Large-cap growth ETFs continue to lead large-cap value ones in 2023. Through May 16, the iShares Russell 1000 Growth ETF (IWF) was up 16%, beating the iShares Russell 1000 Value ETF (IWD) by 1,700 basis points year-to-date. Meanwhile, the SPDR S&P 500 Growth ETF (SPYG) was up 11%, outperforming the SPDR S&P 500 Value ETF (SPYV) by 700 basis points over the same period.

In a prior research piece, I explored the reasons behind the performance difference of Russell- and S&P-based index products this year. The short version: Index providers disagree on whether stocks like Amazon (AMZN), Exxon Mobil (XOM), or Microsoft (MSFT) should be classified as growth stocks, value stocks, or both.

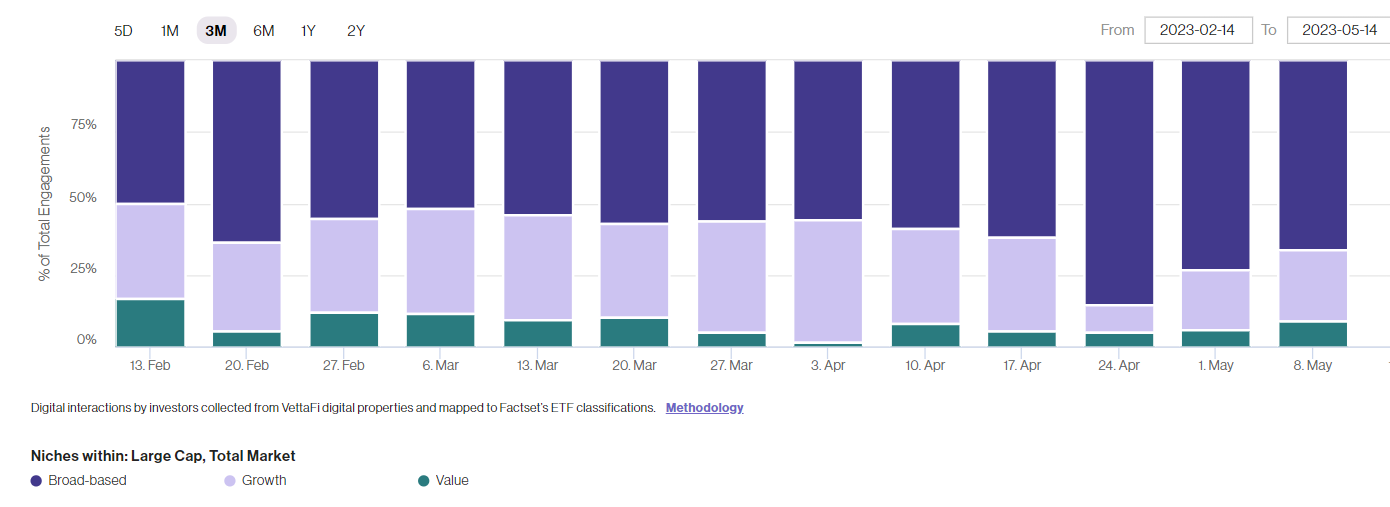

However, this relatively strong performance difference between growth and value has likely been the reason research into growth straetgies has been increasing recently across VettaFi’s platforms.

Growth ETF Engagement Stronger Than Value

Our Explorer data tool shows advisor research into both large-cap and total market growth ETFs (light purple) has been significantly higher than value ETFs (green) over the last three months. (However, growth strategies remain less popular than broad market products.)

Over the past three months, growth strategies have seen more research on VettaFi than value strategies.

However, if performance is what investors are looking for, then it’s worth pointing out that some active ETFs from well-established managers have been performing even better than the index ETFs, easily justifying their premium. Yet many active growth ETFs remain under the radar.

I step through some of these hidden gems below:

T. Rowe Price: Strong Performance For Its Active ETFs

The T. Rowe Price Growth Stock ETF (TGRW) was up 21% to start 2023, but it has flown under the radar. This active equity ETF has just $42 million in assets.

TGRW invests in growth stocks with one or more of the following characteristics: strong cash flow and above-average earnings growth; the ability to sustain earnings momentum in economic downturns; and occupation of a niche in the economy and the ability to expand during times of slow economic growth.

T Rowe Price launched its first ETFs, including TGRW, in August 2020, and recently crossed the $1 billion asset milestone. TGRW is run by Joseph Faith, who has managed the growth strategy since 2014. (The ETF launched in August 2020, but his management history also includes the $47 billion T. Rowe Price Growth Stock Fund (PRGFX).)

Compared to the mutual fund, TGRW offers an alternative for investors who prefer the ETF structure for tax efficiency and cost reasons. The strategy recently had 42% of its assets invested in information technology stocks. Its top three stakes were Apple (AAPL), Intuit (INTU), and Microsoft,

TGRW has a 0.52% expense ratio.

Growth Stalwarts Fidelity, Harbor Capital Now Offer ETFs

Meanwhile, the $150 million Fidelity Growth Opportunities ETF (FGRO) was up 18% year to date. FGRO invests in companies Fidelity believes have above-average growth potential. Management uses fundamental analysis of factors, such as each issuer’s financial condition and industry position, in order to select investments. They also take into account market and economic conditions.

FGRO is lead managed by Kyle Weaver, who has also managed the Fidelity Advisor Growth Opportunities Fund (FAGAX), a $15 billion mutual fund, for more than seven years. Like TGRW, FGRO is a separate product from FAGAX but is constructed similarly.

FGRO also recently had a high (43%) stake in information technology stocks. Its top three include Advanced Micro Devices (AMD), Apple, and Microsoft. FGRO has a 0.59% expense ratio.

Another strong performing active large cap growth ETF is the $120 million Harbor Long Term Growers ETF (WINN), up 24% so far in 2023.

Though the ETF has just over a year of history, Harbor and its sub-advisor Jennison Associates has a long-term relationship through separately managed accounts and mutual funds. For example, the Jennision growth equity team managing WINN also runs the nearly 40-year old and $14 billion Harbor Capital Appreciation Fund (HACAX). However, WINN is not a clone of HACAX and has some additional growth stocks inside.

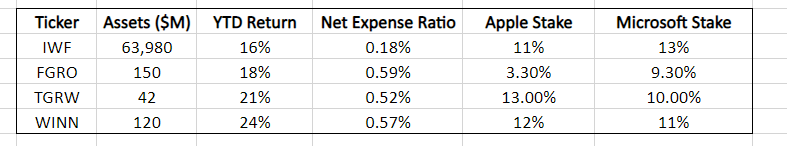

Key Stats of Growth ETFs

All three ETFs recently owned Apple and Microsoft in their top stocks, but their weightings were different.

TGRW and WINN recently had 13% and 11% stakes positions in Microsoft, respectively, and 10% and 12% allocations to Apple. In contrast, FGRO had a 9.3% stake in Microsoft, but a more modest 3.3% position in Apple.

Compare that to the index-based IWF, which, at 13% of assets, had its largest position in Microsoft. Its second largest (11%), was in Apple.

Perhaps that subtle weightings shift made the difference: IWF also has had the lowest YTD return of the four ETFs compared.

Benefits of Active ETFs: Real-Time Expertise

One of the benefits of active ETFs is the ability to real-time tap into management’s efforts to identify which companies are best positioned for growth. They can do this without having to follow reclassifications by index providers.

Managers can also use their discretion to buy or sell stocks at any time when the fundamentals or valuation metrics shift. This usually includes limited capital gain implications.

In the last three years some established growth strategies became available as ETFs. As more investors discover these ETFs, they are likely to appreciate what’s inside.

For more news, information, and analysis, visit the Active ETF Channel.