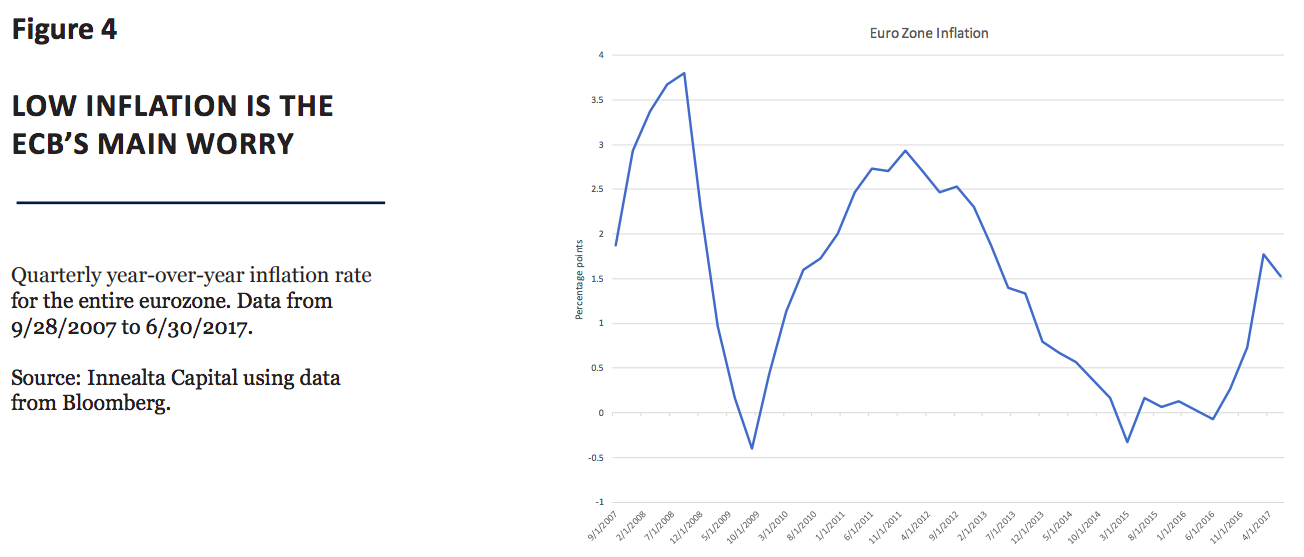

Thus, by scaling back its QE program, the bank recovers a valuable instrument for future action. Most likely, the main factor driving the decision to continue the program is inflation, which is still below the target.

On top of this, GDP growth is not yet satisfying, making the ECB’s case for continued asset purchases stronger.

Paradoxically, Mr Draghi’s announcement, even if it only pertained to a future reassessment of the QE program with no further commitments, was enough to help the euro soar against the dollar.

Besides making imports cheaper – hence putting further downward pressure on inflation –, exports are threatened by such a strong euro, which in turn hurts GDP. Exports by eurozone countries outside the EU have not been growing, a phenomenon observed even before the euro’s recent surge.

The latter will specifically impact multinational companies (many included in the pan-European Stoxx Europe 600 Index) – and hence governments via lower tax revenues. In the end, regardless of what European monetary authorities may wish, it seems that the strong euro is justified for now.

If we look at the trade balance of the EU and the eurozone, we see a strong surplus (see figure 5).

Additionally, internal demand has gotten stronger and the political menace represented by populist movements has subsided. Abroad, the U.S. is not doing much to prop up the dollar, including the passage of reforms that would strengthen its economy – and, therefore, its currency.

The recent volatility around the euro/dollar exchange rate represents, as always, an investment opportunity across a broad set of assets. Innealta’s quantitative analysts are closely monitoring the key variables that determine exchange rate movements, as well as any news developments that may impact its value.

This article was written by Innealta Capital, a participant in the ETF Strategist Channel.

Important information

The information provided comes from independent sources believed reliable, but accuracy is not guaranteed and has not been independently verified. This presentation includes opinions of Innealta Capital (Innealta), a division of AFAM Capital, Inc., and the performance results of such recommendations are subject to risks and uncertainties. All opinions and views constitute our judgments as of the date of writing and are subject to change at any time without notice. This material is not intended as and should not be used to provide investment advice and is not an offer to sell a security, or a solicitation, or an offer, or a recommendation, to buy a security. Investors should consult with an investment advisor to determine appropriate investment vehicles. Investment decisions should be made based on the investor’s specific financial needs and objectives, goals, time horizon and risk tolerance. Any investment is subject to risk. Exchange traded funds (ETFs) are subject to risks similar to those of stocks, such as market risk. The value of an investment and the return on invested capital will fluctuate over time and, when sold or redeemed, may be worth less than its original cost. Country/Regional risk is the chance that world events such as political upheaval or natural disaster will adversely affect the value of securities issued by companies in foreign countries or regions. Country/Regional risk is especially high in emerging markets. Emerging markets risk is defined as the chance that stocks of companies located in emerging markets will be substantially more volatile, and substantially less liquid, than the stocks of companies located in more economically developed foreign markets It is not possible to invest directly in an index. AFAM Capital, Inc. is a registered investment adviser. Al Frank Asset Management and Innealta Capital are divisions of AFAM Capital. AFAM is the investment advisor to individually managed client accounts and certain mutual funds. For more information, please visit afamcapital.com. Registration as an investment advisor does not imply any certain level of skill or training. Innealta is an asset manager specializing in the active management of portfolios of ETFs. Contact your financial advisor for additional information. 300-AFAM-10/2/2017