European carbon allowances continue to rebound strongly in June despite headwinds. With longer-term tailwinds on the horizon, they are an asset class to consider in the near and long term. Advisors and investors looking to diversify their commodity exposures would do well to consider the KraneShares European Carbon Allowance ETF (KEUA), a top-performing ETF in the last week.

The KraneShares European Carbon Allowance ETF (KEUA) offers targeted exposure to the EU carbon allowances market and is actively managed. The EU carbon market covers over 12,000 participants and a variety of industries. Participation is mandatory for companies within predetermined industries such as power, agriculture, industrial, and aviation.

Companies must surrender carbon allowances at the end of the year that equates to their annual emissions. One carbon allowance is equal to one ton of carbon dioxide. Allowances are sold by regulating agencies at auctions to market participants and other interested parties.

Recent legislation in the EU creates greater supply reductions in the long term and more aggressive tightening of the market. The passage of the Carbon Border Adjustment Mechanism could also lead to greater demand for EUAs looking ahead.

KEUA Soars in June, a Top Performing ETF This Week

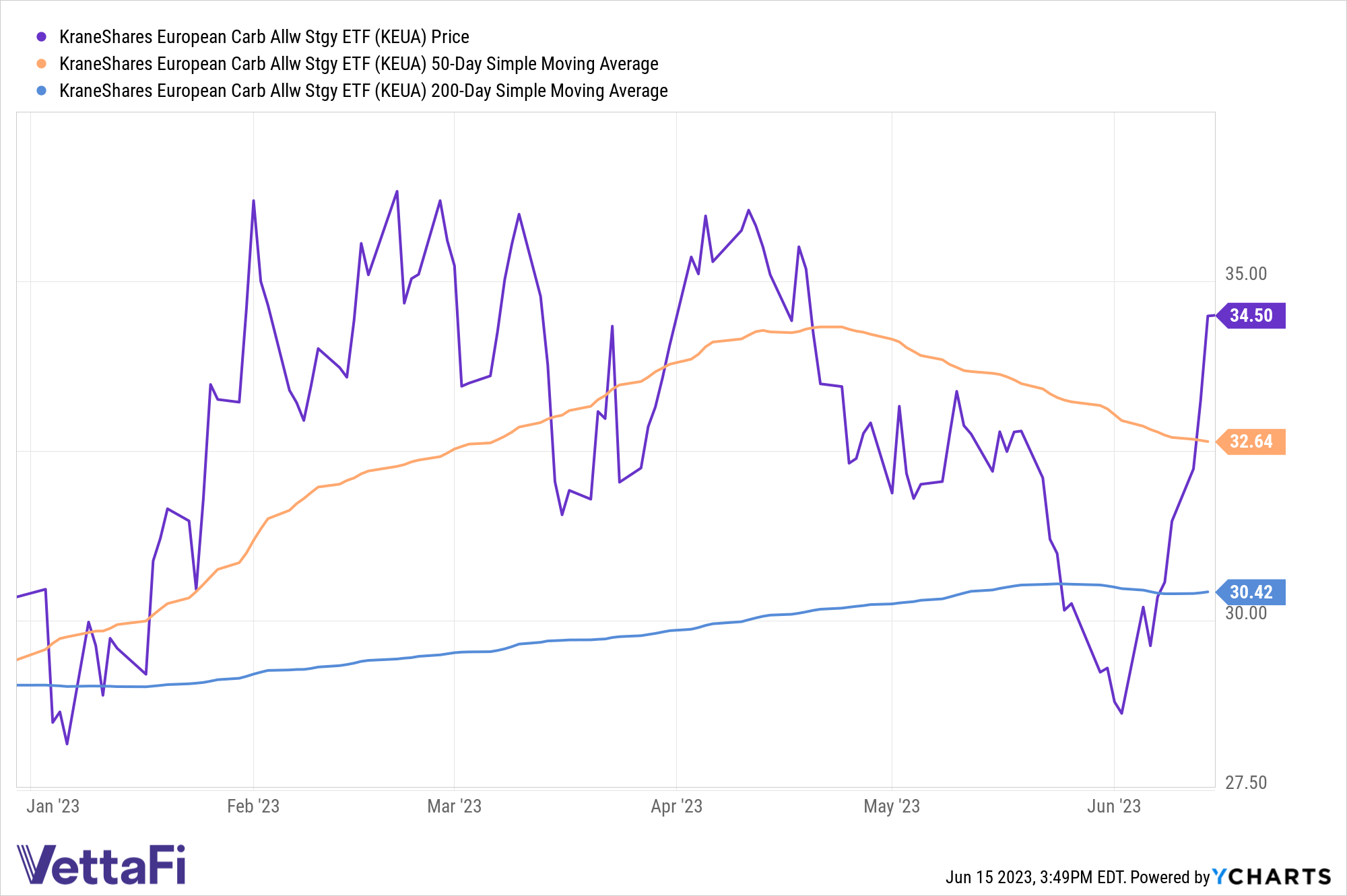

KEUA continues to perform strongly this month, crossing above both its 50-day Simple Moving Average as well as its 200-day SMA this week, a strong buy signal.

See also: “European Carbon Allowances Up 10%: A Summer Guide”

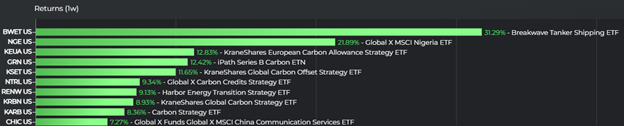

Top-performing ETFs in the last week by returns across all asset classes, excluding leveraged.

Image source: LOGICLY

KEUA is up 19.78% between June 1 through June 15 and is up 13.67% YTD. In the last week alone it gained 12.83% and is the third highest-performing ETF by returns across all asset classes (excluding leveraged funds) in the last week according to LOGICLY data.

See also: “Carbon Allowances Outperform Broad Commodities YTD”

The fund’s benchmark is the IHS Markit Carbon EUA Index. This benchmark tracks the most-traded EUA futures contracts, the oldest and most liquid carbon allowances market. Currently, the market covers roughly 40% of all EU emissions, including 27 member states and Norway, Iceland, and Liechtenstein.

KEUA has an expense ratio of 0.78%.

For more news, information, and analysis, visit the Climate Insights Channel.

Visualizations and data provided by LOGICLY, which is a wholly owned subsidiary of VettaFi.