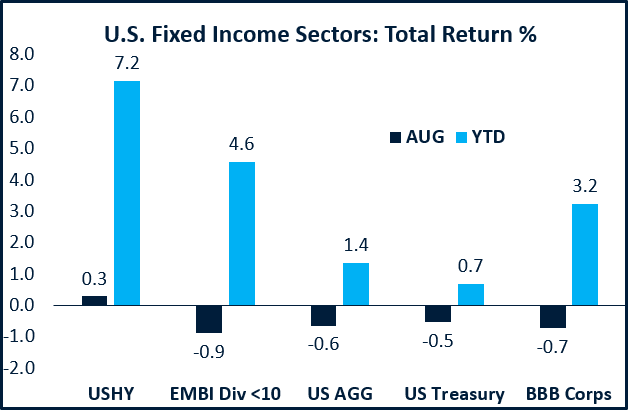

High yield continues to live up to its name. In fact, it was the only major fixed income asset class to generate positive performance in August. According to the BondBloxx Fixed Income Monthly Update, high yield returned 7.2% year-to-date as of Aug. 31. That’s well above the U.S. Aggregate Index’s return of 1.4% for the same period.

Broken down by credit rating categories, the asset class has been performing quite well so far this year. Per BondBloxx, the CCC-rated sector extended its gains in August, going up 13% YTD as of Aug. 31. Meanwhile, single-B and BB-rated bonds have generated YTD returns of 7.8% and 5.3%.

See more: “How High Yield Allocations Can Have Material Risk/Return Implications for Portfolios”

Source: ICE Data Services, JP Morgan, Bloomberg | Data as of 8/31/2023

BondBloxx has three ratings-specific high-yield bond ETFs, which can serve as good entry points into the sector, depending on an investor’s risk tolerance.

The BondBloxx BB-Rated USD High Yield Corporate Bond ETF (XBB) seeks to invest in bonds rated BB1 through BB3. XBB has the lowest default risk in, with an average default rate of 1%, according to Moody’s. Meanwhile, the BondBloxx B-Rated USD High Yield Corporate Bond ETF (XB) seeks to invest in bonds rated B1 through B3. Finally, the BondBloxx CCC-Rated USD High Yield Corporate Bond ETF (XCCC) seeks to invest in bonds rated CCC1 through CCC3.

Precision ETF Exposure for Fixed Income Investors

BondBloxx launched in October 2021 to provide precision ETF exposure for fixed income investors. Its first funds — a suite of seven sector-specific high-yield bond funds — were launched in February 2022. Today, BondBloxx offers 19 ETFs that span U.S. Treasuries, industry- and credit rating-specific high-yield bonds, and emerging markets bonds. The firm exceeded $2 billion in assets under management in early August.

VettaFi’s head of research Todd Rosenbluth called BondBloxx “one of the more innovative providers of fixed income ETFs.”

“They offer advisors and investors the opportunity to target duration with risk-off government bonds,” Rosenbluth said. “In addition, they have a suite of credit quality focused high yield ETFs for those willing to take on additional risk for higher rewards.”

For more news, information, and analysis, visit the Institutional Income Strategies Channel.