Bond ETFs are poised to reach another milestone. They are currently just shy of $2 trillion in global assets under management ($1.993 trillion as of June 20) and ahead of schedule. While it took 17 years to reach $1 trillion, asset growth has exploded in recent years. BlackRock, the ETF industry’s largest provider, which correctly predicted the $2 trillion mark would be reached, now expects bond ETF assets to triple to $6 trillion by 2030.

While Canada listed the first bond ETF, the asset category has experienced tremendous growth in the United States. The first U.S.-listed bond ETFs began trading 21 years ago and now represent $1.4 trillion in assets. Meanwhile in Europe, bond ETF demand has also climbed higher in 2023.

Bond ETFs Took Off During Financial Crisis

The initial global acceleration of flows to bond ETFs occurred following the Financial Crisis in 2008. Many investors became aware of and interested in new ways to access the bond market when markets fell sharply.

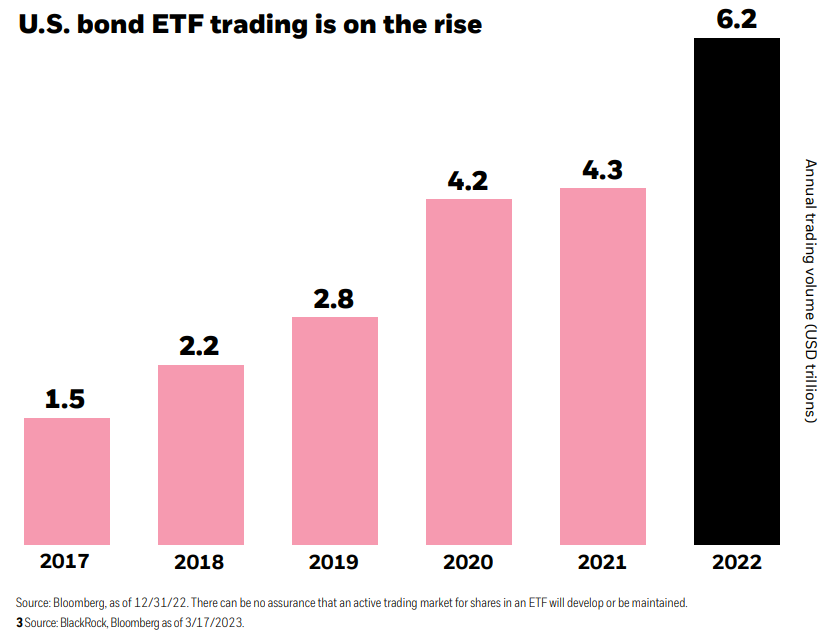

During 2015 and 2018, there were also periods of volatility in high yield bonds that led to a surge in bond ETF flows. More recently, however, there has been record demand. Investors turned to ETFs particularly in the first half of 2020 amid the emergence of COVID-19 and throughout 2022 as the Federal Reserve began rapidly raising interest rates. In the U.S., bond ETF trading rose to $6.2 trillion in 2022, up from $1.5 trillion in 2017 and $4.2 trillion in 2020, according to BlackRock.

U.S. Bond ETF Trading Is Rising

Bond ETFs Are the Glue That Helps Hold Markets Together

“When the bond markets get stressed, we see a surge in bond ETF trading volumes. They have been the glue that helps hold markets together,” explained Steve Laipply, global co-head of iShares Fixed Income ETFs for BlackRock. “Institutional investors first turned to ETFs to access the credit markets. And when the Treasury market recently experienced dislocation during the regional bank driven volatility, Treasury bond ETFs maintained tight bid/ask spreads and investors responded there as well.”

See more: Steve Laipply with BlackRock at Exchange

Regulatory Changes Support Growth

The iShares ETF lineup includes the iShares $ Investment Grade Corporate Bond ETF (LQD) and the iShares 20+ Year Treasury ETF (TLT), two of the firm’s original products. Bond ETFs from BlackRock and other providers are already widely used by insurance companies, but Laipply sees further growth ahead.

“As regulations become more harmonized, insurance company usage of ETFs in their general accounts will growth further,” he noted.

However, insurance companies are not the only institutional investors that are increasingly using bond ETFs. According to a 2022 Brown Brothers Harriman survey, 65% of institutions globally have allocated more than 30% of their portfolios to bond ETFs.

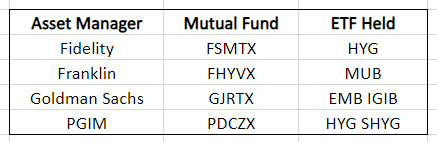

For example, actively managed mutual funds run by Fidelity, Franklin Templeton, Goldman Sachs, and PGIM held stakes in bond ETFs, according to our analysis. Asset managers can reduce trading costs and focus on security selection while accessing an investment style like high yield or municipal bonds via ETFs.

Active Mutual Fund Managers Turn to Bond ETFs

While institutional investors support the recent surge in bond ETF flows and liquidity, there has been strong demand from advisors and direct retail investors too.

Advisors Have More Bond ETF Tools to Work With

For example, in 2023 we have seen net inflows to targeted maturity ETFs that help to manage duration, as well as buy-write ETFs that use options to provide enhanced income. In addition, flows to actively managed bond ETFs remain high.

“The advent of model portfolios has helped boost demand for actively managed bond ETFs by advisors. They are a natural fit,” noted Laipply.

BlackRock expanded its active ETF lineup this year, with prominent manager Rick Rieder running a flexible income offering. Other established active managers like AllianceBernstein, Capital Group, DoubleLine, and PIMCO have also recently brought some of their best active strategies to meet advisors where they want to invest.

Strong Interest to Learn About Bond ETFs

At VettaFi, we are seeing this firsthand. There has been persistently strong attendance for our educational webcasts on a range of bond ETF topics in recent months. During the events, advisors previously told us they found investment-grade corporate bonds most appealing in the first half of 2023. However, they were recently researching high yield bond funds. VettaFi is planning a fixed income ETF symposium in July.

We think the future for bond ETF growth remains bright. The $2 trillion mark is soon to be the latest milestone, but there are many more to be reached. Investors globally are embracing the liquidity and ease of use bond ETFs provide relative to owning a bond directly or indirectly through a mutual fund.

For more news, information, and analysis, visit the Financial Literacy Channel.