![]()

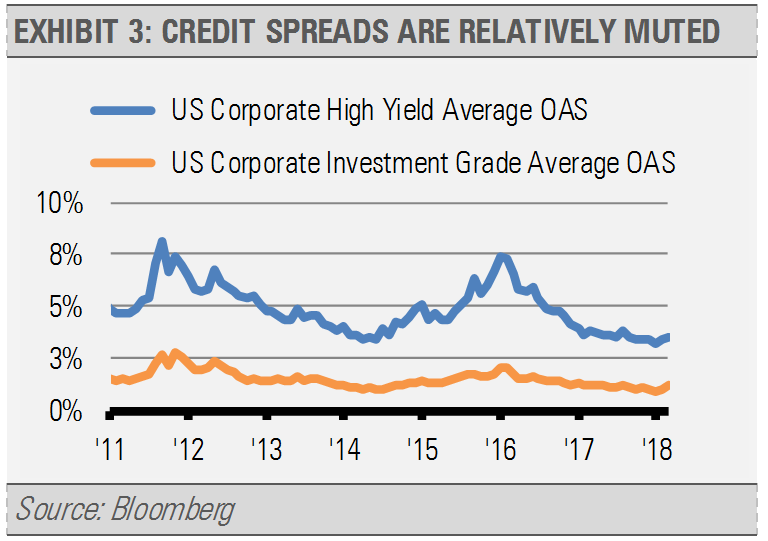

We remain aware of the risks as the curve has flattened and credit spreads will likely increase from here. How bad it gets will depend on whether or not GDP growth is sustainable and can support higher long-term rates as the Fed continues on its tightening path. Further rate hikes amid a pick up in the reduction of the Fed’s balance sheet is a headwind to future economic expansion. Importantly, recent inflation data is likely to suggest to the Fed that they can escalate the pace of future rate hikes. If these hikes work to offset potential growth from expansionary fiscal policy, we would start to see the yield curve flattening trend continue and long rates move back down from their current levels.

Related: Investing in the New Volatility Regime

In this market environment, we think investors should look towards variable rate bonds, preferred stocks as well as target an intermediate duration in their core fixed income allocations. Variable rate bonds can benefit as the Fed raises interest rates on the short-end of the curve. Meanwhile, without the threat of significantly higher long-term interest rates, preferred stocks can generate attractive current yield. Lastly, we think that intermediate duration bonds are attractive as the Fed raises short-term rates and the yield curve flattens.

This article was written by Gary Stringer, CIO, Kim Escue, Senior Portfolio Manager, and Chad Keller, COO and CCO at Stringer Asset Management, a participant in the ETF Strategist Channel.

DISCLOSURES

Any forecasts, figures, opinions or investment techniques and strategies explained are Stringer Asset Management, LLC’s as of the date of publication. They are considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect to error or omission is accepted. They are subject to change without reference or notification. The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment and the material should not be relied upon as containing sufficient information to support an investment decision. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested.

Past performance and yield may not be a reliable guide to future performance. Current performance may be higher or lower than the performance quoted.

Data is provided by various sources and prepared by Stringer Asset Management, LLC and has not been verified or audited by an independent accountant.