Aided by a hot start, growth stocks led the broader market in the first half of 2023. However, many advisors believe other equity factors will be stronger in the second half.

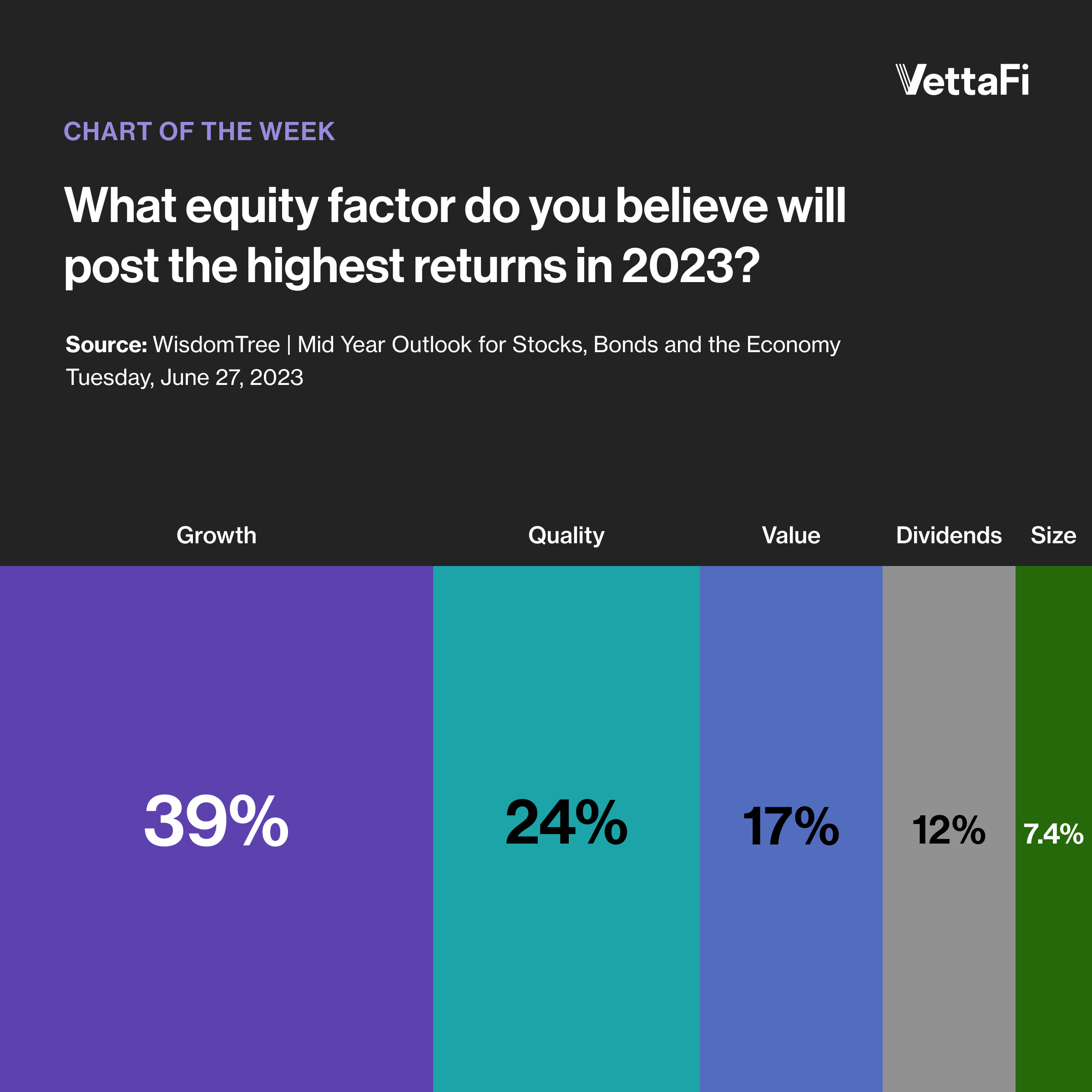

In late June, during a webcast with WisdomTree, VettaFi took the pulse of the advisor community. Only 39% of advisors polled told VettaFi that they expected growth to post the highest returns in 2023.

In the first six months, the iShares Russell 1000 Growth ETF (IWF) was up 27%. This return was more than 1,000 basis points higher than that of the iShares Russell 1000 ETF (IWB). IWF recently had double-digit stakes in Apple and Microsoft, with 4% in Amazon.com and NVIDIA. Information technology represented 43% of the ETF’s assets.

Nonetheless, advisors were looking to other factors. Quality (24%) and value (17%) approaches were chosen most, followed by dividends (12%) and size (7.4%). Given the range of opinions, we wanted to highlight ETFs that combine some of these investment strategies. We previously covered ETFs that pair quality with the value factor. But this time, let’s focus on quality and growth.

QGRO Has Been in Demand in 2023

The American Century US Quality Growth ETF (QGRO) has more than $600 million of assets, due in part to strong net inflows of over $250 million in 2023. The ETF combines pure growth and stable growth companies using a combination of quality, value, and growth attributes. These include cash flow yield, earnings quality, leverage, profitability, and expected sales and earnings growth.

While information technology was the largest sector (35%) of assets, Fortinet and Synopsys were the top two stakes, not Apple and Microsoft. Consumer discretionary stocks like Booking Holding and Ulta Beauty were also well represented in the American Century ETF.

See more: American Century is speaking at the Fixed Income Symposium on July 24

SXQG Is an Under-the-Radar Quality Growth ETF

The 6 Meridian Quality Growth ETF (SXQG) is a smaller ETF with just $30 million in assets. The ETF emphasizes companies that exhibit high quality and growth characteristics relative to their peers. Quality to this fund is defined as high and improving profitability, low leverage and low default probability, and low net equity and debt issuance relative to dividends and net buybacks. The initial screen of companies also removes those with poor liquidity and momentum characteristics.

Information technology (30%) and healthcare (25%) were the two largest sectors. Apple (5.4%) was the largest position but was closely followed by Adobe and Intuitive Surgical. Merck and Vertex Pharmaceuticals were other recent top-10 positions.

VFLO Is a Recently Launched Quality Growth Fund

The VictoryShares Free Cash Flow ETF (VFLO) just launched in June 2023 but already has $45 million in assets. The fund’s focus on free cash flow yield might make it seem like a high-quality value ETF, but growth metrics such as forward sales, EBITDA, and earnings are utilized too. The fund eliminates companies where free cash flow yield is high because of weak growth prospects.

Healthcare (33% of assets) is the largest sector, followed by energy (24%) and information technology (14%). Recent top-10 holdings include AbbVie, Bristol Myers Squibb, and Qualcomm.

Many advisors are skeptical that growth can continue its strong run in the second half. ETFs incorporating other metrics like quality could be just what they are looking for.

For more news, information, and analysis, visit the Core Strategies Channel.