After a strong asset gathering year for actively managed ETFs in 2022, when the non-passive funds pulled in 15% share of the new money, demand has accelerated to start 2023. As of late February, active ETFs pulled in more than one-third of the year-to-date money the industry gathered. This is highly impressive, given that active ETFs still represent approximately 5% of assets. While it is reasonable to be skeptical that the pace of active flows will persist throughout the year, VettaFi recently heard from advisors who were overwhelmingly favorable toward active ETFs.

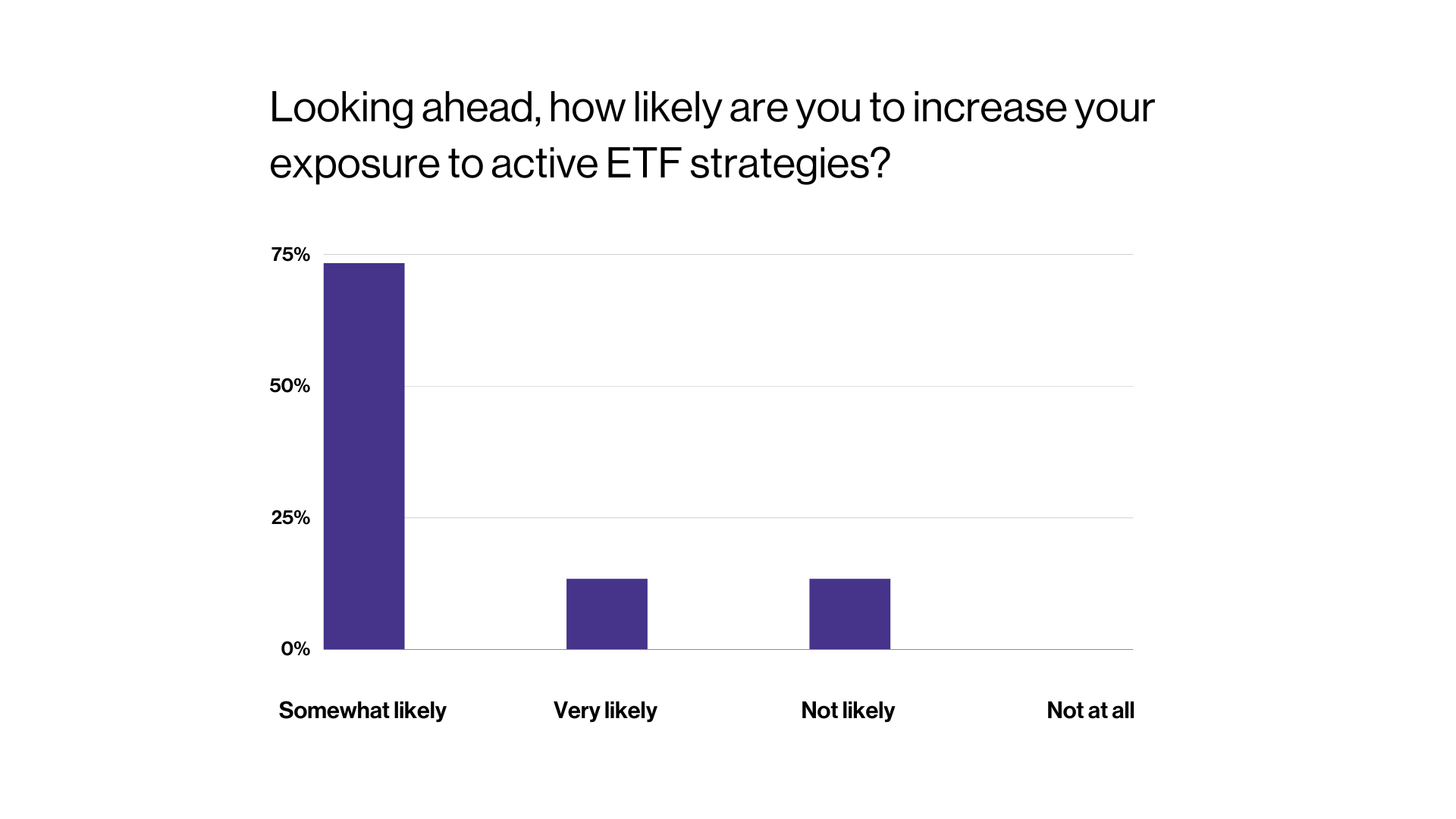

In late February, VettaFi and T. Rowe Price hosted a webcast during which we asked, “Looking ahead, how likely are you to increase your exposure to active ETF strategies?” A combined 87% of the respondents said they were either somewhat or very likely, with the remainder not likely to do so.

While there is the obvious caveat that we asked the question to a self-selected audience, as T. Rowe Price’s ETF lineup only consists of active products, the webcast was titled “Capital Market Considerations for 2023,” with discussion topics including the impact of interest rates and inflation as well as asset allocation considerations. We believe advisors have gained comfort with active ETFs after a down year for equity markets that still involved clients paying an unnecessarily high amount of capital gains.

In addition to T. Rowe Price, some of the largest active managers now offer ETFs that leverage the experienced in-house managers either through unique ETFs or converted mutual funds. This has provided advisors that want help with security selection and market timing with many more products to consider than before. Though active fixed income ETFs came to market first, and there’s more money invested in the JPMorgan Ultra Short Income ETF (JPST), let’s touch on five active equity products gaining traction.

The JPMorgan Equity Premium Income ETF (JEPI) pulled in approximately $4.0 billion in less than two months to start the year, an acceleration from the $13 billion of net inflows in 2022. We previously profiled this equity income strategy that owns lower-risk stocks like AbbVie and Hershey, boosts income, and sported an 11% yield at the end of January through covered calls. Demand has persisted even as the ETF was down fractionally in 2023, lagging the S&P 500 Index.

The Dimensional U.S. Core Equity 2 ETF (DFAC) was previously a mutual fund but converted to an ETF in June 2021 for the tax efficiency benefits. The active large-cap core equity fund pulled in more than $600 million as of late February. The fund recently held over 2,500 securities but was overweighted to financials and industrials relative to the Russell 3000 Index and underweighted to information technology and healthcare. DFAC’s 4.6% gain as of February 24 was stronger than the 4.3% for the iShares Russell 3000 ETF (IWV), even with a nearly identical expense ratio.

The Avantis U.S. Small Cap Value ETF (AVUV) gathered just under $600 million in less than two months of 2023. Adoption had been strong for the fund’s high-quality, low-valuation approach that favors stocks like Foot Locker, Ryder System, and Triton International. AVUV’s 8.2% year-to-date gain was stronger than the 6.9% for the iShares Russell 2000 Value (IWN), despite a similar fee, and AVUV has benefitted from renewed interest in small-caps. Avantis is part of asset manager American Century.

The Putnam Sustainable Leaders ETF (PLDR) launched in May 2021 and had limited assets until February 13, 2023, when it gathered $340 million. Days earlier, Putnam launched a target-date series with retirement dates between 2024 and 2065 with PLDR as a core holding. The sustainable ETF was recently overweighted to healthcare and information technology stocks relative to the S&P 500, while underweighted to energy and financials.

Interestingly, mutual fund versions of this sustainable strategy have over a 30-year track record and more than $5 billion in assets, but Putnam chose to use the relatively new and smaller ETF to support its latest client’s retirement objectives. PLDR’s 3.0% gain trailed the S&P 500 Index by approximately 60 basis points.

The Capital Group Growth ETF (CGGR) added $275 million of new money in less than two months. The large-cap growth fund invests in not just U.S. equities like Microsoft and Tesla but invests globally into companies like ASML and Canadian Natural Resources.

For more news, information, and analysis, visit the Core Strategies Channel.