- Solving the global energy trilemma – the need for secure, affordable, and low-carbon energy – will require fossil fuels and clean energy for years to come.

- Investment products rarely comingle fossil fuel and new energy companies, even though both are at the center of efforts to decarbonize our energy sources.

- The VettaFi 2050 Energy Transition Index (VNRGT) is an index of energy companies that reflects the current energy mix and how it may evolve over time.

Management teams at energy companies and other stakeholders regularly discuss the current energy trilemma. This refers to the need for secure, affordable, and low-carbon energy for the world’s population. Addressing this complex, long-term problem will require both alternative energy and hydrocarbons produced in a more responsible manner.

For investors contemplating the best way to gain exposure to the companies actively addressing this problem, a combination of alternative and traditional energy companies would be a practical approach. However, new energy and traditional oil and gas are rarely commingled in energy investment products. This note discusses the current energy landscape, introduces the VettaFi 2050 Energy Transition Index (VNRGT), and makes a case for combining exposure to clean energy and traditional oil and gas companies.

The current energy landscape may surprise you.

One’s perception of the global energy mix may differ materially from the current reality. Renewable energy has seen strong, undeniable growth over the last two decades from a low base, but that has coincided with overall growth in global energy consumption. Renewables have not significantly displaced fossil fuels. Instead, they are adding to the overall energy supply.

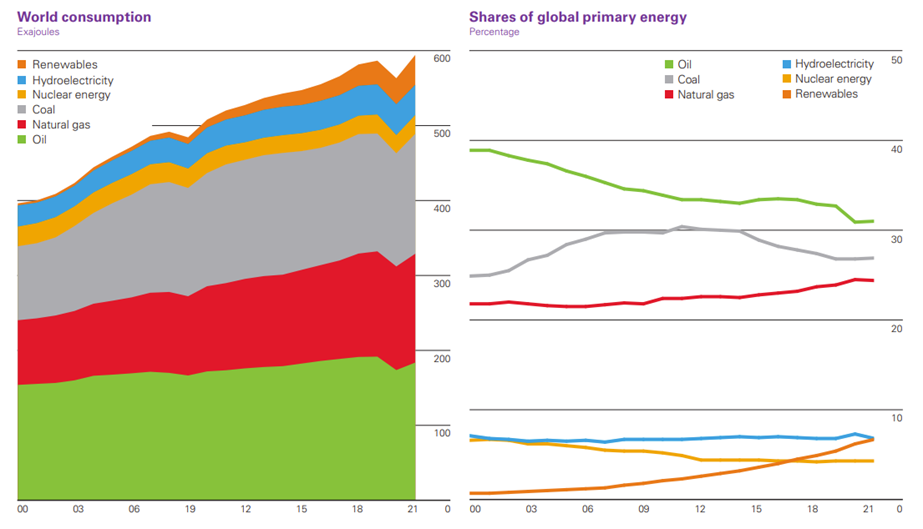

The charts below from the bp Statistical Review of Energy help show this trend. Specifically, fossil fuels (coal, oil, natural gas) accounted for 82% of global primary energy use in 2021. That percentage over time has been remarkably stable. In its World Energy Outlook 2022, the International Energy Agency (IEA) noted that fossil fuels have accounted for around 80% of the global energy mix for decades. Eventually, the share of fossil fuels will start to gradually decline. According to the IEA, global renewable capacity for electricity is expected to increase by about three-fourths between 2022 and 2027, with renewables set to surpass coal to become the largest source of electricity generation.

Source: bp Statistical Review of World Energy 2022

Clean energy and fossil fuels coexist in the energy mix and can coexist in an energy index.

It is evident that the global energy mix will require both fossil fuels and clean energy for years to come. However, broad energy ETFs tend to focus on one or the other. Investment products rarely provide exposure to the full energy landscape — oil, natural gas, solar, wind, nuclear, hydrogen, etc.

To reflect the current energy mix and the evolving landscape, an index needs to combine new energy and fossil fuels with a dynamic weighting scheme. In that vein, the VettaFi 2050 Energy Transition Index (VNRGT) is an index of energy companies that transitions over time from fossil fuel to clean energy companies. The concept is very similar to a target date fund for retirement, which shifts over time as an investor ages. VNRGT, which includes 50 companies, is reconstituted semi-annually in June and December.

At the December 2023 reconstitution, the index was 65.5% fossil fuels and 34.5% clean energy with 34 and 16 companies in each respective category. Using a straight-line approach, the index will gradually adjust at each reconstitution, ultimately ending up with 50 clean energy companies (100% weighting) in December 2050. The 2050 timeline coincides with when emissions would need to reach net zero to achieve the Paris Agreement climate objective. The weighting and constituent count at each reconstitution is detailed in the index methodology.

Why combine clean energy and fossil fuels?

Energy investment products rarely combine alternative energy companies with oil and gas companies. In late 2021, more than 600 financial advisors were asked if clean energy and fossil fuel companies should be combined in one product. Almost 60% of respondents believed they should be together. Respondents cited the need for both types of energy, diversification benefits, better representation, and an “energy is energy” stance.

For investors primarily looking for energy equity exposure, combining clean energy with traditional oil and gas makes sense. Investors can enjoy the dividends and buybacks that come with the free cash flow generation of traditional oil and gas companies, while also enjoying the growth prospects of alternative energy companies.

Over time, the lines between traditional and clean energy will likely be blurred. Oil and gas companies are increasingly investing in renewables and new energy technologies, including buying clean energy companies. For example, bp (BP) bought renewable natural gas producer Archaea Energy in late 2022 in a $4 billion transaction. Chevron (CVX) has invested in Aurora Hydrogen, and ExxonMobil (XOM) took a 49.9% stake in Norwegian biofuel company Biojet AS.

Some of the excess cash flow generated by traditional oil and gas companies will be used for clean energy initiatives or investments in private startups developing new technology. Those efforts and technologies would not be captured by an index of only public alternative energy companies.

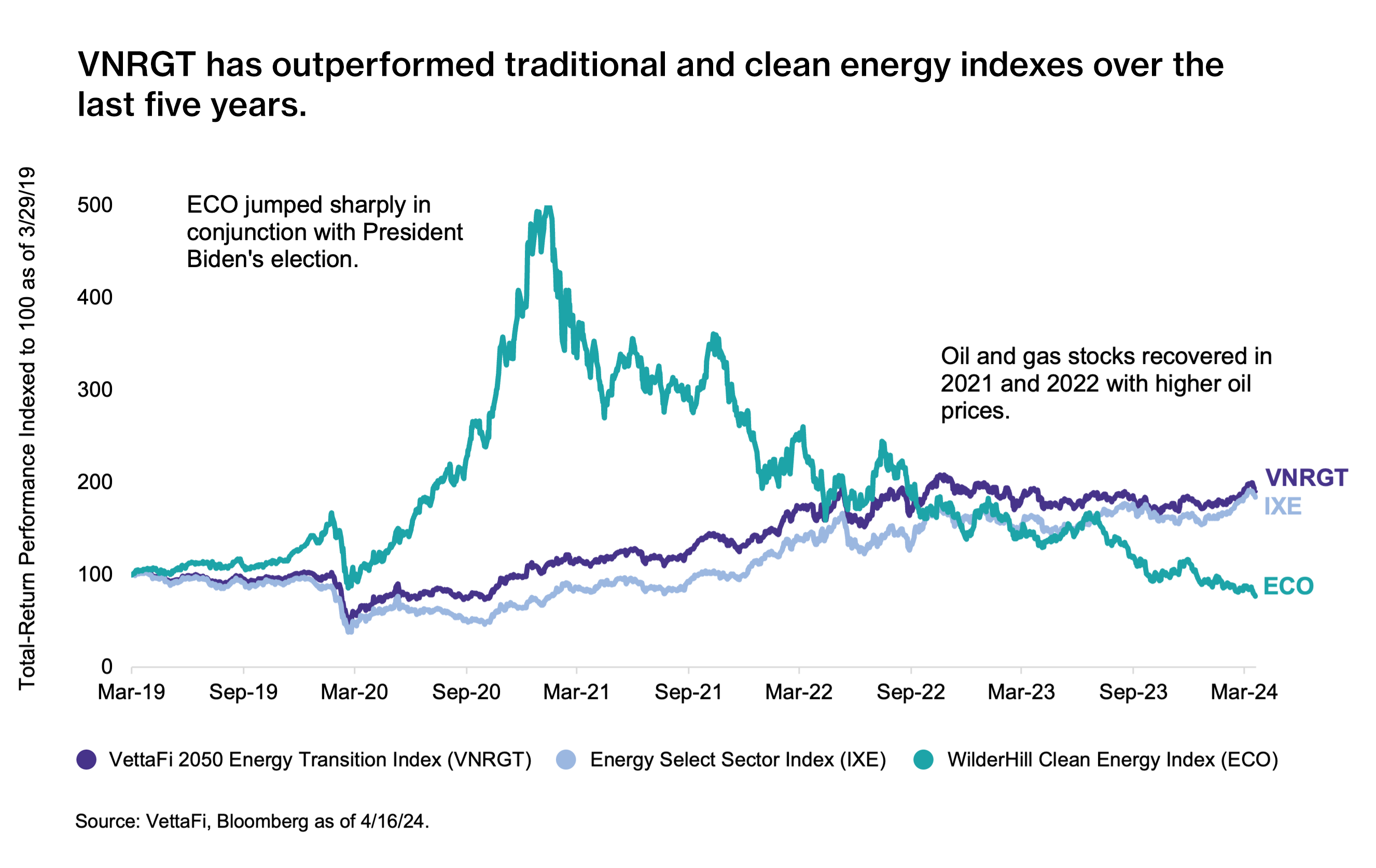

Combining traditional and new energy companies can also provide performance benefits. The relative performance chart below shows the five-year total return for VNRGT compared to the WilderHill Clean Energy Index (ECO) and Energy Select Sector Index (IXE). VNRGT generally outperformed IXE. Relative to ECO, VNRGT lagged when clean energy stocks ran up in conjunction with President Biden’s election in November 2020. However, VNRGT avoided the sharp sell-off in alternative energy in 2021 and 2022 as traditional energy stocks saw strong performance. For the five-year period, VNRGT outperformed both clean energy (ECO) and traditional oil and gas stocks (IXE).

Bottom Line

By combining clean energy and fossil fuel companies with a dynamic weighting scheme, the VettaFi 2050 Energy Transition Index (VNRGT) reflects the current global energy mix and how it will likely evolve over time. It includes the companies that will be addressing the world’s need for secure, affordable, and low-carbon energy for years to come.

For more news, information, and analysis, visit the Energy Infrastructure Channel.