Summary

- Generally, midstream companies are forecasting modest EBITDA growth in 2024 consistent with the stability of fee-based businesses.

- Some companies have also provided long-term guidance for EBITDA growth, which points to a positive outlook beyond 2024.

- Strong adjusted EBITDA guidance contributes to investor confidence in midstream’s ability to maintain dividend growth and buybacks for years to come.

Midstream’s fee-based business model gives the space some unique characteristics such as insulation from commodity price volatility and predictability in future cash flows. Energy infrastructure companies generate fees based on the volume of commodities handled or transported, leading to stable cash flows regardless of commodity price fluctuations. As a result, it’s common for energy infrastructure companies to provide investors with financial guidance for the year ahead and beyond. Today’s note looks at the EBITDA growth expectations for energy infrastructure companies that have provided guidance.

Midstream Company Guidance Points to Modest Growth in 2024

Midstream/MLPs have largely provided 2024 EBITDA guidance. Most names expect modest growth in 2024. Steady-to-growing EBITDA has been a tailwind for midstream in recent years. That is due to energy infrastructure companies having been committed to returning cash to equity investors. Midstream/MLP dividend growth and buyback activity continued throughout 2023. The positive trends are expected to extend through 2024 and beyond.

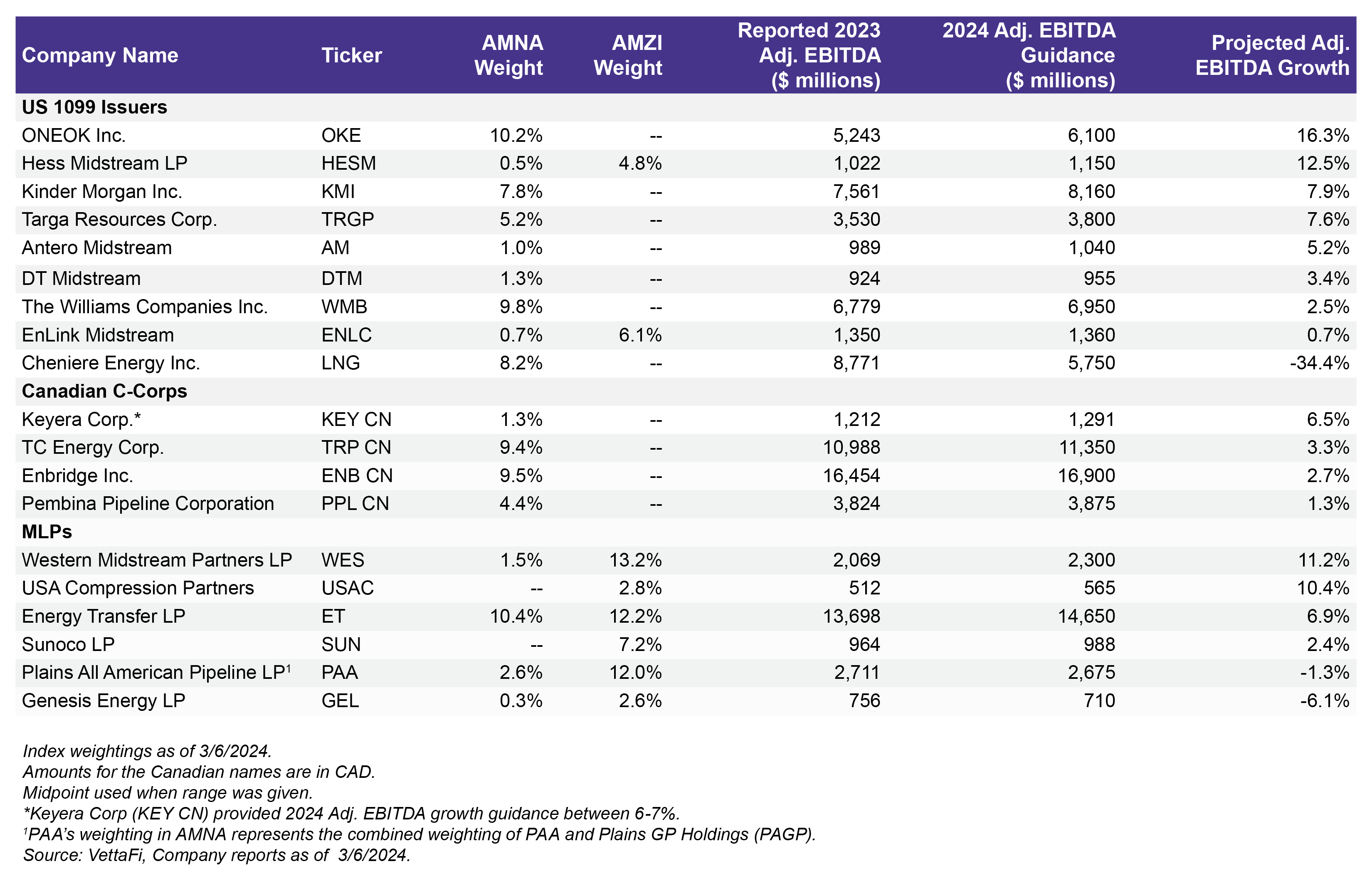

Expectations for 2024 are admittedly varied. A handful of companies are anticipating double-digit adjusted EBITDA growth this year and other names seeing more modest growth. The table below shows 2024 EBITDA guidance for select constituents of the Alerian MLP Infrastructure Index (AMZI) and the Alerian Midstream Energy Index (AMNA). ONEOK (OKE) stands out for its anticipated 16.3% adjusted EBITDA growth in 2024 to $6.1 billion at the midpoint. But that reflects its acquisition of Magellan Midstream Partners in 2H23. Other notable 2024 EBITDA growth guidance announcements include Hess Midstream’s (HESM) 12.5% and Western Midstream’s (WES) 11.2%, with WES having acquired Meritage Midstream in 2023.

An exception to the modest growth trend is Cheniere (LNG), which expects to see $5.5 – $6.0 billion in Adjusted EBITDA for 2024, which would represent a 34.4% year-over-year decline at the midpoint. In 2023, international gas prices moderated and less volumes were sold into short-term markets relative to 2022, LNG management said during its 4Q23 earnings call.

Midstream/MLPs See Long-Term EBITDA Growth

Midstream’s fee-based services are often backed by multiyear contracts. That allows the high predictability of cash flows to extend beyond the upcoming fiscal year. A handful of midstream/MLPs have announced long-term EBITDA guidance pointing to moderate growth (read more).

For example, HESM’s 5% annual distribution growth target through 2026 is supported by its EBITDA growth guidance of at least 10%. Williams Companies (WMB) also expects its long-term dividend growth to be in line with 8% adjusted EBITDA growth over time (read more). During its recent investor day, Enbridge (ENB) extended its adjusted EBITDA growth forecast of 8% at the midpoint through 2026.

Long-term guidance for adjusted EBITDA supports a constructive outlook for midstream/MLPs and ongoing dividend growth. Investors can have greater confidence in midstream payouts with the context of EBITDA growth expectations for the coming years. As of March 6, AMNA and AMZI were yielding 5.9% and 7.0%, respectively.

Bottom Line

Midstream/MLPs are largely expecting modest EBITDA growth in 2024. That should support continued dividend growth and buyback activity, which have been tailwinds for the space.

AMZI is the underlying index for the Alerian MLP ETF (AMLP) and the ETRACS Alerian MLP Infrastructure Index ETN Series B (MLPB). AMNA is the underlying index for the ETRACS Alerian Midstream Energy Index ETN (AMNA).

Related Research

4Q23 Midstream/MLP Dividend Recap: The Growth Continues

4Q23 Caps Solid Year for Midstream/MLP Buybacks

Constructive 2023 EBITDA Guidance Sets Midstream/MLPs Apart

Beyond 2024: Examining Multi-Year Guidance for Midstream

Williams (WMB) and the Golden Age for Natural Gas

vettafi.com is owned by VettaFi LLC (“VettaFi”). VettaFi is the index provider for AMLP, MLPB, and AMNA, for which it receives an index licensing fee. However, AMLP, MLPB, and AMNA are not issued, sponsored, endorsed, or sold by VettaFi, and VettaFi has no obligation or liability in connection with the issuance, administration, marketing, or trading of AMLP, MLPB, and AMNA.

For more news, information, and strategy, visit the Energy Infrastructure Channel.