The Voluntary Carbon Market Integrity Initiative announced new guidelines aimed at ensuring carbon offset integrity and use. The creation of the guidelines could bring much needed investor confidence to the market which KraneShares Global Carbon Offset Strategy ETF (KSET) benefits from.

The VCMI Claims Code of Practice comes after two years of development. It sets the guidelines for companies utilizing offsets for climate reporting purposes, ensuring that only high quality offsets are purchased according to the press release. Carbon offsets come from projects and initiatives worldwide aimed at intentionally reducing emissions. The voluntary market is not to be confused with regulated compliance markets that issue carbon allowances.

“The voluntary carbon market is one tool that can mobilize the much-needed finance to low and middle-income countries towards climate solutions that will accelerate the net-zero transition,” said Razan Al Mubarak, UN Climate Change High-Level Champion, in the press release.

Building Integrity Within the Voluntary Carbon Market

The Claims Code creates three tiers of offsets —platinum, gold, and silver. Each tier carries certain quality thresholds that align with the Integrity Council for Voluntary Carbon Markets’ Core Carbon Principles (CCPs). Going forward, companies must follow a specific reporting process to make a claim through VCMI.

The new reporting process provides a two-fold benefit. It ensures companies are only purchasing higher quality offsets, while also holding companies to net-zero goals. Companies must prove they are working towards and aligned with Paris Agreement net-zero goals. This includes in their lobbying practices, and is a significant requirement.

Companies must also publicly publish their annual emissions and create scientifically supported emissions reductions goals. Furthermore, guidelines’ stringent corporate requirements ensure integrity on the side of businesses and the CCPs work to create integrity within the voluntary market.

“Against a backdrop of recent criticism, we are now at a juncture where only consistent, well-considered global guidance can underpin a high-quality market,” explained. Rachel Kyte, co-chair of VCMI’s steering committee. That in turn will “stimulate the rapid scaling of corporate use we need. The Claims Code will give greater confidence and develop trust in those who use it.”

The guidelines are part of an overhaul of the voluntary carbon offset market. It’s an attempt to inject greater transparency and integrity for market players and participants. Because carbon offsets offer promising opportunity in the transition to net-zero, greater investor confidence would be a strong catalyst for increased adoption.

See also: “New Carbon Offset Guidelines a Boon for Market and Investors”

KSET a Fund to Watch Going Into Second Half

The KraneShares Global Carbon Offset Strategy ETF (KSET) is the first U.S.-listed ETF that offers investors carbon offset investing opportunities and exposure to the voluntary carbon markets. It tracks the S&P GSCI Voluntary Carbon Liquidity Weighted Index. The Index offers a first-of-its-kind benchmark for the global voluntary carbon futures market performance that trades through the CME group.

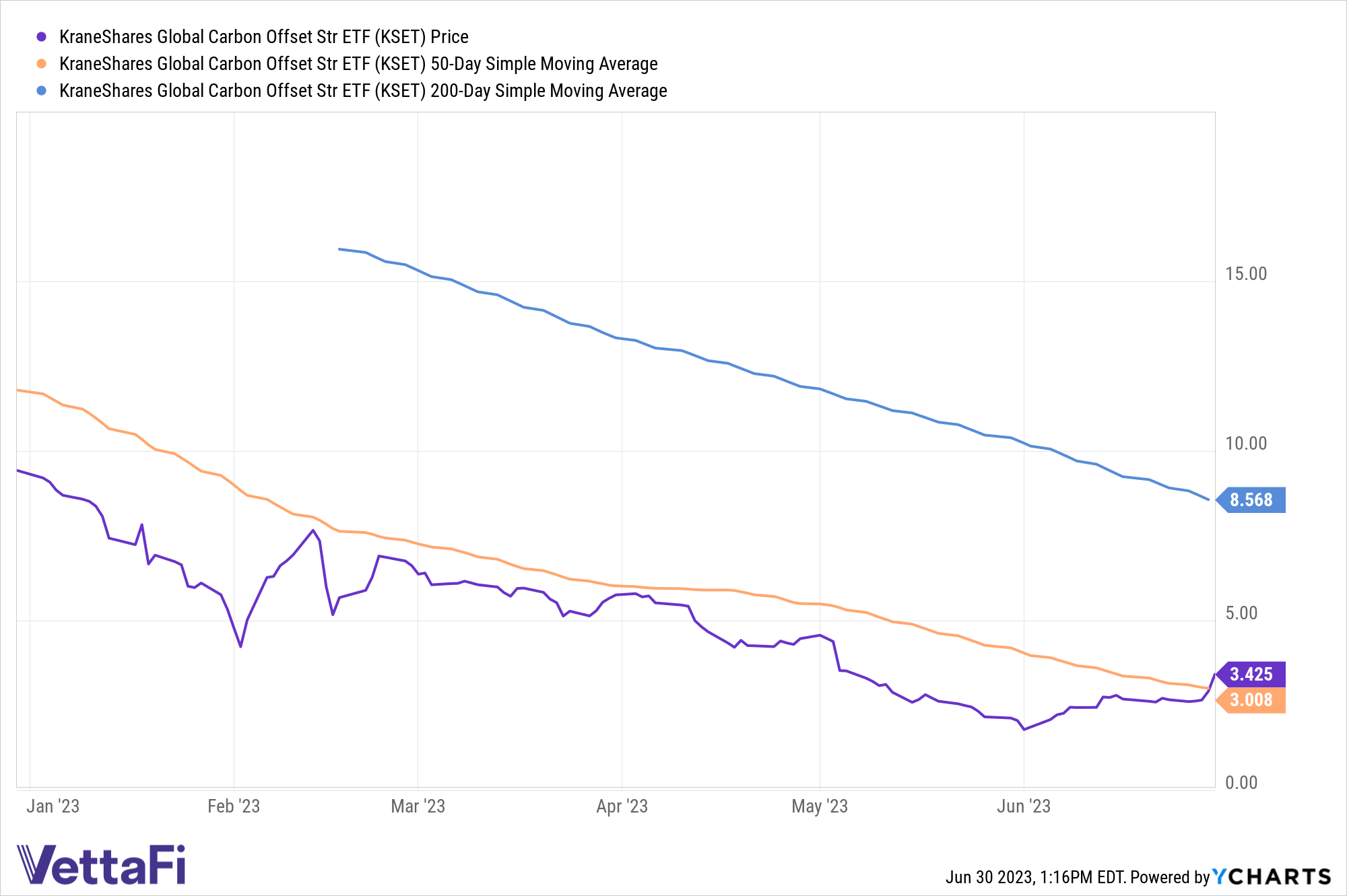

KSET rose on news of the VCMI corporate guidelines at the end of June. The fund crossed above its 50-day Simple Moving Average for the first time this year. Despite the fund remaining well below its 200-day SMA, it remains one to watch in the second half.

The fund is structured to offer global coverage of voluntary carbon markets. It tracks carbon offset futures contracts comprised of nature-based global emissions offsets (N-GEOs) as well as global emissions offsets (GEOs) that trade via the CME group.

The voluntary carbon markets are a dynamic space. As such, the index is structured in a way that will allow flexibility in re-weighting the securities it tracks. It will also move securities in and out of the index regularly. The index only tracks carbon offset credit futures that have a maturity within the next two years. Furthermore, the index weights the offset futures it tracks by the total value of their traded volume over the last six months.

KSET carries an expense ratio of 0.79%.

For more news, information, and analysis, visit the Climate Insights Channel.