Summary

- Utilities and midstream can provide similar portfolio benefits and may be found together in the income or real asset sleeves of portfolios.

- A long-term correlation between utilities and midstream/MLPs is relatively low at around 0.3, highlighting important differences between these investments.

- Rising interest rates have been a headwind for utilities, facing both higher borrowing costs for their capital-intensive businesses and greater competition from other income investments.

Both utilities and midstream can be broadly classified as energy infrastructure. However, beyond some high-level commonalities, there are important differences between these two investments. Today’s note takes a closer look at how utilities compare to midstream corporations and MLPs.

How are utilities and midstream/MLPs similar?

Utilities and midstream can provide similar portfolio benefits and may be found in the same sleeves of a portfolio. For example, both are real assets, which can act as a hedge against inflation while providing diversification benefits relative to stocks and bonds. Both are also known for their income, albeit midstream/MLPs provide more generous yields as discussed below.

There are also commonalities in their underlying businesses. Utilities and midstream provide critical services that support our everyday lives by meeting our needs for energy. Accordingly, both power and pipelines are regulated at the federal and state levels.

Key differences: interest rate sensitivity, yields, and more.

Despite high-level similarities, a ten-year monthly correlation between a utilities index and midstream and MLP indexes is only around 0.3. The low correlation reinforces important differences between these investments and their performance drivers.

Utilities’ greater interest rate sensitivity is particularly relevant given rising rates over the last several months. Utilities tend to use debt extensively to fund significant capital expenditures. Because of their notable debt burdens, rising interest rates can be a headwind. Thus far in 2023, utilities are the worst-performing sector, down 9.1% on a total-return basis through August 24.

On the other hand, midstream MLPs and corporations tend to be less impacted by rising rates (read more). The Alerian MLP Infrastructure Index (AMZI) and Alerian Midstream Energy Select Index (AMEI) are up 15.7% and 8.2%, respectively, on a total-return basis through August 24. For midstream, oil prices and energy sentiment tend to be more relevant performance drivers over time.

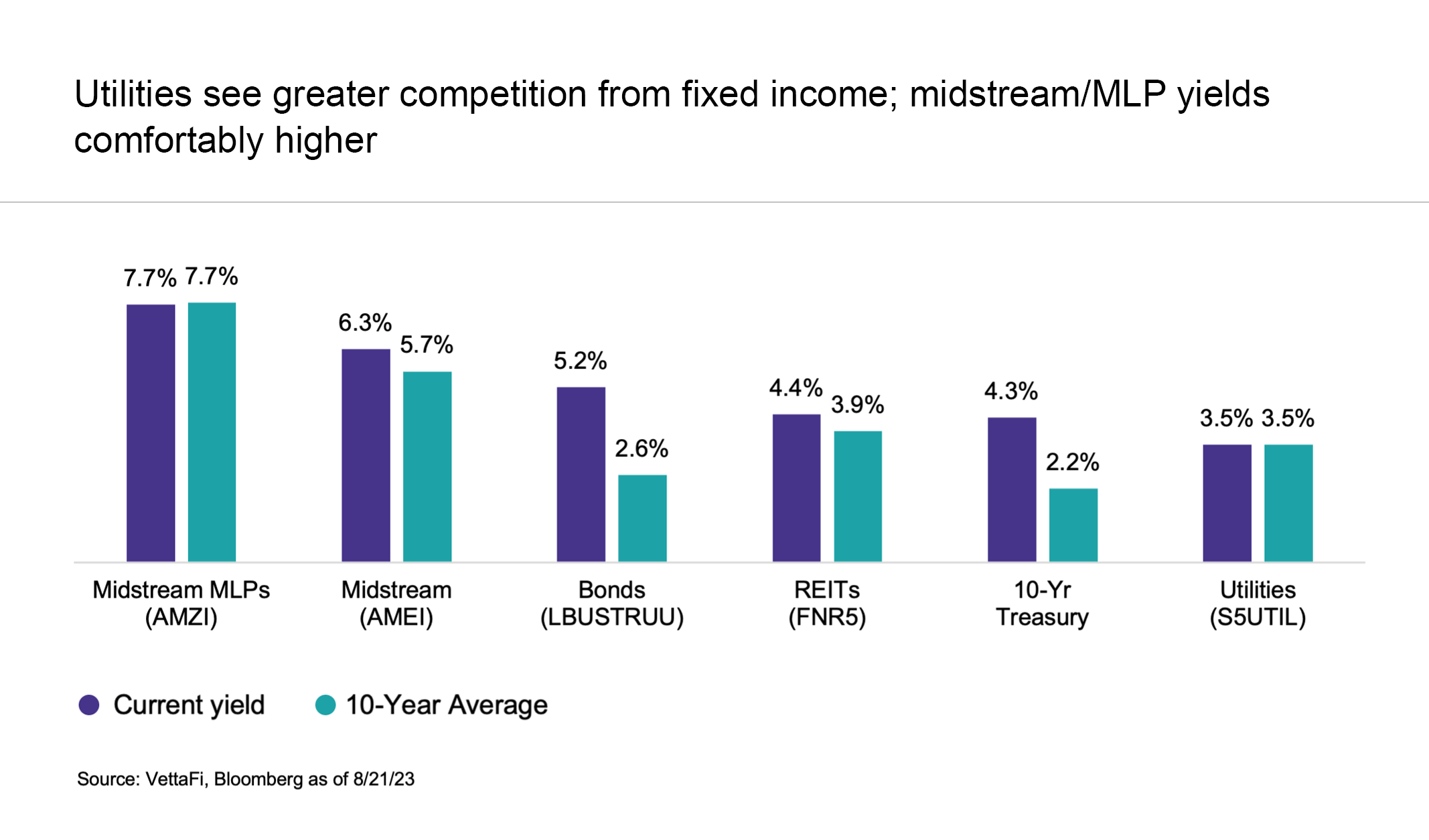

Higher interest rates also mean more competition for utilities from other income investments. Corporate bonds and the 10-Year Treasury offer more generous yields than utilities today. The S&P 500 Utilities Index (S5UTIL) is yielding right in line with its ten-year average at 3.5%, while most other income investments are yielding above their historical averages. Utility yields are much lower than those offered by midstream and MLPs.

Another key difference between midstream and utilities is that midstream companies are largely generating free cash flow as capital spending has come down meaningfully since 2019. Midstream corporations and MLPs have used excess cash flow for debt reduction, dividend growth, and buybacks. For the AMZI and AMEI, over two-thirds of constituents by weighting have a buyback program.

On the other hand, utilities are capital intensive businesses that typically spend more in capital expenditures than they generate in operating cash flow. As utilities increasingly invest in renewable power generation with the goal of decarbonization, capex is unlikely to slow down.

On a more positive note, utilities can be attractive for their defensive qualities. Last year, when the S&P 500 fell 18.1% on a total-return basis and notched one of its worst years ever, utilities saw small gains for the year.

Utilities: here, there, and everywhere. MLPs: harder to find.

Investors may have exposure to utilities across different investments, whereas midstream exposure is less likely to happen by accident. Utilities represent about 2.5% of the S&P 500 by weighting, while there are only four midstream corporations in the S&P 500. MLPs are excluded from the benchmark altogether. In addition to broad market funds, investors may also have exposure to utilities in dividend-focused investment products.

Investors are unlikely to have noticeable MLP exposure unless they own MLP-focused products. This can add to the diversification benefits of MLPs, as there is likely little overlap with other portfolio holdings. There are several exchange-traded products focused on energy infrastructure, including a few with noticeable weightings to utilities. Beyond those, midstream corporations or MLPs may be included in energy, alternative income, or high-dividend strategies, but MLP exposure will be limited to 25% or less to avoid fund-level taxation (read more).

Bottom Line:

Utilities and midstream/MLPs share some similarities, including the broad classification of energy infrastructure. However, there are also important differences between these investments that can impact performance and portfolio contributions.

AMZI is the underlying index for the Alerian MLP ETF (AMLP) and the ETRACS Alerian MLP Infrastructure Index ETN Series B (MLPB). AMEI is the underlying index for the Alerian Energy Infrastructure ETF (ENFR) and the ALPS Alerian Energy Infrastructure Portfolio (ALEFX).

For more news, information, and analysis, visit the Energy Infrastructure Channel.

Related Research:

Midstream/MLPs Resilient in Periods of Rising Rates

Is Your Income Stream Too Dependent on the Fed?

Midstream 2Q23 Dividend Recap: MLPs Drive Growth

Midstream Buybacks Picked Up in 2Q23

MLPs Shine, REITs Lag in 2022 Performance for Income Investments

Targa Resources Becomes 4th Midstream C-Corp in S&P 500

Beyond the K-1: Tax Treatment for an MLP Fund

Vettafi.com is owned by VettaFi LLC (“VettaFi”). VettaFi is the index provider for AMLP, MLPB, ENFR, and ALEFX, for which it receives an index licensing fee. However, AMLP, MLPB, ENFR, and ALEFX are not issued, sponsored, endorsed, or sold by VettaFi, and VettaFi has no obligation or liability in connection with the issuance, administration, marketing, or trading of AMLP, MLPB, ENFR, and ALEFX.