive advantages.

Pipelines Have Optionality

If a pipeline no longer serves its original purpose, there is the potential to repurpose the line. Existing assets provide optionality. As a result of the shale boom in the U.S., some existing pipelines were reversed (Capline for example) or converted to transport a different hydrocarbon (Pony Express from natural gas to oil). Depending on geography, installing a brand-new pipeline system could be a challenge. Leveraging an existing system would be preferable.

Pipelines may be repurposed to move captured carbon dioxide, with companies like EnLink Midstream (ENLC) repurposing pipelines for CO2 in Louisiana. There is also the potential for natural gas pipelines to be converted to transport hydrogen. Existing gas pipelines could move hydrogen at a blend of up to 15% with little modification. Additionally, existing diesel or jet fuel pipelines could transport renewable diesel or sustainable aviation fuel without modification.

At the extreme, pipelines do not have to be used to move fuels. Management from Plains (PAA/PAGP) noted that they had conversations with utilities and telecom companies in the past about using idled pipelines for power lines or broadband wires, given challenges with securing rights of way. Having steel in the ground and a clear path from one point to another creates value and optionality that may be underappreciated. That said, the expectation is that midstream assets in the U.S. will continue transporting fuels for decades to come.

Bottom Line:

U.S. and Canadian energy infrastructure is expected to have a long useful life into the future even as the energy landscape evolves.

Related Research:

PAA/PAGP Fireside Chat: Capital Allocation, Permian in Focus

Plains All American on Oil Demand Longevity

Global LNG Market Poised for Long-Term Growth

Canadian LNG Projects Advance to Meet Asian Demand

Midstream Connects US Gas With Growing Mexican Demand

Midstream Positions for Ballooning U.S. LNG Exports

Propane Helps Fuel Midstream/MLP Growth

MLPs and the Fastest-Growing Hydrocarbon You’ve Not Heard Of

For more news, information, and strategy, visit the Energy Infrastructure Channel.