A new year brings a new set of factors for investors to consider. One can’t ignore the way 2023 ended, particularly given the big back and forth between high interest rates and inflation. Still, 2024 will have its own narratives and storylines for investors to assess. The new year fog and that ongoing macro uncertainty, then, may boost the case for an equal weight ETF to kick off the year.

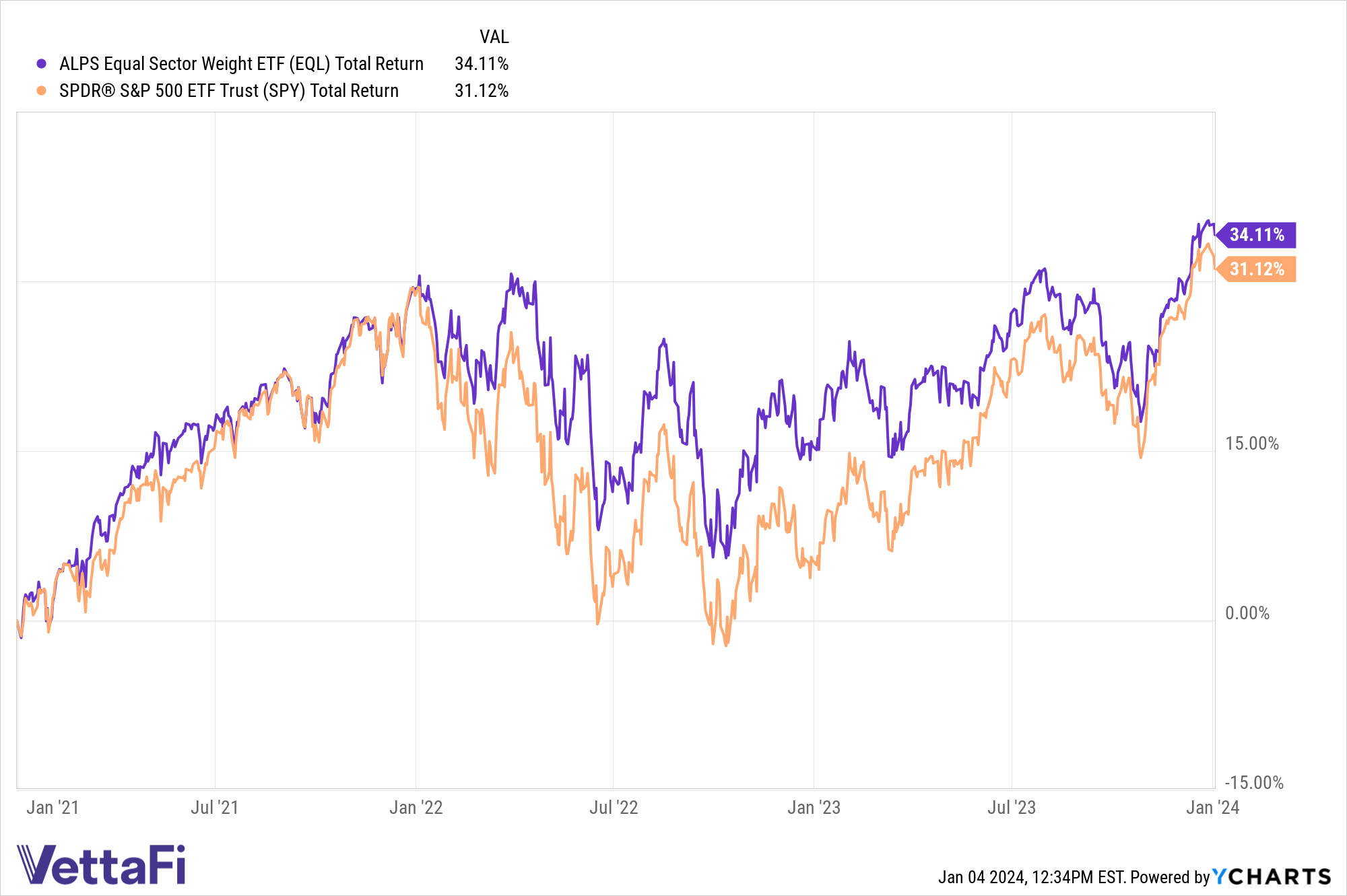

An ETF like the Alps Equal Sector Weight ETF (EQL) offers investors a balanced approach to the new year. The equal weight strategy gives each sector of the economy an equal weight, which of course sets it apart from ETFs like the SPDR S&P 500 ETF Trust (SPY). In fact, EQL has managed to outperform SPY over the last three years, per YCharts data.

Equal weight ETF EQL has outperformed SPY over the last three years per YCharts.

See more: Bull vs. Bear: Should Portfolios Include Small-Caps in 2024?

EQL not only offers more balanced exposure than the very techy, top-heavy SPY, but also mitigates the concentration risk in ETFs like SPY. The ETF builds its portfolio across sectors via the use of SPDR funds. It invests in sectors including energy, utilities, industrials, and more. The strategy tracks the NYSE Select Sector Equal Weight Index for a 26 basis point (bps) fee.

Equal Weight ETF EQL’s Track Record

That approach has produced robust returns even amid a tech-heavy market. EQL has returned 16.5% over the last year, outperforming both its ETF Database Category and Factset Segment averages. What’s more, EQL has also outperformed both its averages over the last five years, as well, demonstrating the strategy’s adaptability across different market environments.

In an expensive market environment impacted by concentration risk, and with events-driven market shocks in the cards, too, EQL may merit a closer look. For investors looking to move cash off the side lines, the strategy could be a solid place to start.

For more news, information, and analysis, visit the ETF Building Blocks Channel.