In the first quarter of 2024, fixed income investors turned to investment-grade corporate bond ETFs.

The Vanguard Intermediate-Term Corporate Bond ETF (VCIT) pulled in $2.3 billion, while the Vanguard Long-Term Corporate Bond ETF (VCLT) added $1.5 billion. Peer intermediate-term investment-grade ETFs from iShares and State Street Global Advisors also added $1.0 billion. In contrast, the iShares Boxx $ High Yield Corporate Bond ETF (HYG) had $2.1 billion of net outflows.

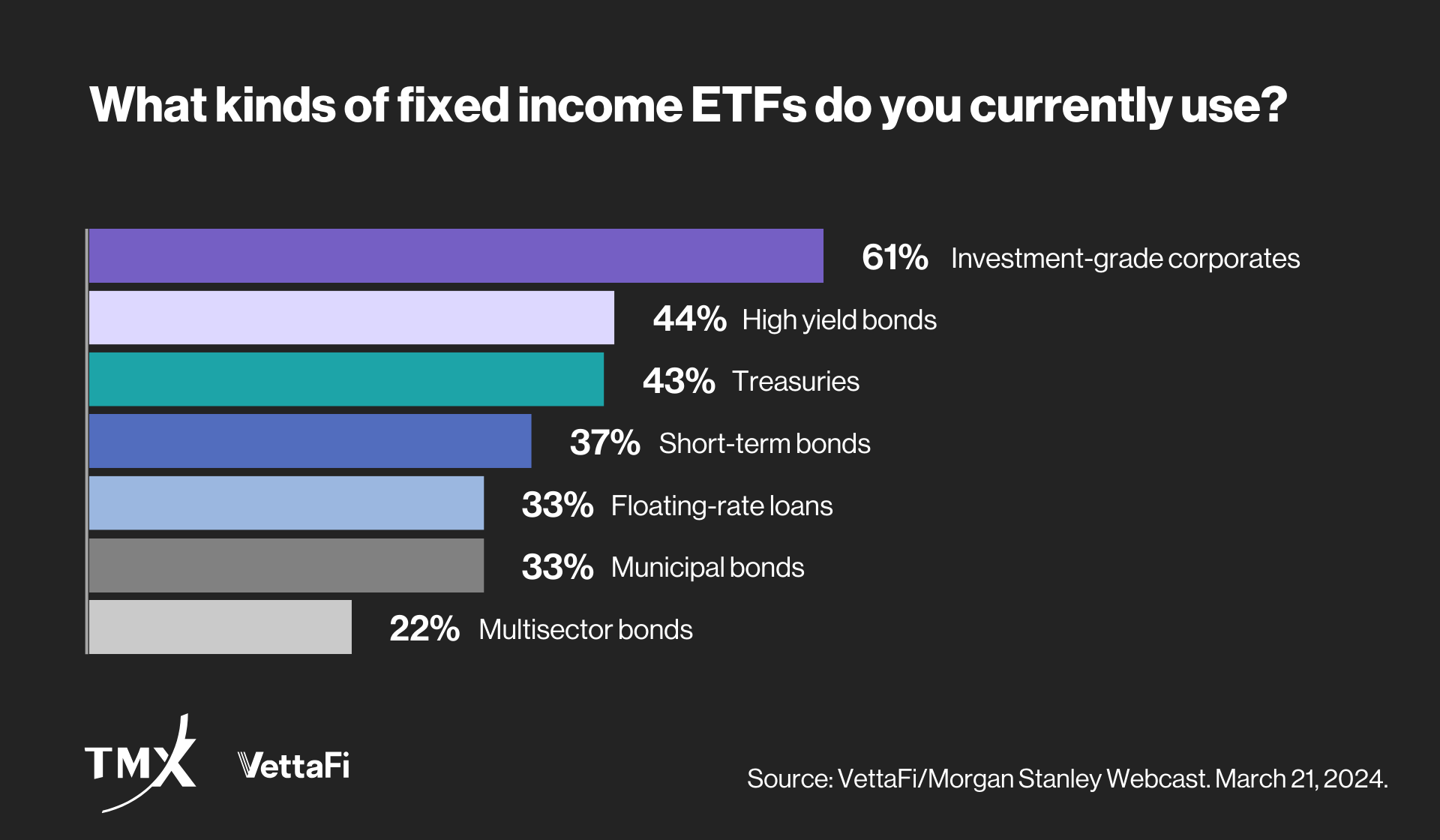

What Fixed Income ETFs Are Advisors Using?

During a late March VettaFi webcast, we asked advisors: “What kinds of fixed income ETFs do you currently use?” The most popular answer was investment-grade grade corporates (61%) followed by high yield bonds (44%) and Treasuries (43%).

In 2023, hunkering down in short-term Treasuries was rewarding. However, as the economy has shown signs of strength, many advisors are looking to take on credit risk. Yet they have questions. For example, how much should they take on and what areas in credit make the most sense?

During the three-hour VettaFi Fixed Income Symposium on April 18, we plan to learn the answers to these and other questions. The nine-part, fast-moving event starts at 11 a.m. ET and will feature experts behind fixed income mutual funds and ETFs.

Will Taking on Credit Risk Be Rewarding?

In the middle of the event, we will have a dedicated session at 12:30 p.m. about taking on credit risk. Jason Greenblath of American Century and Matt Wrzesniewsky of Goldman Sachs will join me. American Century offers multisector active ETFs like the American Century Multisector Income ETF (MUSI). This ETF recently had 31% of its assets in investment-grade corporate bonds and 16% in high yield. The remainder was primarily in U.S. government bonds and mortgages.

Meanwhile, Goldman Sachs offers smart-beta index-based corporate bond ETFs like the Goldman Sachs Access High Yield Corporate Bond ETF (GHYB). The fund eliminates issuers with relatively weak fundamentals. As of early April, the fund had 54% of its assets in bonds rated BB but 11% in CCC issues.

In February, S&P Global Ratings Credit Research & Insights expected the U.S. trailing-12-month speculative-grade corporate default rate to reach 4.75% by December 2024, up slightly from 4.5% in December 2023. S&P believes defaults in 2024 will largely come from consumer-facing sectors, such as consumer products and media and entertainment, as well as the still highly leveraged healthcare sector.

Other Fixed Income Experts to Join VettaFi

In addition to Greenblath, at the Fixed Income Symposium I will be talking to experts behind other multisector mutual funds and ETFs. For example, at 11:45 a.m., I will be with Dominic Nolan of Aristotle Funds, which offers the Aristotle Core Income Fund. Joining us will be Mark Cintolo of Natixis Investment Managers, which offers the Oakmark Bond Fund.

Later in the day, at 1:55 p.m., we will be talking with TCW’s Mark McNeil and Riverfront Investment Group’s Tim Anderson. They will discuss how the First Trust TCW Opportunistic Fixed Income ETF (FIXD) and the Riverfront Strategic Income Fund (RIGS) are positioned for the second half of 2024.

On April 18, the VettaFi Fixed Income Symposium will help advisors understand where the best opportunities to take on risk will be rewarded in 2024. Register today.

For more news, information, and analysis, visit VettaFi | ETF Trends.