Fixed income ETFs continue to gain in popularity, but not all investors are taking the same approach. For all of them, though, it is important to think about what advantages ETFs offer to client portfolios.

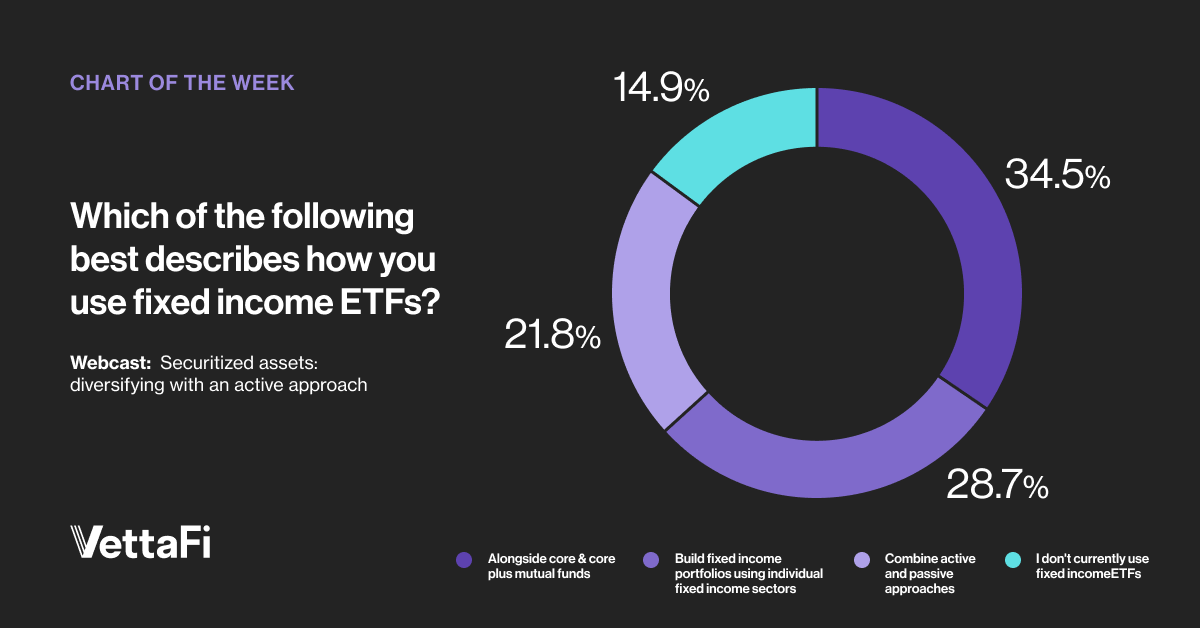

During a late June webcast with John Hancock, VettaFi asked advisors to best describe how they used fixed income ETFs. Let’s leave aside for now the 22% of the respondents who were not using fixed income ETFs but attended the webcast to gain education. There are many use cases.

Just over one-third of respondents (35%) were using ETFs alongside core and core plus mutual funds. Meanwhile, just under one third (29%) were combining active and passive approaches. The remainder (15%) were building fixed income portfolios using individual fixed income sectors. Let’s explore each of these in order of preference.

Advisors Use Fixed Income in Many Ways

Using Fixed Income ETFs with Core Mutual Funds

The Bond Fund of America (ABNFX) is one of the most widely held bond mutual funds. The $78 billion intermediate core bond fund earns a four-star rating from Morningstar. The fund invests in mostly AAA-rated government and agency bonds with some exposure to primarily investment-grade corporate bonds. The fund’s recent duration was 6.4 years and ABNDX sported a 3.4% 30-day SEC yield.

Some advisors might want to boost income using high-yield ETFs. For example, the iShares Broad USD High Yield Corporate Bond ETF (USHY) offers an 8.6% 30-day SEC yield. USHY invests in primarily BB- and B-rated corporate bonds. The ETF is competitively priced with a 0.15% expense ratio.

Other advisors might want to shorten the interest-rate sensitivity using ETFs, given the likelihood for still higher interest rates. They might turn to short-term investment grade bond ETFs. The Vanguard Short-Term Corporate Bond ETF (VCSH) has an average duration of 2.7 years and sports a 5.3% yield. VCSH’s exposure to A- and BBB-rated bonds would keep the credit profile high.

Combining Active and Passive Fixed Income ETFs

Some advisors are using both active and passive ETFs together. A passive ETF like the Vanguard Total Bond Market ETF (BND) can serve as a core of the portfolio. BND tracks an investment-grade index with a mix of government and corporate bonds. The ETF’s fee of 0.03% makes it a good starting point for advisors. However, some advisors might want to use active ETFs to shorten duration or boost income.

The JPMorgan Ultra-Short Income ETF (JPST) sports a 5.0% yield and has duration of less than one year. JPST benefits from an experienced management team, led by James McNerny, to choose the exposure. The fund recently had 33% invested in investment-grade corporate bonds and 27% in commercial paper, with just 4% in Treasuries.

Building Fixed Income Portfolios Using Individual Fixed Income Sectors

For those advisors turning to ETFs to build portfolios to meet clients’ risk and reward objectives, the good news is there are lots of tools available. Many of them have come out in the last few years and gained traction.

For example, the BondBloxx Bloomberg One Year Target Duration ETF (XONE) allows investors to benefit from the liquidity and ease of use of ETFs in accessing the Treasury market. XONE simply owns Treasuries with an average of one year of duration.

See related: ETF360 Video with BondBloxx’s Joanna Gallegos

Meanwhile, the Janus Henderson AAA CLO ETF (JAAA) invests in high-quality collateralized loan obligations (CLOs). CLOs have historically been less correlated to the broader fixed income market and are less interest rate sensitive. JAAA recently had a 6.3% 30-day SEC yield.

See related: ETF360 Video with Janus Henderson’s Nick Childs

Separately, American Century is one of the many firms that now offers municipal bond ETFs including the Avantis Core Municipal Fixed Income ETF (AVMU). AVMU is actively managed and yet charges a modest 0.15%. The fund recently had approximately 70% of assets in AA-rated bonds.

The fixed income ETF universe is filled with exciting products for advisors to consider. Indeed, on July 24 Tom Lydon and I will be moderating a fixed income ETF symposium hosted by VettaFi. The event will spotlight experts from a range of asset managers and will cover various compelling bond investment styles. More details will come, but we hope you can join us.

For more news, information, and analysis, visit Vettafi | ETF Trends.