- A constructive midstream earnings season was unfortunately easily lost amid last week’s macro headlines and a challenging energy tape.

- Most midstream MLPs and corporations reported better-than-expected results with constructive outlooks and a continued focus on shareholder returns.

- For income investors, midstream continues to provide attractive yields with strong underlying dividend trends, and for energy investors, midstream provides more defensive energy exposure and can better weather commodity price volatility as seen last week.

Most midstream MLPs and corporations announced earnings last week and a few names declared their quarterly dividends as well. However, positive company updates were easily missed amid ongoing market volatility from banking-related headlines, the Fed announcement on Wednesday, and an ugly energy tape. Today’s note focuses on key takeaways from midstream earnings season, which point to continued strong fundamentals in midstream despite macro volatility.

Midstream income story remains as strong as it’s been in years.

Dividend trends remain very strong in midstream. Next week’s dividend recap will provide more details, but in short, it was a solid quarter with a handful of companies growing their payouts sequentially. Strong free cash flow generation, better balance sheets, and higher MLP distribution coverage (read more) add confidence to MLP/midstream yields.

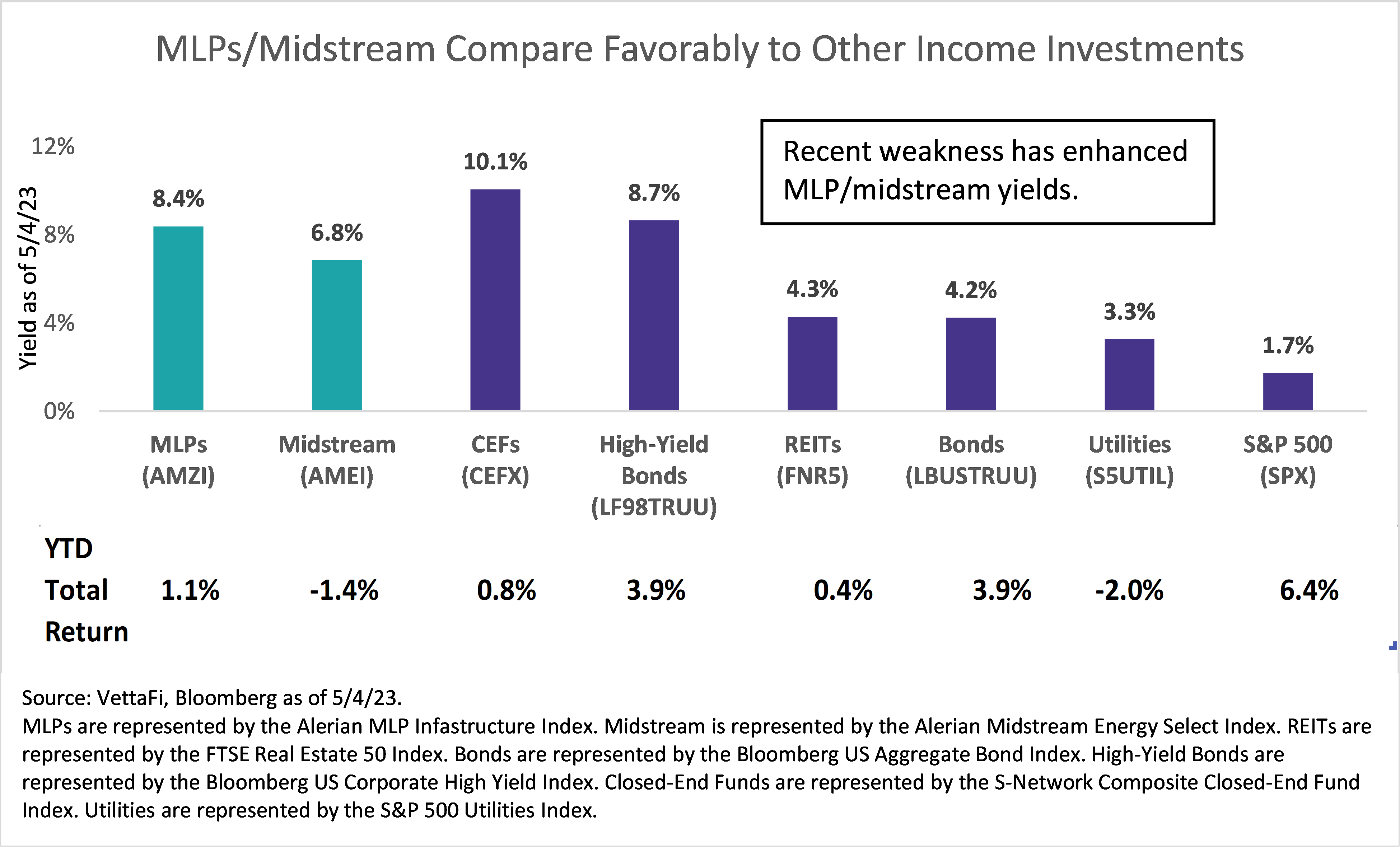

Compared to other income investments, MLPs and broader midstream continue to provide very attractive yields as shown in the chart below, only falling behind closed-end funds (CEFs) and high-yield bonds. Income investments have broadly lagged the S&P 500 so far this year, with bonds providing the best total return. However, MLPs’ total return through last Thursday was better than REITs, utilities, and CEFs even after a tough couple of days in the energy space. MLPs and midstream can enhance the yield of an income portfolio while also providing diversification benefits. For more on how energy infrastructure stacks up against other income investments, please join our upcoming webcast on Tuesday, June 6, at 2 p.m. ET, “Why Your Income Portfolio Needs Energy Infrastructure.”

First quarter earnings results were solid, and shareholder returns remain in focus.

Last week was the peak of midstream earnings season as well over 20 Alerian index constituents reported first quarter numbers. Overall, results have come in ahead of consensus expectations with just a few exceptions. Although most confirmed 2023 outlooks, a couple companies raised full-year 2023 financial guidance, including Cheniere Energy (LNG), Antero Midstream (AM), and Magellan Midstream Partners (MMP). Energy Transfer (ET) and Sunoco (SUN) also raised guidance to reflect recent acquisitions.

Companies continue to focus on returns to shareholders through dividend growth and buybacks. For example, Energy Transfer (ET) guided to an annual distribution growth target of 3-5%, and Enterprise Products Partners (EPD) will evaluate another distribution increase mid-2023 as reiterated on the 1Q23 earnings call. Buyback activity will be detailed in an upcoming note, but several companies were active with repurchases in 1Q23, though buyback spend was lighter for some names relative to 4Q22 levels. Having repurchased $52 million of shares in 1Q23, Targa Resources (TRGP) announced a new $1 billion buyback authorization last week

Growth spending ticks up for some on natural gas and NGL opportunities.

Capital discipline has been a focus for the midstream space, and most names maintained their growth spending targets. Antero Midstream actually announced a haircut to its 2023 growth capex. On the other hand, Williams (WMB), ET, EPD, and TRGP are among the names that announced measured increases to growth capital spending largely related to natural gas or natural gas liquids (NGL) opportunities. For example, ET is moving forward with a 250,000-barrel-per-day expansion to its NGL export capacity at Nederland (read more), and TRGP announced a new NGL fractionation facility at Mont Belvieu. Growth spending tends to be met with added scrutiny as some investors would prefer to see more capital shifted towards dividends or buybacks, but there is merit to prioritizing attractive long-term growth opportunities alongside shareholder returns.

Positive outlook on producer activity and volumes.

Midstream companies with a focus on gathering and processing work closest to the wellhead and have a front-row seat to producer activity and drilling plans. By and large, commentary from these companies was constructive, even as some anticipate a near-term decline in natural gas rigs due to low prices. WMB noted on its call that many of its larger producer customers are well hedged, supporting gas production volumes. WMB also pointed to ongoing growth in areas of the Marcellus and Utica with condensate and rich gas (i.e. gas that includes more NGLs), while MPLX (MPLX) also highlighted a shift towards rich gas basins. Year-to-date through May 5, the US natural gas rig count was up one rig, according to Baker Hughes.

Last week, TRGP indicated that activity levels remain strong for both public and private producers across its systems. On ONEOK’s (OKE) call Wednesday, Bakken rigs were characterized as sticky, and management noted that producers are generating “a tremendous amount of cash flow” even at current commodity prices. Crestwood Equity Partners (CEQP) connected 70 new wells to their gathering assets in 1Q23 ahead of their internal forecasts and expect to add another 190 wells at the midpoint by year end. Considering WTI oil prices were above $80 per barrel as recently as April 18, producers are not going to suddenly change their plans after one bad week for oil prices, but natural gas producers are likely recalibrating to ongoing low prices.

Bottom Line: Midstream continues to execute well, providing attractive income and defensive energy exposure.

A constructive midstream earnings season was unfortunately easily lost among last week’s macro headlines. Importantly, midstream held up better than broader energy last week consistent with its defensive nature. The Alerian MLP Infrastructure Index (AMZI) and Alerian Midstream Energy Select Index (AMEI) fell just -3.3% and -2.2%, respectively, on a price-return basis compared to the -5.7% loss for the Energy Select Sector Index (IXE). Meanwhile, oilfield services and exploration and production indexes saw similar losses to the IXE as US oil prices fell -7.1% and natural gas prices fell -11.3%. Midstream’s fee-based business mode typically results in more resilient performance in periods of market volatility like we saw last week.

Admittedly, a recession could lead to more pain for energy stocks, including potentially midstream despite its defensive qualities. Cautious investors may tilt their energy exposure toward MLPs/midstream to reduce commodity price exposure. On the other hand, investors that see the recent macro volatility as temporary may be inclined to use price weakness as a buying opportunity as MLP/midstream yields remain attractive and underlying dividend trends remain strong as will be discussed next week.

Related Research:

An Examination of Improved MLP Distribution Coverage

The Fastest-Growing Hydrocarbon You Haven’t Heard Of

For more news, information, and analysis, visit the Energy Infrastructure Channel.

AMZI is the underlying index for the Alerian MLP ETF (AMLP) and the ETRACS Alerian MLP Infrastructure Index ETN Series B (MLPB). AMEI is the underlying index for the Alerian Energy Infrastructure ETF (ENFR) and the ALPS Alerian Energy Infrastructure Portfolio Variable Insurance Trust (ALEFX). CEFX is the underlying index for the Invesco CEF Income Composite ETF (PCEF) and the ETRACS 1.5x Leveraged Closed-End Fund ETN (CEFD).

vettafi.com is owned by VettaFi LLC (“VettaFi”). VettaFi is the index provider for AMLP, MLPB, PCEF, and CEFD, for which it receives an index licensing fee. However, AMLP, MLPB, PCEF, and CEFD are not issued, sponsored, endorsed, or sold by VettaFi. VettaFi has no obligation or liability in connection with the issuance, administration, marketing, or trading of AMLP, MLPB, PCEF, and CEFD.