When the next market rally occurs, it could help to aim for the middle when trying to maximize profit potential. That is, aim for mid-cap equities.

According to Investopedia, mid-cap equities have prospered over the course of various bull runs in the recent past. While large-cap equities can offer investors a safe haven when volatility hits, mid-cap equities have outperformed their large-cap brethren when markets are trending higher.

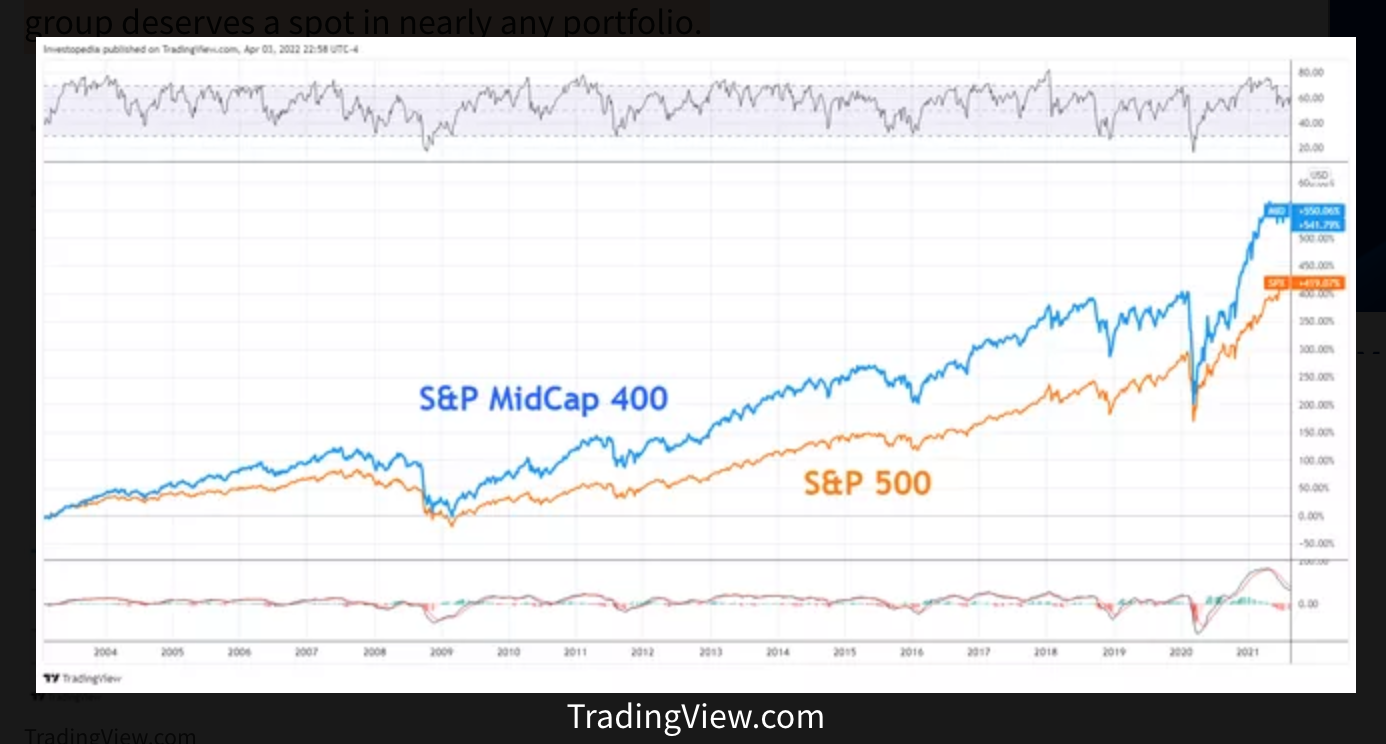

“Over the past 20 years, mid-caps have consistently outperformed their large-cap counterparts, as shown in the chart below,” wrote Casey Murphy (fact-checked by Ryan Eichler). Murphy focused on “the performance of mid-cap stocks during notable periods over the past 20 years when the markets were rising and why this relatively underfollowed group deserves a spot in nearly any portfolio.”

Given their strong performance, it’s notable that their popularity doesn’t match. Retail and institutional investors don’t have many mid-cap opportunities on their proverbial radars.

“Historically, mid-cap companies have posted strong performance relative to their more popular large-cap counterparts,” Murphy added. “According to research conducted by S&P Dow Jones Indices, mid-cap companies, as measured by the S&P 400 Mid Cap index, outperformed the S&P 500 and S&P 600 between Dec. 30, 1994, and May 31, 2019, at an annualized rate of 2.03%, and 0.92%, respectively.”

A Mid-Cap ETF to Marvel At

Traders have an opportunity to play upside in mid-cap equities with the Direxion Daily Mid Cap Bull 3X Shares (MIDU). MIDU seeks daily investment results, before fees and expenses, of 300% of the daily performance of the S&P MidCap 400 Index.

The index measures the performance of 400 mid-sized companies in the United States. With the extra leverage, MIDU is up 19% within the last three years, rebounding strongly from the height of the pandemic in 2020.

For more news, information, and strategy, visit the Leveraged & Inverse Channel.

For more news, information, and strategy, visit the Leveraged & Inverse Channel.