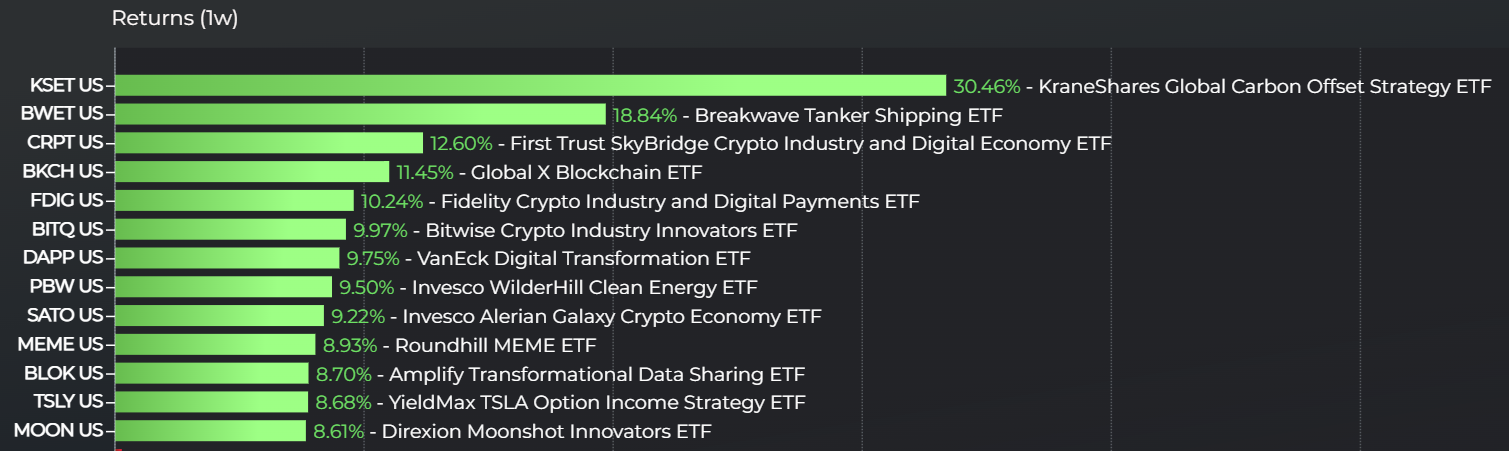

In this edition of the top-performing ETFs, climate change investing stood out via the carbon offset ETF KSET. The KraneShares Global Carbon Offset Strategy ETF (KSET) nearly doubled the one-week returns of the next best-performing ETF. KSET returned 30.5% over the last week, perhaps benefiting from new guidelines designed to streamline the offset market.

See more: “Voluntary Carbon Market Tightens Guidelines, KSET Gains”

KSET launched last August and has seen its returns spike significantly over the last month, returning 57.37% in that time. That performance has helped drive the strategy’s price above its 50-day Simple Moving Average (SMA) which indicates a change in its overall momentum. The carbon offset ETF charges 79 basis points to track the S&P GSCI Global Voluntary Carbon Liquidity Weighted Index.

Elsewhere in the top performers, crypto ETFs and specifically oil tanker shipping returned for another week of returns. The Breakwave Tanker Shipping ETF (BWET) returned 18.8% over the last week, surprising yet again and not too far away from KSET.

BWET provides long-only exposure to oil tanker shipping, historically an area uncorrelated with major asset classes. The ETF holds near-dated freight futures to provide investors exposure to the oil tanker shipping charter rate. BWET charges a 350 basis point fee for that approach. The ETF has returned nearly 50% over the last three months, having launched this May.

Crypto remained a powerful theme in performance. Six of the top twelve ETFs focused on crypto and the blockchain overall. The First Trust Skybridge Crypto Industry and Digital Economy ETF (CRPT) took the top crypto ETF spot, returning 12.6% over the week.

CRPT actively invests in firms that derive at least 50% of revenue from crypto activities, or devote at least 50% of their assets to the industry. The strategy charges 85 basis points for its approach, returning a staggering 85.5% YTD.

KSET led the way for this week’s top-performing ETFs, per LOGICLY.

For more news, information, and analysis, visit the Climate Insights Channel.