Bull vs. Bear is a weekly feature where the VettaFi writers’ room takes opposite sides to debate controversial stocks, strategies, or market ideas — with plenty of discussion of ETF ideas to play either angle. For this edition of Bull vs. Bear, Elle Caruso and Karrie Gordon debate the merits of including small-caps in portfolios moving into 2024.

Elle Caruso, staff writer, VettaFi: Hey there, Karrie! I’m looking forward to discussing small-caps with you today. While small-caps are generally more volatile than large-caps, I think investors’ aversion to the asset class is overdone in the current environment.

If the economy falls into a deep recession, small-caps may not decline as much as investors expect. Historically, the small-cap sell-off is overdone and leaves investors poorly positioned for the early-cycle bull market.

Investors may be best-positioned maintaining a long-term allocation to small-caps, with the current environment presenting an attractive entry point. While small-caps have seen compelling returns in recent weeks, the asset class is still trading at a significant discount. Small-caps are currently cheap from both a historical perspective and in comparison to large-cap stocks.

Let’s compare the underlying fundamentals of the iShares Russell 2000 ETF (IWM) and the iShares Core S&P 500 ETF (IVV). IWM has a P/E ratio of 11.10, while IVV is trading at a P/E ratio of 23.16. This is a substantial difference. Historically, small-cap stocks have traded at higher P/E ratios than large-caps, creating a unique opportunity in the current environment.

The Bumpiest Ride Equities Can Buy

Karrie Gordon, staff writer, VettaFi: Small-caps are known for their rebound potential coming out of an economic downturn. However, that rebound window is narrow, often leading to returns chasing, which carries its own host of problems. The alternative is to carry longer-term targeted exposure, which only adds significant volatility to a portfolio.

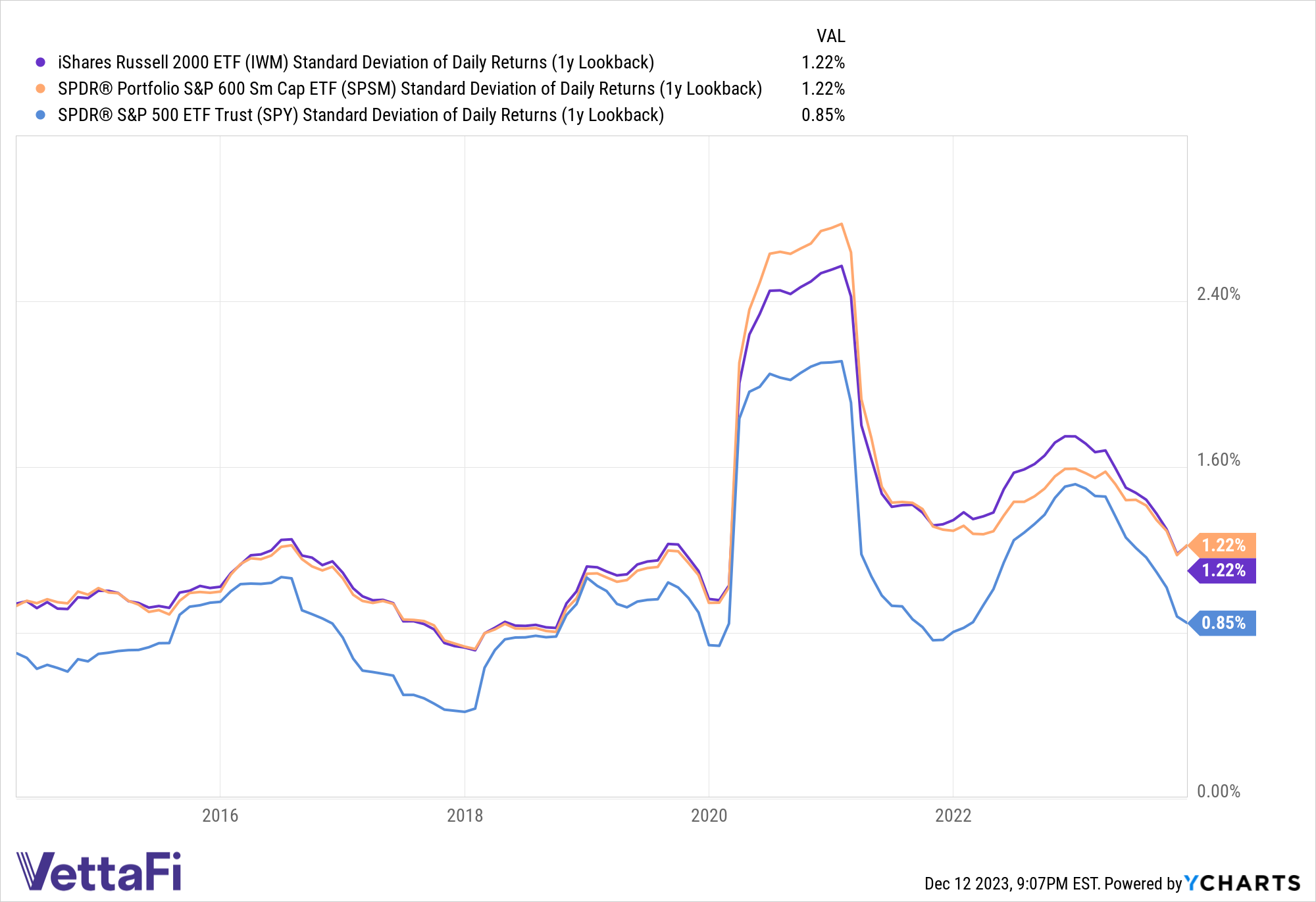

As the SPDR Portfolio S&P 600 Small Cap ETF (SPSM) launched in 2013, I calculated the standard deviation of daily returns using a one-year look-back beginning in April 2014. Standard deviation measures returns dispersion compared to the fund’s average returns. From April 2014 to now, the SPDR S&P 500 ETF Trust (SPY) consistently yielded a lower standard deviation than SPSM and the iShares Russell 2000 ETF (IWM).

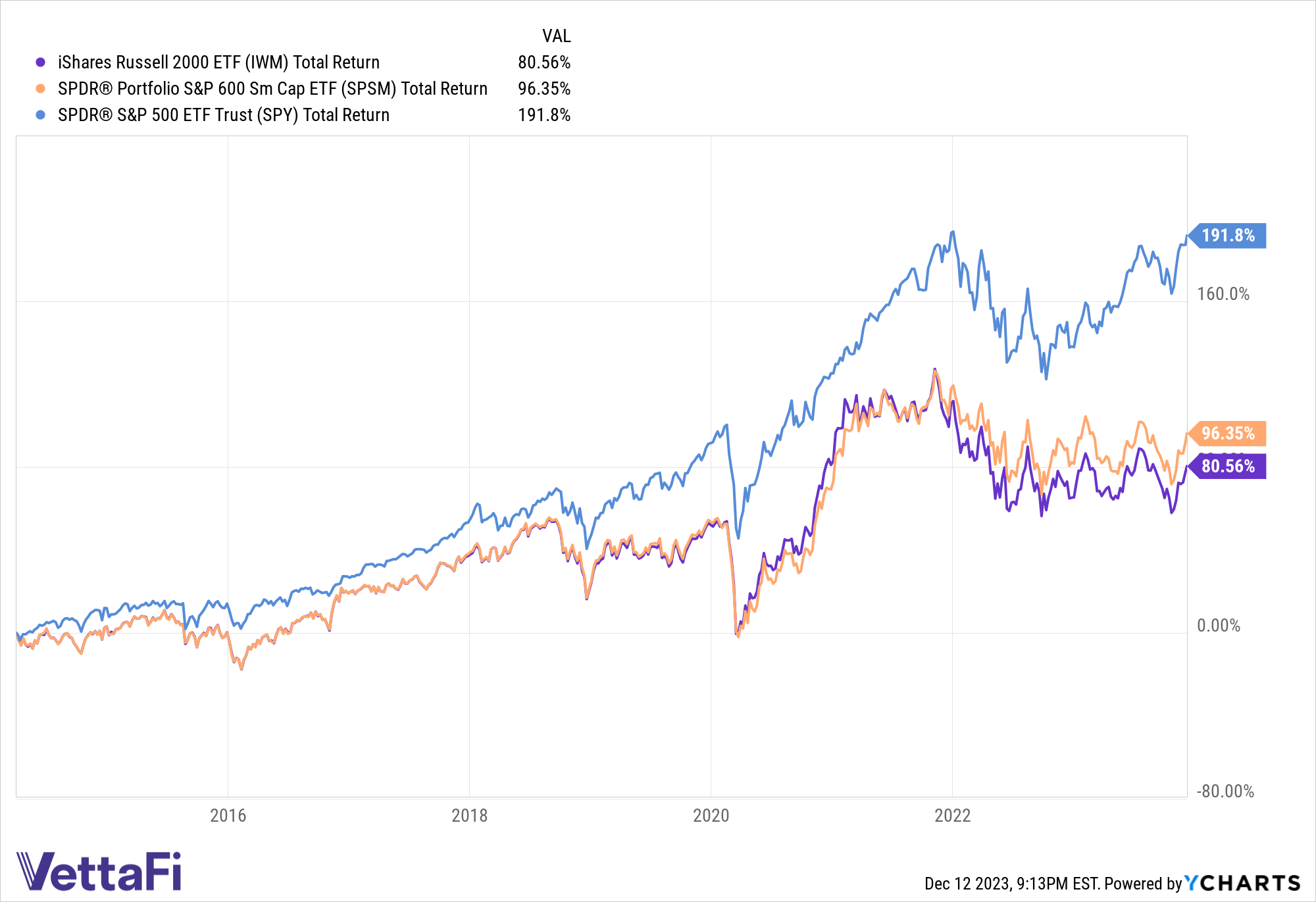

Now flipping that same period of performance to look at total returns, SPY gained 191.8% on a total return basis. In comparison, SPSM rose 96.35% and IWM gained 80.56% between April 2014 and now.

The large-cap ETF generated both better total returns and a smoother ride than the small-cap ETFs. The story is the same in a five-year look-back, three-year look-back, and YTD. Large-caps consistently generate better total returns with less volatility in a variety of market and economic environments. If small-caps offer a performance benefit, it is short-lived and rapidly overshadowed by large-cap performance.

Can Small-Caps Maintain This Recovery Rally?

Caruso: While low valuations present an attractive entry point, small-caps have displayed tremendous growth in recent weeks. In the past few weeks, small-cap stocks have outpaced the mega-caps that dominated market returns during the first three quarters of 2023.

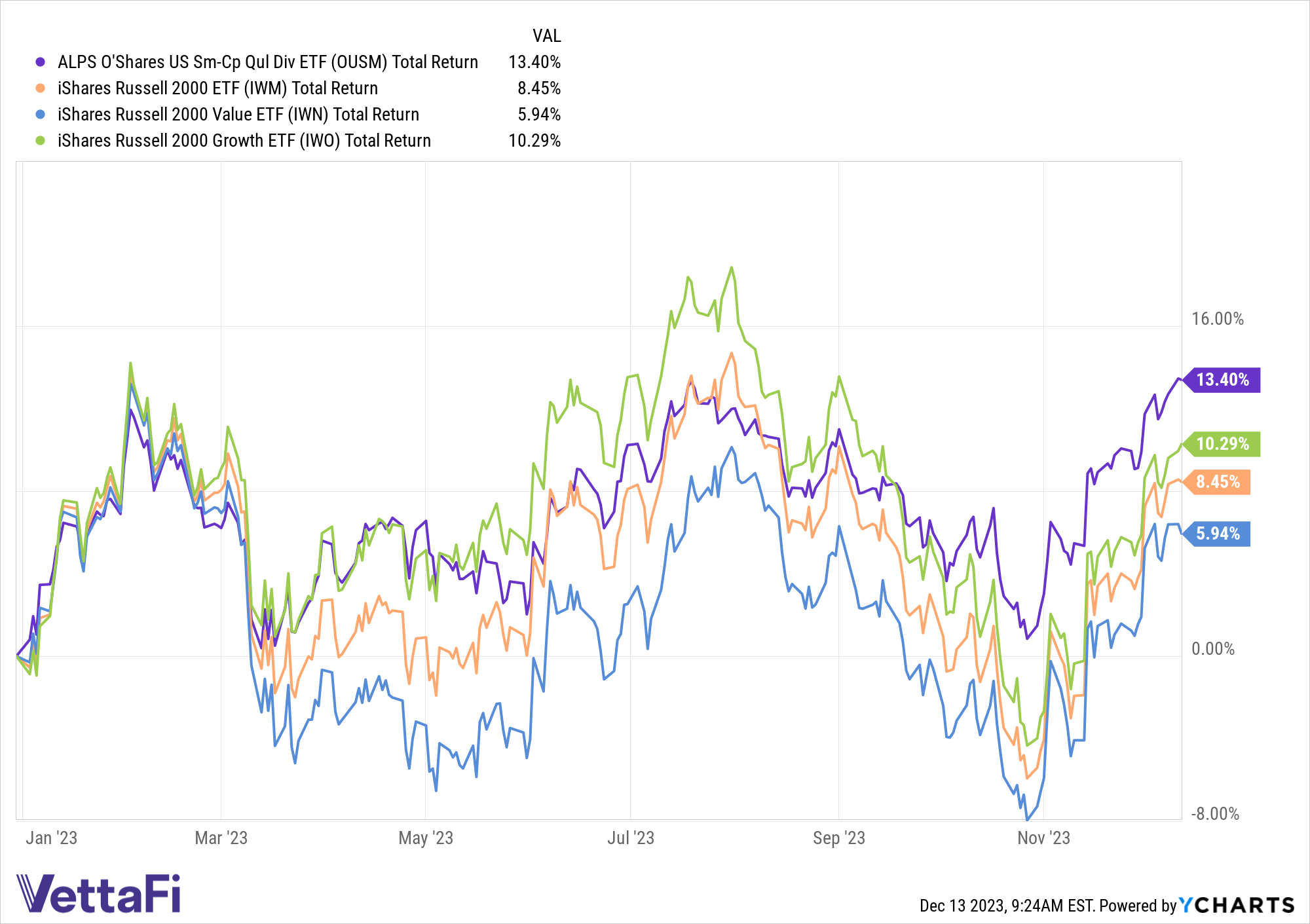

The small-cap benchmark Russell 2000 Index entered positive territory for the year just a few weeks ago and is now up 8.5% as of December 12. However, getting more selective, high-quality exposure to small-caps via the ALPS O’Shares US Small-Cap Quality Dividend ETF (OUSM) can further enhance returns.

OUSM is up 13.4% year to date through December 12. The ALPS’ ETF has exhibited better performance and less volatility than broad-based small-cap indexes in 2023.

OUSM has been supported by its quality methodology screens for high profitability, low leverage, low volatility, and superior dividend growth, leading to its top decile performance among small-caps (as of August 31).

Rebounding performance coupled with low valuations and a supportive macroeconomic environment create significant tailwinds for small-cap stocks.

Weighing in on Banks

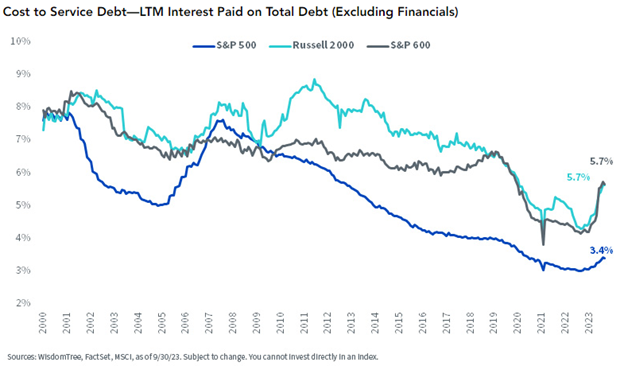

Gordon: Small businesses rely heavily on financing from banks. When interest rates climb, small businesses feel the squeeze much more significantly than their large-cap peers that issue corporate bonds. According to research from WisdomTree, as of the end of October, the average interest rate that small businesses paid for financing was 5.7%. In comparison, the S&P 500’s average interest rate paid was 3.5%.

Image source: WisdomTree

Small-caps, as measured by the Russell 2000, consistently pay higher financing interest rates, but especially during periods of economic distress and strain. The higher cost of financing cuts into revenue and margins as well as eroding earnings before interest and taxes (EBIT).

It is also unwise to discount the impact of bank stability on small-caps. Indeed, at the height of the mini banking crisis in March, IWM dropped more than 9%, while SPY lost just 0.82% between March 1 and March 17, 2023.

The regional banking crisis remained an isolated incident in 2023, but forecasts for the banking sector in 2024 called for more challenges. Fitch Ratings predicts deterioration for the U.S. banking sector next year. Likewise, Moody’s calls for a diminished global bank outlook in 2024, citing an increase in asset risk due to loan quality stressors.

It’s still unknown how commercial real estate loan defaults will affect regional banks long term, but that the WSJ coins it the “real-estate doom loop” is telling. What’s more, the delinquency rate on consumer loans is at its highest in a decade, according to the Fed, and consumer default rates continue to climb. Given rising unemployment and a significant reduction in real GDP forecasts next year, it adds up to an equation that likely doesn’t “solve” in favor of banks anytime soon.

Small-Caps Can Work in This New Economic Regime

Caruso: 2023 has not been the most constructive macroeconomic environment for small-caps; however, this appears to be changing. It’s important investors notice this shift before the opportunity is gone.

Small-caps have tended to rally in periods following economic turndowns, earlier in recovery/new economic cycles than large-caps. This means small-caps could be very well-positioned going into the new year as economists forecast 2924 will see rate cuts and a soft landing for the U.S. economy.

Small-caps have historically snapped back in the first year of a bull market rally. Currently, projections for a soft landing become more likely for the U.S., while the rest of the world is seeing more pronounced economic slowing. This positions U.S. small-caps to outperform their domestic large-cap peers due to their U.S. revenue bias, margin expansion, and valuation disparities.

According to Morningstar, small-caps have 79% U.S. revenue exposure compared to only 61% U.S. revenue exposure for large-caps as of August 31.

For these reasons, I’m bullish on maintaining an allocation to small-cap stocks via an ETF that targets high-quality stocks.

Small-Caps Underperformed in an Optimal Environment

Gordon: The midterm outlook calls for falling rates beginning as early as the second half of 2024. Small-caps do offer rebound potential when the economy resumes growth, but it’s short-lived momentum. As inflation and rates stabilize long term, small-caps could prove to be the equity laggards once more.

While the last decade was an anomalous one for rates and volatility, it was an ideal scenario for small businesses. Rates remained predictable and extremely low, and consumption proved robust. Small businesses thrived, yet even in an optimal environment, they underperformed large-caps. In the low-rate environment of the last decade (going back to 2013), IWM underperformed SPY every year but two on an annual basis (2013 and 2016).

The window of opportunity that small-cap investing proves advantageous is narrow, volatile, and not without enhanced risk. In the current environment of higher rates for longer, large-caps offer more defensive positioning against the compounding effects of interest rates on banks and small-caps. Given the various bank stressors in the coming months, reducing or eliminating exposure to small-caps in favor of their more stable, larger peers could prove beneficial.

The first half of next year looks challenging for U.S. equities broadly. In such an environment, income-enhancing equity funds like the NEOS S&P 500 High Income ETF (SPYI) or the JPMorgan Equity Premium Income ETF (JEPI) are worth consideration. These strategies provide exposure to equities while offering income enhancement through their options strategies. Premiums earned from the options offer the potential for a measure of loss mitigation when equities fall.

Looking Outside the Traditional Equity Box for Opportunity

Alternatively, in an environment of forecast reduced economic growth, looking to portfolio diversifiers could prove advantageous. There is opportunity in overlooked commodity funds like the KraneShares California Carbon Allowances ETF (KCCA). The fund benefits from policy support as well as increasing focus on the energy transition within the U.S.

Whether you’re looking short-, mid-, or long term, the benefits of small-caps are overshadowed by volatility and long-term underperformance. Particularly for these next several months, small-caps look poorly positioned, given banking stress and higher-for-longer rates.

For more news, information, and analysis, visit the ETF Building Blocks Channel.