- On a year-over-year basis, over 90% of the broad Alerian Midstream Energy Index (AMNA) by weighting has grown their dividends. No AMNA constituent has cut its dividend for seven straight quarters.

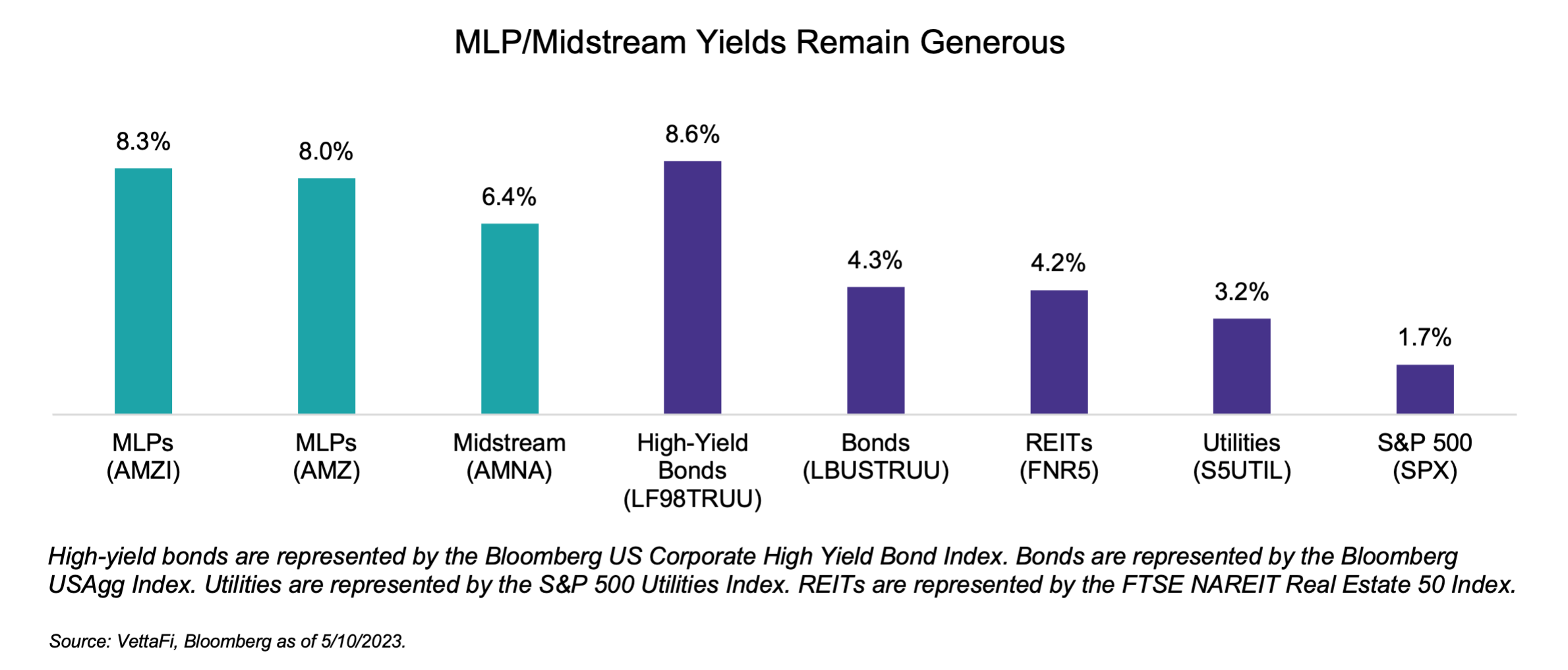

- Dividend growth complements the already compelling yields for MLPs/midstream, which tend to be more generous than other income investments.

- Some midstream companies have set multi-year growth targets for dividends, which provides helpful visibility to future payouts.

Another quarter of strong dividend announcements from midstream MLPs and corporations is well-timed amid broader market and energy volatility. Investors turning to midstream for income or as a safer haven in the energy space will be glad to know that dividend trends remain positive even as MLP yields sit above 8%. Today’s note recaps 1Q23 dividends across the Alerian midstream and MLP benchmark indexes, examines current yields in the context of other income investments, and highlights companies with formal dividend growth targets.

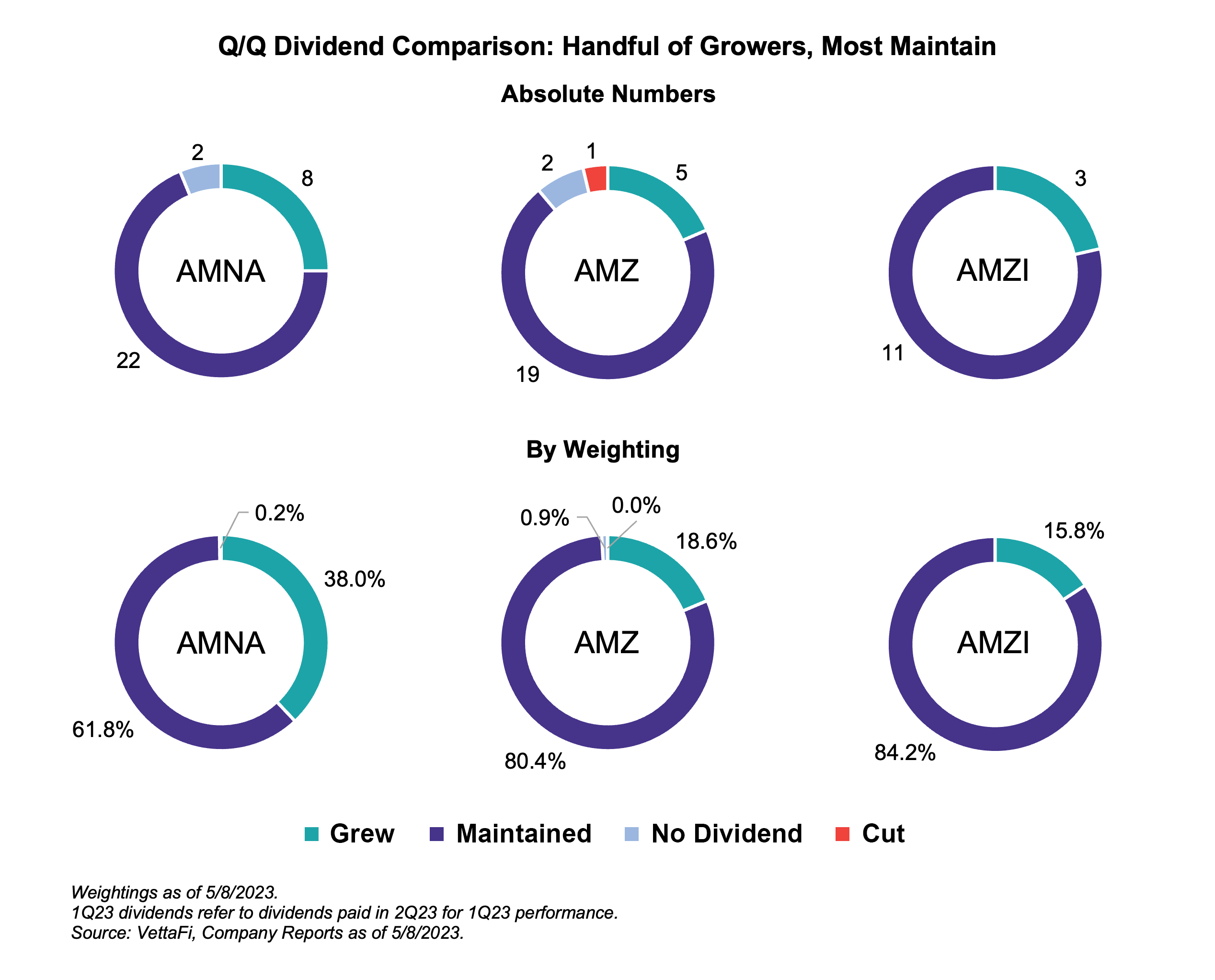

1Q23 Dividends: Handful of growers and one small cut.

Midstream dividends remained strong for 1Q23, with a handful of names increasing their payouts and a lone cut from a small MLP. Targa Resources (TRGP) led the way, announcing a 43% increase in its quarterly dividend to $0.50 per share. For context, companies that previously cut payouts, like TRGP, are now raising from a lowered base, allowing them to grow at greater percentages. DT Midstream (DTM) raised its dividend by 7.8% to $0.69 per share.

Canadian midstream players TC Energy (TRP CN) and Pembina Pipeline Corporation (PPL CN) also grew their payouts by 3.3% and 2.3%, respectively. Energy Transfer (ET), Kinder Morgan (KMI), Hess Midstream (HESM), Delek Logistics (DKL), and Global Partners (GLP) also raised their payouts sequentially. USD Partners (USDP) suspended its distribution to use free cash flow to support operations and potentially reduce debt. USDP had a less than 0.1% weighting in the Alerian MLP Index (AMZ) as of May 8, 2023.

Meanwhile, Western Midstream (WES) announced an enhanced distribution of $0.356 per unit this quarter related to 2022 performance in addition to its base distribution of $0.50 per unit. Cheniere Energy Partners (CQP) lowered the variable component of its distribution by $0.04 this quarter to $0.255 per unit. For this comparison, we use base distributions for WES and CQP. As such, both are categorized in the maintain category for the quarter-over-quarter and year-over-year comparisons.

The pie charts below show quarter-over-quarter changes to dividends for the Alerian Midstream Energy Index (AMNA), the AMZ, and the Alerian MLP Infrastructure Index (AMZI), by comparing 1Q23 payouts to those made for 4Q22. To be clear, 1Q23 dividends refer to dividends paid in 2Q23 based on operational performance in 1Q23.

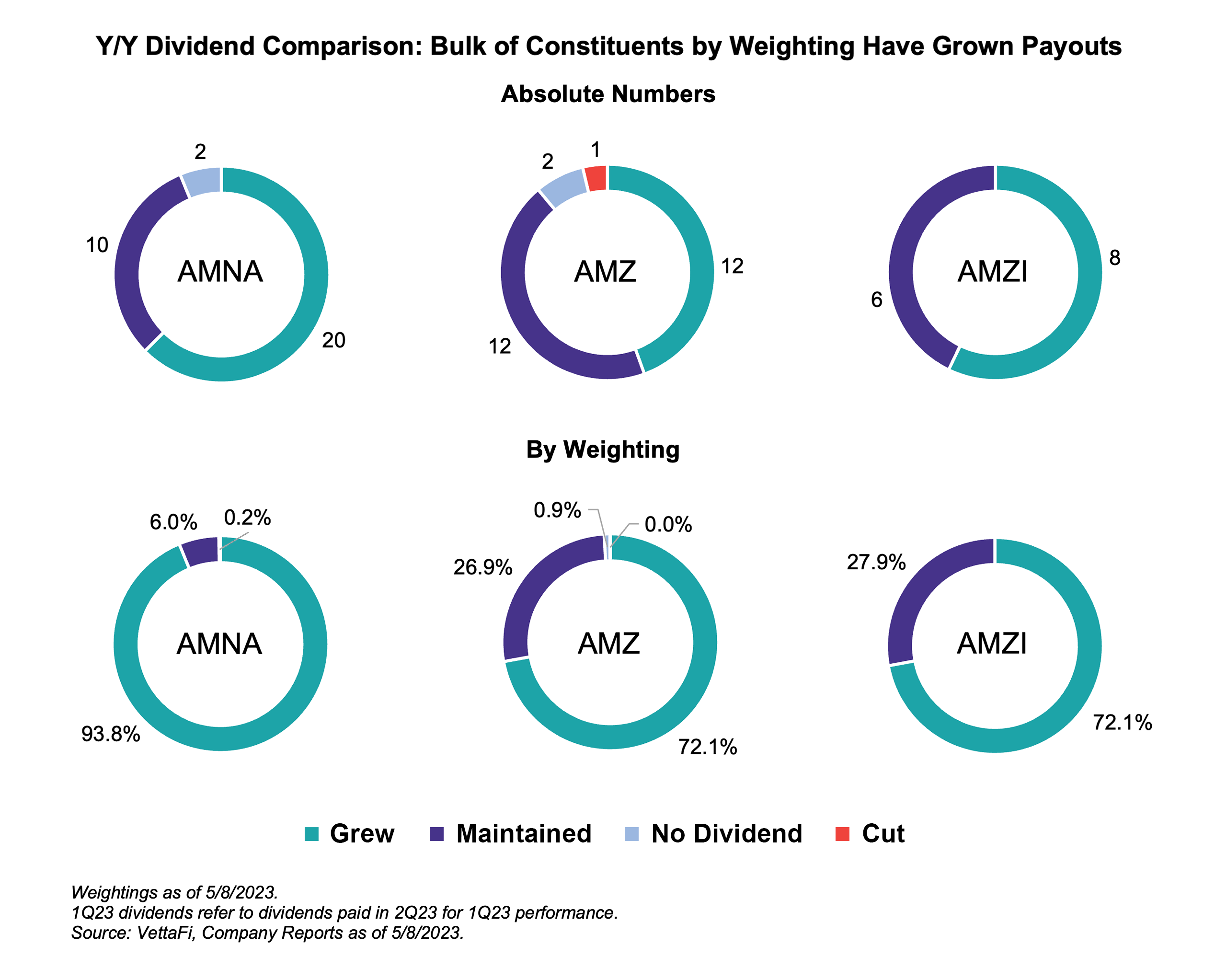

Most constituents are paying higher dividends than they were a year ago.

On a year-over-year basis, several companies have grown their payouts (see chart below). For AMNA, the broad North American midstream benchmark, 93.8% of constituents by weighting have grown their dividends over the past year. For the MLP indexes, AMZ and AMZI, just over 70% of both indexes by weighting have increased their distributions on a year-over-year basis. Again, WES and CQP are categorized here as maintained per their base distributions. The names that have grown tend to be bigger by market cap and therefore tend to have a higher weighting in the indexes.

Yields have stayed attractive compared to other income investments.

Energy infrastructure companies tend to offer generous yields compared to other equity income investments, and dividend growth is enhancing already compelling income. MLP/midstream yields have increased lately amid weakness in energy, even as fundamentals remain strong (read more). AMZI was yielding just 30 basis points less than high-yield bonds last week, and investment-grade companies account for more than 75% of AMZI by weighting. Investment-grade companies tend to constitute a large portion of both MLP and midstream indexes (read more). The bias towards dividend growth and absence of cuts for AMNA constituents adds confidence to the MLP/midstream yields shown. For more on how energy infrastructure stacks up against other income investments, please join our upcoming webcast on Tuesday, June 6, at 2 p.m. ET, “Why Your Income Portfolio Needs Energy Infrastructure.”

Visibility for continued growth in midstream dividends.

Some companies have set multi-year growth targets for dividends, which provide investors with visibility to future payouts. Energy Transfer (ET) announced a new 3-5% annual distribution growth target in late April. Other names have included dividend growth as part of multi-year capital allocation frameworks (read more). For example, Cheniere Energy (LNG) announced it plans to further grow its dividend by approximately 10% through the construction of Corpus Christi Stage 3, which is expected to reach substantial completion between 2H25 and 1H27. LNG increased its dividend by 20% in 2022, as part of its “20/20 Vision” Long-Term Capital Allocation Plan. Plains All American (PAA/PAGP) also included an annual distribution growth target of $0.15 per unit as part of its multi-year capital allocation framework. HESM recently reaffirmed its 5% annual distribution growth target through at least 2025. TC Energy (TRP CN) has guided to 3-5% annual dividend growth.

Bottom Line

Midstream MLPs and corporations continue to offer compelling income supported by fee-based business models and solid free cash flow generation. MLP/midstream yields have increased, but underlying fundamentals for dividends remain very strong, potentially creating opportunity for investors seeking income.

For more news, information, and analysis, visit the Energy Infrastructure Channel.

AMZI is the underlying index for the Alerian MLP ETF (AMLP) and the ETRACS Alerian MLP Infrastructure Index ETN Series B (MLPB). AMZ is the underlying index for the JP Morgan Alerian MLP Index ETN (AMJ) and the ETRACS Quarterly Pay 1.5x Leveraged Alerian MLP Index ETN (MLPR). AMNA is the underlying index for the ETRACS Alerian Midstream Energy Index ETN (AMNA).

Related Research

MLPs/Midstream: Solid 1Q23 Updates Lost in Macro Void

4Q22 Midstream/MLP Dividends: The Growth Continues

Examining Midstream/MLP Credit Ratings and Yields

Midstream/MLPs: The Benefits of Capital Allocation Frameworks

Vettafi.com is owned by VettaFi LLC (“VettaFi”). VettaFi is the index provider for AMLP, MLPB, AMJ, MLPR and AMNA, for which it receives an index licensing fee. However, AMLP, MLPB, AMJ, MLPR, and AMNA are not issued, sponsored, endorsed, or sold by VettaFi, and VettaFi has no obligation or liability in connection with the issuance, administration, marketing, or trading of AMLP, MLPB, AMJ, MLPR, and AMNA.