It’s been the year of active equity ETFs, the year of covered call ETFs, and a year when growth and quality has mattered most in the equity market. All of this is now clear from the year-to-date net inflows and fund performance records. However, based on advisor sentiment shared with VettaFi throughout the year, a lot of this could be seen coming.

VettaFi hosted approximately 230 virtual events with more than 6,000 advisors in 2023. To us, there are tremendous insights to be gleaned from listening to financial professionals with their fingers on the pulse. On a weekly basis, VettaFi publishes a “Chart of the Week” showcasing some of this data. Here’s a few examples.

Advisors Embraced Active ETFs

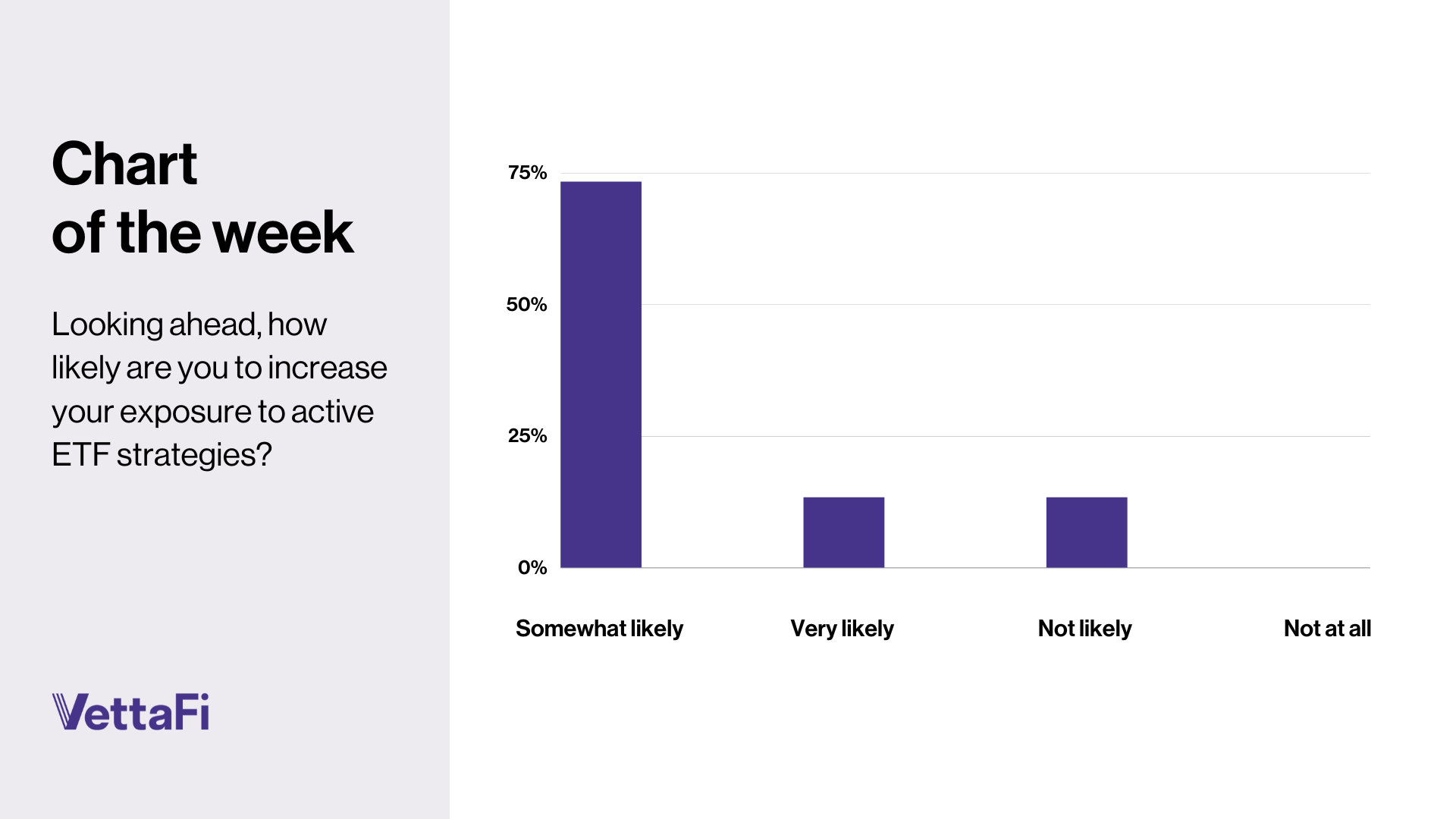

In late February 2023, VettaFi and T. Rowe Price hosted a webcast during which we asked, “Looking ahead, how likely are you to increase your exposure to active ETF strategies?” A combined 87% of the respondents said they were either somewhat or very likely, with the remainder not likely to do so.

See related: “Advisors Plan to Use Active ETFs More in 2023”

This proved to be true, as active ETFs gathered $97 billion in the first 11 months of 2023. The cash haul represented 21% of the net inflows. This compares to active ETFs consisting of just a 6% share of the overall asset base.

Covered Call ETFs in Demand

Equity ETFs captured 71% of the active ETF net inflows. Some of the demand for active was for options-based equity income ETFs. The JPMorgan Equity Premium Income ETF (JEPI) added $13 billion. Its more growth-oriented sibling, the JPMorgan Nasdaq Equity Premium Income ETF (JEPQ) pulled in $6.1 billion. Other peer ETFs to see net inflows were Amplify CWP Enhanced Dividend Income ETF (DIVO) and the NEOS S&P High Income ETF (SPYI). We also saw new alternative income products from BlackRock, Goldman Sachs, and Morgan Stanley.

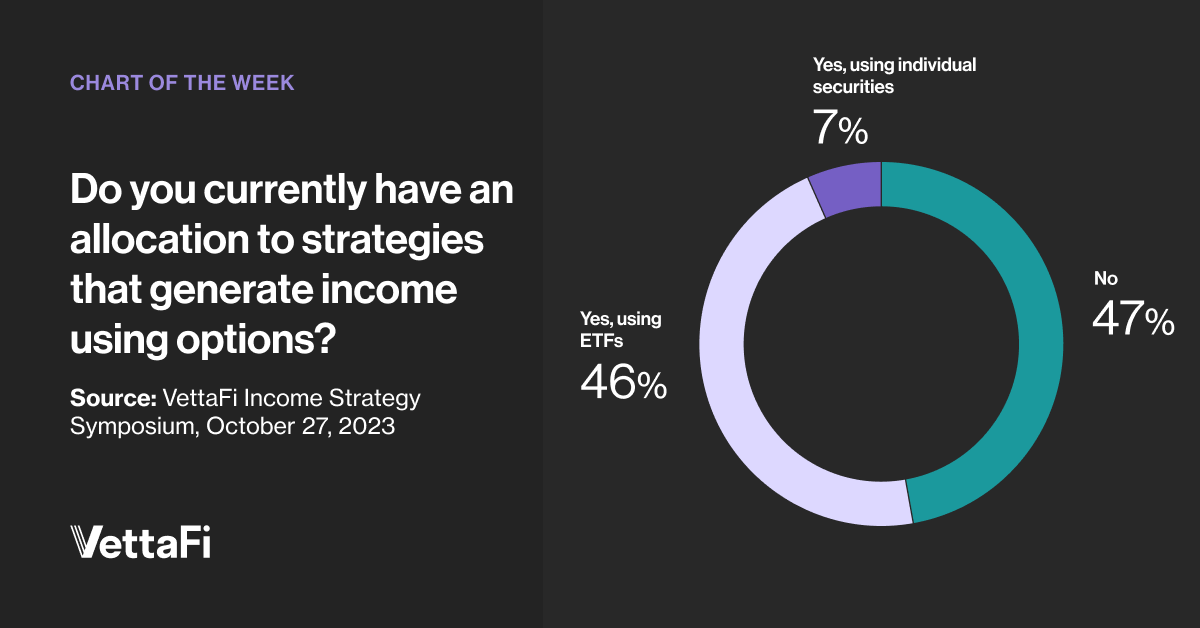

Given the growing supply. VettaFi asked a simple question to attendees during the Income Strategy Symposium in October. “Do you currently have an allocation to strategies that generate income using options?” While 47% of respondents said no, this was closely followed by the 46% that said yes, using ETFs. Approximately 7% said yes, using individual securities.

See related: “Alternative Income ETF Comfort“

Growth and Quality Performing Well

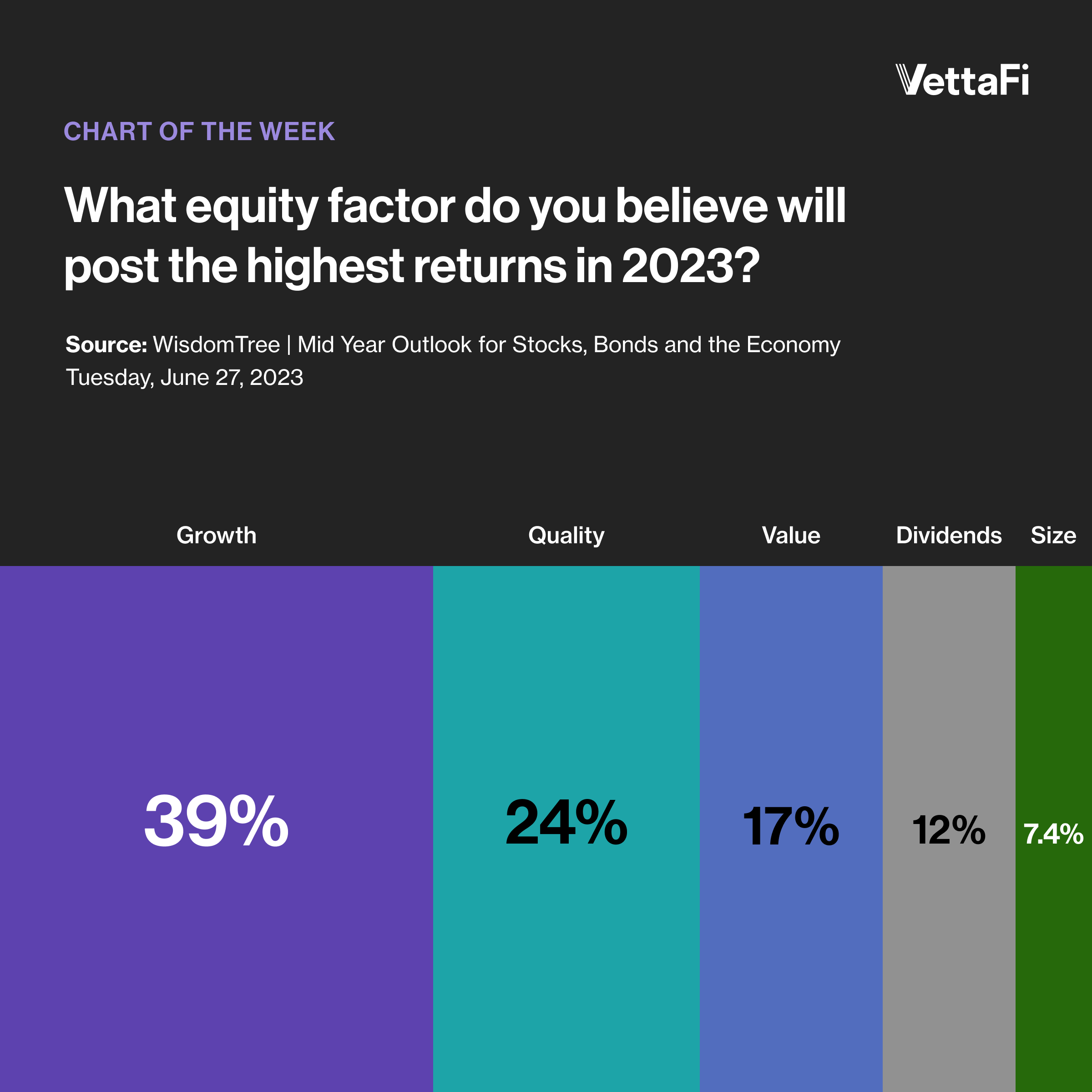

The S&P 500 Index was up 21% in the first 11 months of 2023. There are many ETFs that track factor slices of this broad market. Many investors likely realize that the iShares S&P 500 Growth ETF (IVW) was a rare one to outperform ,as growth stocks had an excellent start to the year. Indeed, IVW was up 25%. However, the Invesco S&P 500 Quality ETF (SPHQ) also climbed 19% and aided meaningful gains in November, as companies with strong balance sheets and consistent earnings performed well.

In late June, during a webcast with WisdomTree, VettaFi took the pulse of the advisor community. 39% of advisors polled told VettaFi that they expected growth to post the highest returns in 2023. Quality (24%) was the second most selected factor.

See related: Quality Growth Coming into Focus

Financials in Focus

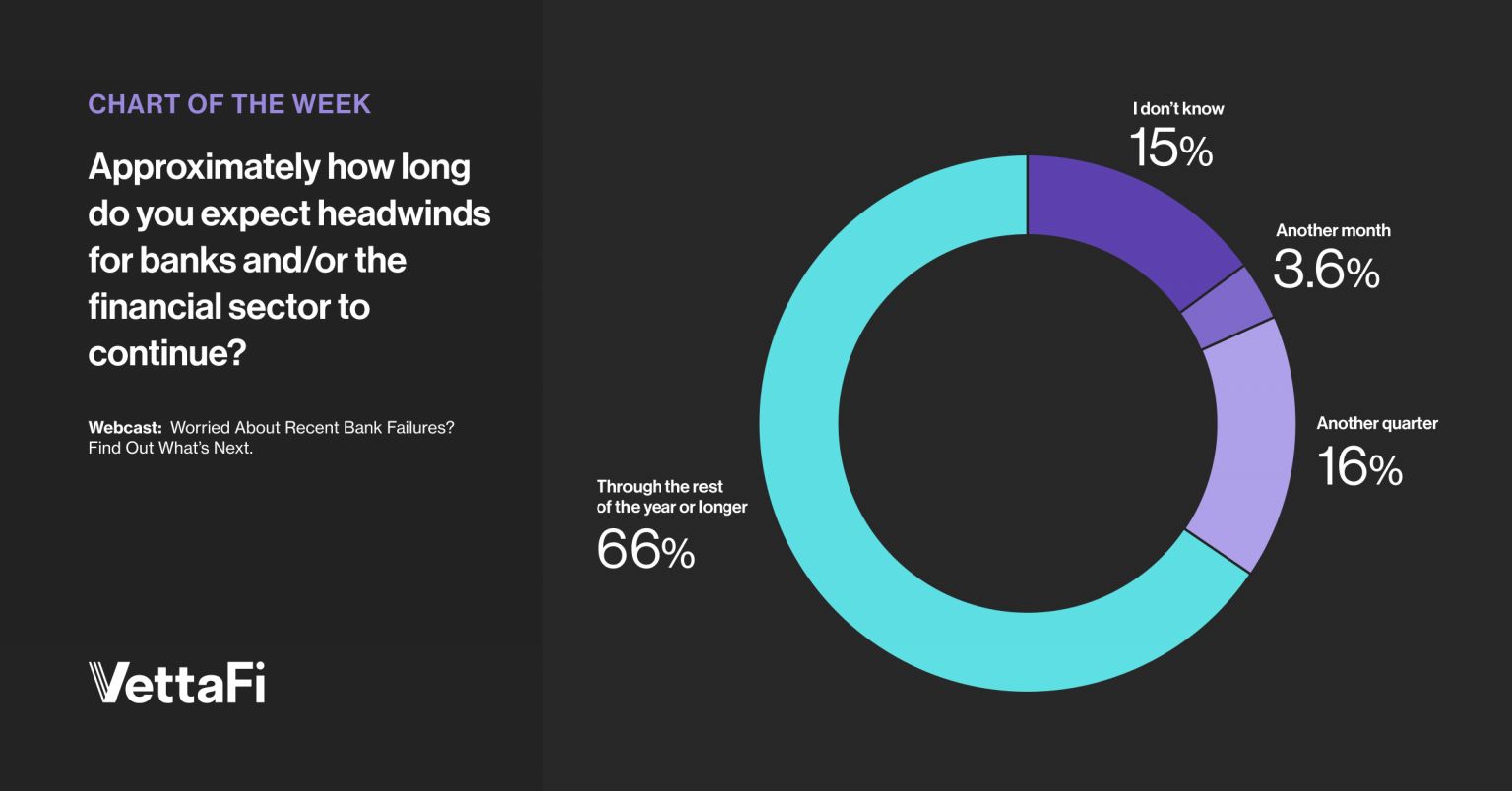

It may seem like years ago, but the failure of regional banks – Signature Bank and Silicon Valley Bank — occurred in the first quarter of 2023. However, it remained a concern for many advisors as the year progressed.

VettaFi hosted a webcast with ProShares in late May. We asked “Approximately how long do you expect headwinds for banks and/or the financial sector to continue?” Nearly two thirds (66%) answered, “through the rest of the year or longer,” while 16% believed that headwinds will be over in another quarter.

The Financial Select Sector SPSR (XLF) was up just 6.4% year-to-date through November, underperforming the S&P 500 Index. Yet, in the last three months, the financial ETF was up 4.6%. This recent gain beat the broader benchmark’s gain of just 1.7%.

See related: Are Financials in Your ETF?

Exchange Conference to Dive Into More Than ETFs

I was recently looking over the agenda for Exchange, the advisor conference taking place between February 11-14. The letters E, T, and F play a key role in the VettaFi name and two of our websites (ETF Trends and ETF Database). However, Exchange will be much more than a discussion about ETFs. Advisors are not solely focused on ETFs.

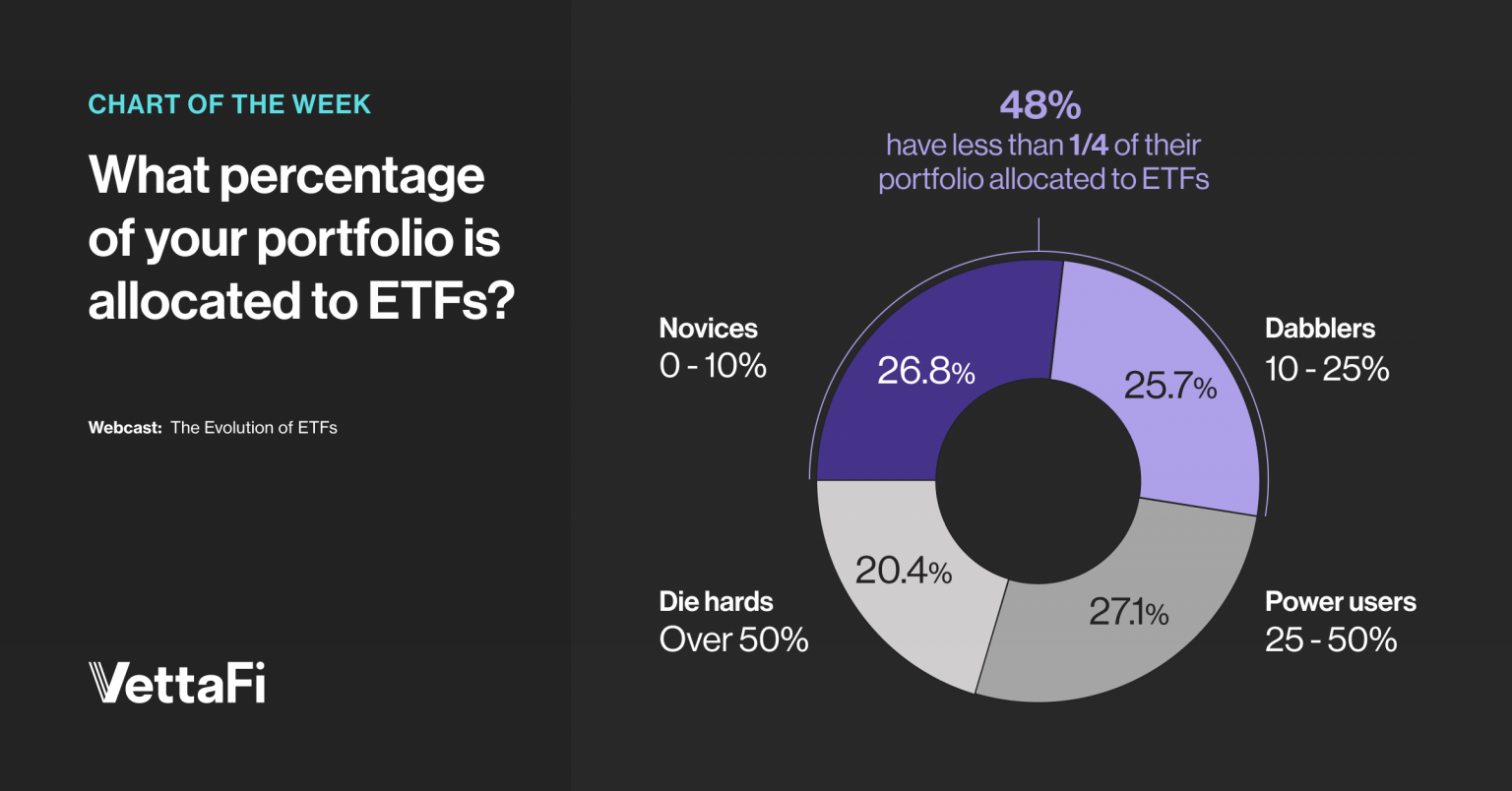

During a June webcast with Dimensional Funds focused on ETFs, we asked advisors: “What percentage of your portfolio is allocated to ETFs?” Only 20% of respondents were ETF die-hards with more than half of assets invested in ETFs. Meanwhile, 48% were either dabblers (between 10% and 25% allocated to ETFs) or novices (less than 10%).

See related: Pairing ETFs with Other Investments

This is why I’m excited to be leading a two-hour Study Hall on Sunday afternoon at Exchange. For those that want to get up to speed, we will be providing ETF due diligence and answers on how to build portfolios using ETFs.

In addition, there will be ethics training; investment experts like Jeremy Grantham, Jeff Gundlach, Dr. David Kelly; a workshop with Carson Coaching; and sessions focused on supporting family offices and building multigenerational practices. I can’t wait to see you at Exchange.

For more news, information, and analysis, visit VettaFi | ETF Trends.