Bull vs. Bear is a weekly feature where the VettaFi writers’ room takes opposite sides for a debate on controversial stocks, strategies, or market ideas — with plenty of discussion of ETF ideas to play either angle. For this edition of Bull vs. Bear, James Comtois and Nick Peters-Golden discussed whether or not the time is now to add duration to fixed income.

James Comtois, staff writer, VettaFi: Ahoy, Nick! It’s good to be back in the Bull Vs. Bear arena to discuss long-duration bond ETFs. And I have to say, I’m quite bullish on these funds. After an historically bad year for fixed income, investors have more confidence going further out on the duration curve.

And who can blame them? After all, as many people are saying these days, bonds are back because yields are back. The yield on the 10-year Treasury note was 4.208% as of Aug. 28. That’s up from the almost 3.9% they were yielding at the start of the year, and well above the 3.11% from a year ago. So, I think now may be the time for investors to add duration to their portfolios.

But what say you, Nick? Is now the time for long duration to shine? Or should fixed income investors keep things short and sweet for the time being?

Nick Peters-Golden, staff writer, VettaFi: Hello there, James! Yes, it feels great to be back in the saddle. I’m excited to get into this topic, as it’s a big one on the minds of a lot of investors right now. However, with every headline I see, I can’t help but think that it is still just a tad too soon to start adding duration. The Fed has shown a steel will so far in trying to tame inflation, and the conditions are not yet ripe for adding more duration risk to portfolios with short-term options perhaps more appealing.

Riding Economic Tailwinds

Comtois: Oh, I understand the apprehension. After all, long-duration bonds arguably triggered the collapse of Silicon Valley Bank and led to what VettaFi’s own financial futurist called the world’s most boring banking crisis. But that banking crisis, like many other economic crises, appears to have been contained.

In fact, the economy is seeing many tailwinds that the asset class is enjoying. The debt ceiling fight is also in the rearview mirror. Inflation is way down from its peak of 9% last year. Plus, the probability of a recession occurring this year has dropped considerably. All of these factors make long-duration funds far less risky than they were only a few months ago. Provided, of course, you still have some short- and medium-duration bonds in your portfolio.

Eyeing the Fundamentals

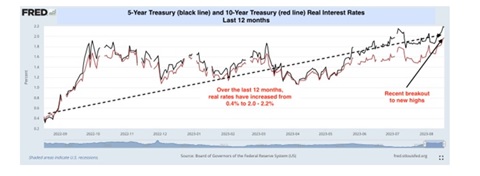

Peters-Golden: Let’s get down to the fundamentals here, to start with. First off, longer-dated U.S. Treasuries are still struggling according to DataTrek Research. Investors holding anything longer than debt with five year maturities are down over the last twelve months on a total return basis.

That, per the good folks at DataTrek, owes less to inflation expectations than to where real interest rates are. Investors calculate the real interest rate by taking the nominal interest rate and subtracting the inflation rate. Based on their analysis, real rates have risen by about 1.7 percentage points over the last year. That has “more than offset” the decline in expected inflation which has also contributed to the dip in Treasury prices.

The U.S. economy’s continued resilience as well as the Fed’s balance sheet reduction, DataTrek suggests, may likely continue to keep real rates high. Taking that together, the underlying data looks to be arguing “against” getting into long term Treasuries right now. Instead, the folks at DataTrek are urging their clients to overweight “shorter-maturity” debt.

Meanwhile, let’s consider what we can actually currently get from investment grade corporate bonds. The Moody’s Seasoned AAA Corporate Bond Yield sits at nearly 5% according to YCharts. It recently peaked for the year but hit a higher point last year. That’s a high yield but riskier than offerings that I’ll get into later with even higher yields. Is it time to add duration? The data isn’t all in favor — it’s probably better to hold off right now.

The End Is Nigh

Comtois: I can understand the desire to hold off on adding duration. But holding off could cause investors to miss out on a good opportunity. Which brings me to my next point: We may be nearing the end of the Fed rate hike cycle.

Thanks to the rise in rates, bonds are more attractive than they’ve been in well over a decade. But if we are indeed approaching the end of the U.S. central bank’s quantitative tightening, yields may peak. And should rates fall, investors can lock in these strong yields with longer-term bonds.

Since long-term bonds have historically outperformed post Fed hiking cycles, investors may want to go further toward the longer end of the yield curve. According to Alexandra Lawson, client portfolio manager, fixed income at Goldman Sachs Asset Management, extending duration can achieve stickier yields and provide investors with a more durable source of cash flow.

So, for investors looking to add duration to their portfolios, BondBloxx offers eight duration-specific U.S. Treasury ETFs that seek to offer exposure to Treasuries in durations ranging from six months to 20 years.

Is the Rate Hike Cycle Actually Over?

Peters-Golden: So much of the case for adding duration to investors’ portfolios relies on the idea that the rate cycle has already ended. I don’t think we’re actually there yet. You can see it in the nearly manic coverage of Federal Reserve Chair Jerome Powell’s remarks in Jackson Hole last week. Market watchers are still reading between the lines in his remarks like Beatles listeners playing records backwards for secret messages. The Fed’s goal is to keep us all on edge, and they’re achieving that goal so far.

Seriously, though, we have some way to go before meeting the Fed’s 2% inflation target. In some ways, market watchers’ desire to read between the lines of Powell’s speech comes from avoiding his actual message: We’re not close to hitting a 2% inflation target. Dread it, run from it, but the next 25 bps hike will come all the same. Yes, we might see a pause in September, but the Fed is not satisfied by a 3.2% inflation rate.

Taken together, that tells me we’re still too soon in looking to add duration. Market watchers may anticipate maybe one more rate hikes, but earlier in 2023 talking heads were discussing cuts possibly happening this year. The market itself had even priced cuts in as part of a much-ballyhooed recession that never materialized.

Should we see more than one additional rate hike, a lot of investors already diving into duration will feel the pinch. If we’re just reading into Powell’s messaging alone for this bear point, we’ve received almost no indication that the Fed will stop raising rates. To some extent that beggars belief because of the sheer pace of hikes, but at the same time, it really is their only tool. As the economy stubbornly pushes forward (though yes, it may be losing some steam), I think we’re on track for more hikes, or at least a long period of “potential” hikes.

That makes locking into a longer rate 10-year investment grade offering a questionable choice right now. Some might urge investors to worry about missing the boat on this one, but there is time. Meanwhile, there are some other intriguing strategies that may be a better option right now that I’ll get to next.

There’s Risk and Then There’s “Risk”

Comtois: While I eagerly wait to hear about these better options, I should point out that, when discussing fixed income of any type, risk is a matter of degree. Treasuries are by far the least risky investment there is. Even if you extend the duration, we’re talking about something that’s quite possibly the safest investment someone can make.

And as I mentioned above, now that the drama over the debt ceiling is over and done with, long duration Treasuries are a pretty safe bet.

However, for investors still a bit apprehensive, they could split the difference with the BondBloxx Bloomberg Seven Year Target Duration US Treasury ETF (XSVN), which invests in a portfolio of U.S. Treasury securities with a target duration of seven years.

Alternative Options to Adding Duration

Peters-Golden: Fixed income is back in 2023, yes, but fixed income itself is such a diverse space. Investors have more options than just your standard corporate or government bonds. Though perhaps not as innovative as equity products, let alone so-called liquid alts, short term debt securities can be really interesting. Specifically, I’m thinking about so-called floating rate notes (FRNs).

Floating rate notes, the most recent product innovation from the Treasury, offer a flexible short- and even medium-term option for investors right now. Introduced in 2013, FRNs “float,” or allow their interest payments to change over time. If rates rise, so too do FRNs’ payments. The FRNs index themselves to the 13-week Treasury bill auction high rate. FRNs see rising demand when investors expect rates to rise – and as I discussed above, I think we’re in for at least one more rate hike.

While FRNs aren’t necessarily yielding a ton on their own, the WisdomTree Floating Rate Treasury Fund (USFR), which invests in FRNs, offers a 5.4% distribution yield and a 5.5% average yield to maturity. USFR has returned 4.2% over the last year, too, compared to -2.6% returns for its ETF Database Category Average.

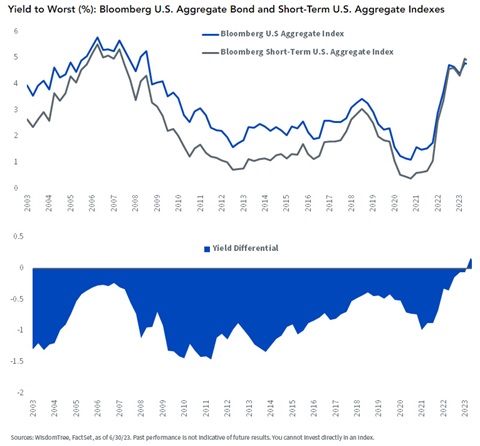

Let’s look even broader than that, however, at other short-term debt security options. Income is back in fixed income and as such, it doesn’t have to just provide ballast. You can still get really potent yields that match or even surpass longer duration products. Check out this graph from WisdomTree, for example:

We can see there’s little reason to add significant duration when short-term aggregate bonds are matching up pretty well. That doesn’t mean not including duration eventually. Heck, responsible portfolio managers, advisors, and investors would diversify their fixed income exposure to have some already.

Comtois: Well, as always, Nick, you’ve given me plenty to think about. And yes, I will heartily agree that it’s important to diversify one’s bond portfolio. But with fixed income yields high and the economy in better shape than previously forecast, long-duration funds can give investors the chance to lock in high yields before rates decline. And again, Treasuries are the safest category, or one of the safest fixed income investments, there is out there. So, investors should look into adding some duration to their portfolios.

Until next time, Nick! Or should I say, so long…?

Peters-Golden: Let’s make our parting a “short” one — and get back together soon to see who’s right.

For more news, information, and analysis, visit the Innovative ETFs Channel.